Pictet Asset Management Holding SA trimmed its position in Waste Connections, Inc. (NYSE:WCN - Free Report) by 2.7% during the 4th quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 5,437,786 shares of the business services provider's stock after selling 148,144 shares during the quarter. Waste Connections accounts for approximately 1.0% of Pictet Asset Management Holding SA's holdings, making the stock its 14th biggest holding. Pictet Asset Management Holding SA owned about 2.11% of Waste Connections worth $933,010,000 at the end of the most recent reporting period.

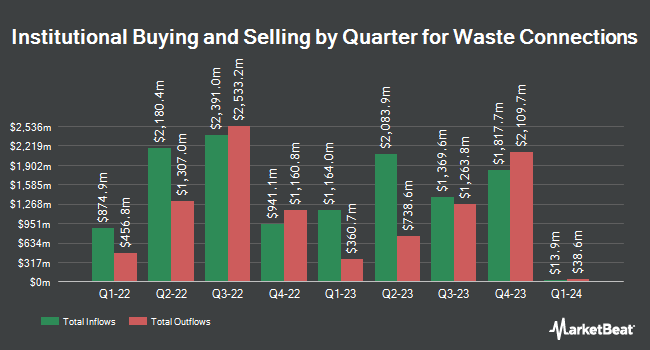

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in the company. Manchester Capital Management LLC bought a new position in shares of Waste Connections during the fourth quarter valued at about $26,000. Private Trust Co. NA increased its holdings in Waste Connections by 153.3% during the 4th quarter. Private Trust Co. NA now owns 152 shares of the business services provider's stock valued at $26,000 after purchasing an additional 92 shares during the period. Stonebridge Financial Group LLC bought a new position in Waste Connections during the 4th quarter valued at approximately $27,000. Smartleaf Asset Management LLC raised its position in Waste Connections by 59.7% during the 4th quarter. Smartleaf Asset Management LLC now owns 190 shares of the business services provider's stock valued at $33,000 after purchasing an additional 71 shares during the last quarter. Finally, Sierra Ocean LLC purchased a new stake in Waste Connections in the 4th quarter worth approximately $39,000. 86.09% of the stock is currently owned by institutional investors.

Wall Street Analyst Weigh In

A number of equities analysts recently commented on WCN shares. StockNews.com downgraded Waste Connections from a "buy" rating to a "hold" rating in a report on Friday, February 14th. Scotiabank decreased their price objective on shares of Waste Connections from $196.00 to $192.00 and set a "sector perform" rating for the company in a report on Monday, January 27th. Jefferies Financial Group cut their target price on shares of Waste Connections from $225.00 to $210.00 and set a "buy" rating on the stock in a research note on Thursday, January 30th. Stifel Nicolaus increased their price target on shares of Waste Connections from $205.00 to $212.00 and gave the stock a "buy" rating in a research note on Wednesday, December 11th. Finally, Truist Financial restated a "buy" rating and issued a $210.00 price objective (up from $200.00) on shares of Waste Connections in a report on Friday, February 14th. Four equities research analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has assigned a strong buy rating to the stock. According to data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $202.43.

View Our Latest Stock Report on WCN

Waste Connections Stock Up 0.8 %

Shares of NYSE WCN traded up $1.50 during trading on Tuesday, reaching $196.69. The company had a trading volume of 379,344 shares, compared to its average volume of 970,436. Waste Connections, Inc. has a 12-month low of $160.34 and a 12-month high of $197.74. The company has a quick ratio of 0.65, a current ratio of 0.65 and a debt-to-equity ratio of 1.03. The business's 50-day moving average is $187.47 and its 200 day moving average is $182.95. The stock has a market cap of $50.82 billion, a PE ratio of 82.30, a P/E/G ratio of 3.07 and a beta of 0.81.

Waste Connections (NYSE:WCN - Get Free Report) last announced its quarterly earnings data on Wednesday, February 12th. The business services provider reported $1.16 EPS for the quarter, missing the consensus estimate of $1.20 by ($0.04). Waste Connections had a net margin of 6.92% and a return on equity of 15.54%. As a group, equities analysts forecast that Waste Connections, Inc. will post 5.28 earnings per share for the current fiscal year.

Waste Connections Dividend Announcement

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, March 13th. Investors of record on Thursday, February 27th were given a $0.315 dividend. The ex-dividend date was Thursday, February 27th. This represents a $1.26 annualized dividend and a yield of 0.64%. Waste Connections's dividend payout ratio (DPR) is presently 52.72%.

About Waste Connections

(

Free Report)

Waste Connections, Inc provides non-hazardous waste collection, transfer, disposal, and resource recovery services in the United States and Canada. It offers collection services to residential, commercial, municipal, industrial, and exploration and production (E&P) customers; landfill disposal services; and recycling services for various recyclable materials, including compost, cardboard, mixed paper, plastic containers, glass bottles, and ferrous and aluminum metals.

See Also

Before you consider Waste Connections, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Waste Connections wasn't on the list.

While Waste Connections currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.