Pier Capital LLC purchased a new position in shares of IMAX Co. (NYSE:IMAX - Free Report) during the third quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The institutional investor purchased 205,811 shares of the company's stock, valued at approximately $4,221,000. Pier Capital LLC owned approximately 0.39% of IMAX at the end of the most recent quarter.

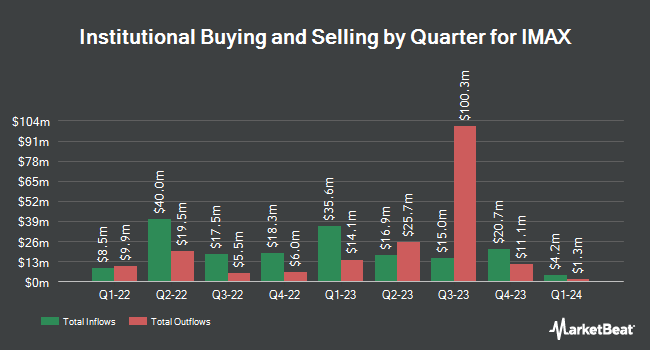

Several other institutional investors also recently bought and sold shares of the business. FMR LLC raised its position in shares of IMAX by 108.4% during the 3rd quarter. FMR LLC now owns 3,949,643 shares of the company's stock worth $81,007,000 after purchasing an additional 2,054,031 shares during the last quarter. Victory Capital Management Inc. lifted its position in shares of IMAX by 33.1% in the second quarter. Victory Capital Management Inc. now owns 1,293,221 shares of the company's stock valued at $21,687,000 after acquiring an additional 321,506 shares in the last quarter. Bank of New York Mellon Corp boosted its stake in shares of IMAX by 90.6% in the second quarter. Bank of New York Mellon Corp now owns 587,694 shares of the company's stock worth $9,856,000 after acquiring an additional 279,410 shares during the last quarter. Castleark Management LLC purchased a new stake in shares of IMAX during the third quarter worth approximately $5,199,000. Finally, Mizuho Markets Americas LLC raised its stake in IMAX by 47.5% in the 3rd quarter. Mizuho Markets Americas LLC now owns 387,689 shares of the company's stock valued at $7,952,000 after purchasing an additional 124,811 shares during the last quarter. 93.51% of the stock is owned by institutional investors and hedge funds.

IMAX Trading Down 1.4 %

IMAX stock traded down $0.37 during midday trading on Friday, hitting $25.85. 260,738 shares of the company's stock were exchanged, compared to its average volume of 550,553. IMAX Co. has a 1-year low of $13.20 and a 1-year high of $26.84. The business has a 50-day simple moving average of $22.94 and a two-hundred day simple moving average of $20.16. The stock has a market capitalization of $1.36 billion, a PE ratio of 58.75, a P/E/G ratio of 1.66 and a beta of 1.23.

IMAX (NYSE:IMAX - Get Free Report) last announced its earnings results on Wednesday, October 30th. The company reported $0.35 earnings per share for the quarter, topping the consensus estimate of $0.23 by $0.12. IMAX had a net margin of 6.74% and a return on equity of 7.53%. The company had revenue of $91.50 million during the quarter, compared to analyst estimates of $93.71 million. During the same quarter last year, the firm posted $0.27 earnings per share. IMAX's revenue was down 11.9% compared to the same quarter last year. As a group, research analysts expect that IMAX Co. will post 0.77 EPS for the current fiscal year.

Analysts Set New Price Targets

Several equities research analysts have issued reports on the stock. StockNews.com cut shares of IMAX from a "buy" rating to a "hold" rating in a research note on Friday, November 29th. Barrington Research reaffirmed an "outperform" rating and set a $24.00 price objective on shares of IMAX in a research note on Thursday, October 31st. Wedbush reissued an "outperform" rating on shares of IMAX in a research note on Wednesday, November 27th. JPMorgan Chase & Co. boosted their target price on IMAX from $20.00 to $21.00 and gave the stock a "neutral" rating in a report on Monday, October 14th. Finally, Rosenblatt Securities reaffirmed a "buy" rating and issued a $28.00 price target on shares of IMAX in a report on Thursday, October 31st. One equities research analyst has rated the stock with a sell rating, two have issued a hold rating, seven have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, IMAX presently has an average rating of "Moderate Buy" and a consensus price target of $24.22.

View Our Latest Research Report on IMAX

IMAX Company Profile

(

Free Report)

IMAX Corporation, together with its subsidiaries, operates as a technology platform for entertainment and events worldwide. The company operates in two segments, Content Solutions and Technology Products and Services. The company offers IMAX DMR, a proprietary technology that digitally remasters films and other content into IMAX formats for distribution to the IMAX network; IMAX Enhanced that provides end-to-end technology across streaming content and entertainment devices at home; and SSIMWAVE, an AI-driven video quality solutions for media and entertainment companies.

See Also

Before you consider IMAX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IMAX wasn't on the list.

While IMAX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.