Piedmont Lithium (NASDAQ:PLL - Get Free Report) is scheduled to release its earnings data before the market opens on Tuesday, November 12th. Analysts expect Piedmont Lithium to post earnings of ($0.46) per share for the quarter. Individual that wish to listen to the company's earnings conference call can do so using this link.

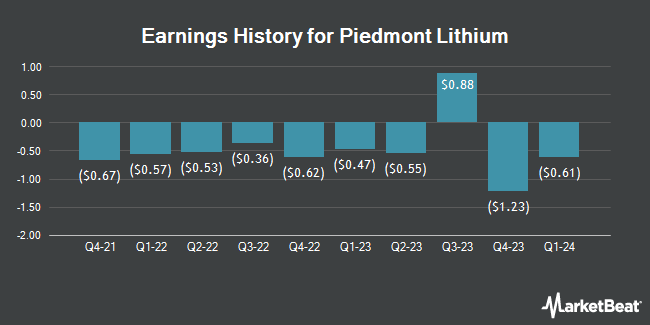

Piedmont Lithium (NASDAQ:PLL - Get Free Report) last announced its quarterly earnings results on Thursday, August 8th. The mineral exploration company reported ($0.69) earnings per share for the quarter, missing the consensus estimate of ($0.16) by ($0.53). The company had revenue of $13.23 million for the quarter, compared to the consensus estimate of $14.89 million. During the same period in the prior year, the business earned ($0.55) earnings per share. On average, analysts expect Piedmont Lithium to post $-3 EPS for the current fiscal year and $0 EPS for the next fiscal year.

Piedmont Lithium Stock Performance

Shares of NASDAQ PLL traded up $0.14 during trading on Tuesday, reaching $13.49. 627,581 shares of the company traded hands, compared to its average volume of 704,480. The stock has a market capitalization of $262.11 million, a PE ratio of -6.74 and a beta of 0.74. The firm has a 50 day simple moving average of $10.12 and a 200-day simple moving average of $10.91. Piedmont Lithium has a 52-week low of $6.57 and a 52-week high of $31.82. The company has a quick ratio of 2.32, a current ratio of 2.32 and a debt-to-equity ratio of 0.01.

Analysts Set New Price Targets

Several brokerages recently commented on PLL. Roth Mkm reaffirmed a "buy" rating and issued a $31.00 price objective (down previously from $40.00) on shares of Piedmont Lithium in a report on Wednesday, October 30th. Macquarie cut shares of Piedmont Lithium from a "neutral" rating to an "underperform" rating and set a $7.80 target price for the company. in a report on Wednesday, October 16th. B. Riley dropped their price target on shares of Piedmont Lithium from $26.00 to $20.00 and set a "buy" rating on the stock in a research note on Monday, August 12th. JPMorgan Chase & Co. reaffirmed an "underweight" rating and issued a $8.00 target price (down from $9.00) on shares of Piedmont Lithium in a report on Monday, October 21st. Finally, BMO Capital Markets boosted their price target on Piedmont Lithium from $8.50 to $9.00 and gave the company a "market perform" rating in a report on Tuesday, October 29th. Two equities research analysts have rated the stock with a sell rating, three have issued a hold rating and three have given a buy rating to the stock. Based on data from MarketBeat.com, Piedmont Lithium presently has a consensus rating of "Hold" and a consensus price target of $22.26.

View Our Latest Stock Report on Piedmont Lithium

About Piedmont Lithium

(

Get Free Report)

Piedmont Lithium Inc, a development stage company, engages in the exploration and development of resource projects in the United States. The company primarily holds a 100% interest in the Carolina Lithium Project that include an area of approximately 3,706 acres located within the Carolina Tin-Spodumene Belt situated to the northwest of Charlotte, North Carolina in the United States.

Featured Articles

Before you consider Piedmont Lithium, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Piedmont Lithium wasn't on the list.

While Piedmont Lithium currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.