Pier Capital LLC reduced its stake in The Vita Coco Company, Inc. (NASDAQ:COCO - Free Report) by 50.8% during the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 143,744 shares of the company's stock after selling 148,329 shares during the period. Pier Capital LLC owned approximately 0.25% of Vita Coco worth $4,069,000 at the end of the most recent reporting period.

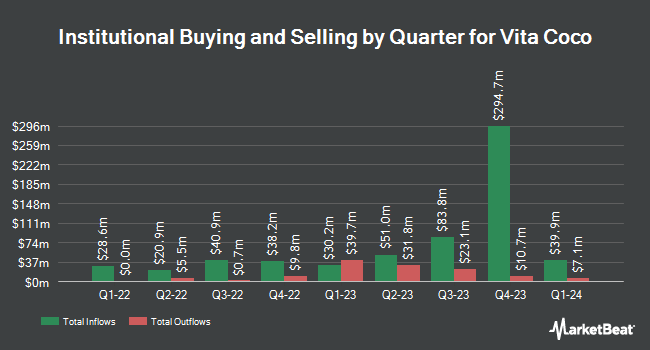

Other hedge funds and other institutional investors have also recently bought and sold shares of the company. CWM LLC raised its position in Vita Coco by 40.7% in the 2nd quarter. CWM LLC now owns 2,720 shares of the company's stock valued at $76,000 after purchasing an additional 787 shares in the last quarter. Arizona State Retirement System raised its holdings in Vita Coco by 9.5% in the second quarter. Arizona State Retirement System now owns 11,107 shares of the company's stock valued at $309,000 after acquiring an additional 960 shares in the last quarter. US Bancorp DE lifted its stake in Vita Coco by 8.5% in the third quarter. US Bancorp DE now owns 14,968 shares of the company's stock worth $424,000 after acquiring an additional 1,178 shares during the last quarter. Captrust Financial Advisors lifted its stake in Vita Coco by 7.2% in the third quarter. Captrust Financial Advisors now owns 21,291 shares of the company's stock worth $603,000 after acquiring an additional 1,433 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank grew its holdings in Vita Coco by 25.6% during the 3rd quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 7,027 shares of the company's stock worth $199,000 after acquiring an additional 1,434 shares in the last quarter. 88.49% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

A number of equities research analysts have recently weighed in on COCO shares. Bank of America raised their price objective on shares of Vita Coco from $30.00 to $38.00 and gave the company a "neutral" rating in a report on Friday. Craig Hallum lifted their price target on Vita Coco from $33.00 to $36.00 and gave the stock a "buy" rating in a report on Thursday, October 31st. Three investment analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat, Vita Coco presently has an average rating of "Moderate Buy" and a consensus price target of $32.14.

Check Out Our Latest Stock Analysis on COCO

Insider Activity

In other news, COO Jonathan Burth sold 2,244 shares of the company's stock in a transaction that occurred on Monday, September 30th. The stock was sold at an average price of $30.01, for a total transaction of $67,342.44. Following the completion of the sale, the chief operating officer now owns 124,605 shares in the company, valued at $3,739,396.05. This represents a 1.77 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, CMO Jane Prior sold 3,638 shares of Vita Coco stock in a transaction on Wednesday, December 4th. The shares were sold at an average price of $37.04, for a total transaction of $134,751.52. Following the completion of the transaction, the chief marketing officer now owns 130,751 shares in the company, valued at approximately $4,843,017.04. This trade represents a 2.71 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 84,951 shares of company stock valued at $3,021,869 in the last ninety days. 34.20% of the stock is currently owned by company insiders.

Vita Coco Stock Performance

Shares of COCO stock traded up $0.27 during mid-day trading on Friday, hitting $36.31. 322,427 shares of the stock were exchanged, compared to its average volume of 408,243. The stock's fifty day simple moving average is $32.29 and its two-hundred day simple moving average is $28.90. The Vita Coco Company, Inc. has a 12-month low of $19.41 and a 12-month high of $37.20. The stock has a market capitalization of $2.06 billion, a price-to-earnings ratio of 36.68, a P/E/G ratio of 2.39 and a beta of 0.31.

Vita Coco (NASDAQ:COCO - Get Free Report) last released its quarterly earnings results on Wednesday, October 30th. The company reported $0.32 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.26 by $0.06. Vita Coco had a return on equity of 26.49% and a net margin of 11.99%. The firm had revenue of $133.00 million for the quarter, compared to the consensus estimate of $138.56 million. During the same quarter last year, the business posted $0.26 EPS. The firm's quarterly revenue was down 3.6% compared to the same quarter last year. On average, research analysts expect that The Vita Coco Company, Inc. will post 1.07 earnings per share for the current fiscal year.

About Vita Coco

(

Free Report)

The Vita Coco Company, Inc develops, markets, and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa, and the Asia Pacific. The company offers coconut oil and coconut milk; juice; Runa, a plant-based energy drink; packaged water under the Ever & Ever brand name; and PWR LIFT, a protein-infused fitness drink.

See Also

Before you consider Vita Coco, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vita Coco wasn't on the list.

While Vita Coco currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat just released its list of 10 cheap stocks that have been overlooked by the market and may be seriously undervalued. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.