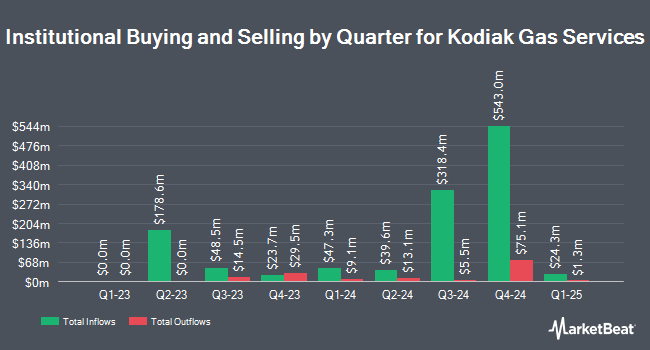

Pier Capital LLC raised its position in Kodiak Gas Services, Inc. (NYSE:KGS - Free Report) by 40.9% during the third quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 235,603 shares of the company's stock after purchasing an additional 68,391 shares during the period. Pier Capital LLC owned about 0.27% of Kodiak Gas Services worth $6,832,000 at the end of the most recent reporting period.

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in KGS. FMR LLC lifted its holdings in shares of Kodiak Gas Services by 444.4% during the 3rd quarter. FMR LLC now owns 4,889,804 shares of the company's stock worth $141,804,000 after acquiring an additional 3,991,630 shares during the period. Wellington Management Group LLP purchased a new position in shares of Kodiak Gas Services during the 3rd quarter worth about $44,558,000. Zimmer Partners LP lifted its holdings in shares of Kodiak Gas Services by 313.0% during the 3rd quarter. Zimmer Partners LP now owns 1,779,851 shares of the company's stock worth $51,616,000 after acquiring an additional 1,348,899 shares during the period. Hotchkis & Wiley Capital Management LLC purchased a new position in shares of Kodiak Gas Services during the 3rd quarter worth about $9,741,000. Finally, HITE Hedge Asset Management LLC lifted its holdings in shares of Kodiak Gas Services by 74.8% during the 2nd quarter. HITE Hedge Asset Management LLC now owns 780,600 shares of the company's stock worth $21,279,000 after acquiring an additional 334,086 shares during the period. 24.95% of the stock is currently owned by hedge funds and other institutional investors.

Insider Transactions at Kodiak Gas Services

In related news, insider Ewan William Hamilton sold 3,000 shares of the firm's stock in a transaction on Thursday, November 21st. The stock was sold at an average price of $40.45, for a total transaction of $121,350.00. Following the transaction, the insider now directly owns 31,745 shares in the company, valued at $1,284,085.25. This trade represents a 8.63 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Corporate insiders own 0.18% of the company's stock.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on KGS shares. Stifel Nicolaus increased their price objective on shares of Kodiak Gas Services from $31.00 to $35.00 and gave the stock a "buy" rating in a report on Wednesday, August 14th. Royal Bank of Canada increased their target price on shares of Kodiak Gas Services from $35.00 to $40.00 and gave the stock an "outperform" rating in a research report on Monday, November 11th. Truist Financial increased their target price on shares of Kodiak Gas Services from $35.00 to $40.00 and gave the stock a "buy" rating in a research report on Friday, November 8th. JPMorgan Chase & Co. increased their target price on shares of Kodiak Gas Services from $34.00 to $42.00 and gave the stock a "neutral" rating in a research report on Friday, November 29th. Finally, Redburn Atlantic started coverage on shares of Kodiak Gas Services in a research report on Thursday, September 19th. They set a "buy" rating and a $35.00 target price for the company. Two investment analysts have rated the stock with a hold rating and nine have given a buy rating to the company's stock. Based on data from MarketBeat.com, Kodiak Gas Services currently has an average rating of "Moderate Buy" and an average price target of $37.09.

Read Our Latest Stock Analysis on KGS

Kodiak Gas Services Stock Down 1.6 %

Shares of KGS stock traded down $0.69 during mid-day trading on Friday, reaching $41.17. 645,731 shares of the company were exchanged, compared to its average volume of 773,034. Kodiak Gas Services, Inc. has a fifty-two week low of $17.52 and a fifty-two week high of $42.02. The company has a debt-to-equity ratio of 1.86, a quick ratio of 0.93 and a current ratio of 1.27. The company has a market capitalization of $3.61 billion, a P/E ratio of 141.97 and a beta of 1.14. The business's 50 day simple moving average is $34.59 and its 200 day simple moving average is $29.80.

Kodiak Gas Services Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Friday, November 8th. Stockholders of record on Friday, November 1st were given a dividend of $0.41 per share. This represents a $1.64 dividend on an annualized basis and a dividend yield of 3.98%. The ex-dividend date was Friday, November 1st. Kodiak Gas Services's payout ratio is currently 565.54%.

About Kodiak Gas Services

(

Free Report)

Kodiak Gas Services, Inc operates contract compression infrastructure for customers in the oil and gas industry in the United States. It operates in two segments, Compression Operations and Other Services. The Compression Operations segment operates company-owned and customer-owned compression infrastructure to enable the production, gathering, and transportation of natural gas and oil.

See Also

Before you consider Kodiak Gas Services, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kodiak Gas Services wasn't on the list.

While Kodiak Gas Services currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.