Pier 88 Investment Partners LLC lowered its holdings in shares of Booking Holdings Inc. (NASDAQ:BKNG - Free Report) by 21.4% in the 3rd quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The fund owned 1,100 shares of the business services provider's stock after selling 300 shares during the quarter. Booking accounts for about 1.0% of Pier 88 Investment Partners LLC's portfolio, making the stock its 24th largest position. Pier 88 Investment Partners LLC's holdings in Booking were worth $4,633,000 as of its most recent SEC filing.

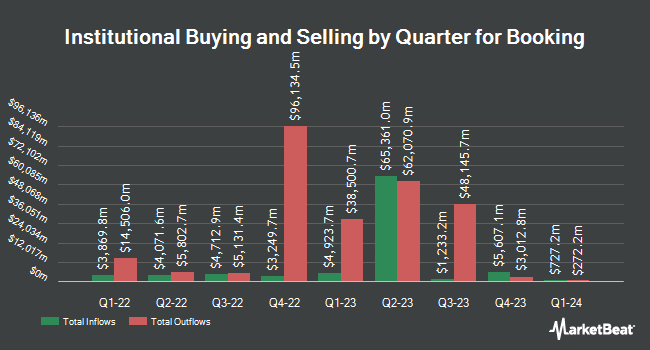

Other institutional investors have also bought and sold shares of the company. Sheaff Brock Investment Advisors LLC increased its stake in Booking by 0.8% in the 1st quarter. Sheaff Brock Investment Advisors LLC now owns 403 shares of the business services provider's stock worth $1,461,000 after buying an additional 3 shares during the period. CVA Family Office LLC increased its stake in Booking by 8.1% in the 2nd quarter. CVA Family Office LLC now owns 40 shares of the business services provider's stock worth $158,000 after buying an additional 3 shares during the period. American National Bank increased its stake in Booking by 3.7% in the 2nd quarter. American National Bank now owns 84 shares of the business services provider's stock worth $333,000 after buying an additional 3 shares during the period. First Horizon Advisors Inc. increased its stake in Booking by 3.2% in the 2nd quarter. First Horizon Advisors Inc. now owns 96 shares of the business services provider's stock worth $380,000 after buying an additional 3 shares during the period. Finally, Jacobsen Capital Management increased its stake in Booking by 1.6% in the 2nd quarter. Jacobsen Capital Management now owns 191 shares of the business services provider's stock worth $757,000 after buying an additional 3 shares during the period. Institutional investors own 92.42% of the company's stock.

Booking Trading Down 0.3 %

BKNG traded down $16.46 on Thursday, hitting $4,970.98. 242,053 shares of the company's stock were exchanged, compared to its average volume of 248,227. Booking Holdings Inc. has a fifty-two week low of $3,079.50 and a fifty-two week high of $5,069.44. The firm has a 50-day moving average price of $4,311.61 and a 200-day moving average price of $3,966.44. The stock has a market cap of $164.54 billion, a price-to-earnings ratio of 33.84, a P/E/G ratio of 1.56 and a beta of 1.38.

Booking Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Friday, December 6th will be paid a dividend of $8.75 per share. The ex-dividend date is Friday, December 6th. This represents a $35.00 annualized dividend and a yield of 0.70%. Booking's dividend payout ratio (DPR) is presently 23.75%.

Analysts Set New Price Targets

BKNG has been the topic of a number of research reports. B. Riley raised their target price on shares of Booking from $4,650.00 to $5,100.00 and gave the company a "buy" rating in a research report on Thursday, October 31st. Benchmark reissued a "buy" rating and set a $4,600.00 target price on shares of Booking in a research report on Tuesday, October 29th. Jefferies Financial Group raised their target price on shares of Booking from $4,200.00 to $4,300.00 and gave the company a "hold" rating in a research report on Tuesday, October 22nd. Barclays raised their target price on shares of Booking from $4,500.00 to $5,100.00 and gave the company an "overweight" rating in a research report on Thursday, October 31st. Finally, StockNews.com upgraded shares of Booking from a "hold" rating to a "buy" rating in a report on Saturday, November 9th. Ten research analysts have rated the stock with a hold rating, twenty-two have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat, the company presently has a consensus rating of "Moderate Buy" and an average price target of $4,749.83.

View Our Latest Report on Booking

Insider Buying and Selling at Booking

In other Booking news, insider Paulo Pisano sold 100 shares of the business's stock in a transaction dated Tuesday, August 27th. The shares were sold at an average price of $3,887.61, for a total transaction of $388,761.00. Following the sale, the insider now directly owns 3,787 shares in the company, valued at $14,722,379.07. This represents a 2.57 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. 0.12% of the stock is currently owned by corporate insiders.

About Booking

(

Free Report)

Booking Holdings Inc, formerly The Priceline Group Inc, is a provider of travel and restaurant online reservation and related services. The Company, through its online travel companies (OTCs), connects consumers wishing to make travel reservations with providers of travel services across the world. It offers consumers an array of accommodation reservations (including hotels, bed and breakfasts, hostels, apartments, vacation rentals and other properties) through its Booking.com, priceline.com and agoda.com brands.

Further Reading

Before you consider Booking, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Booking wasn't on the list.

While Booking currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.