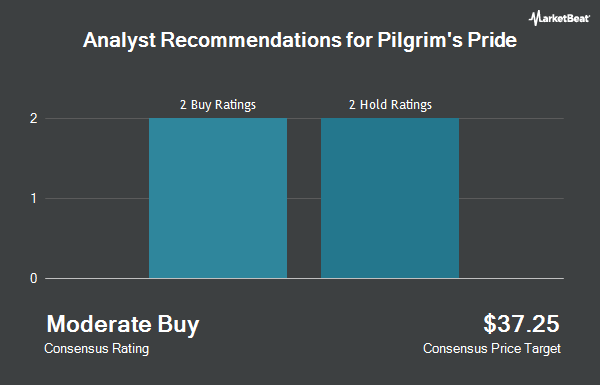

Shares of Pilgrim's Pride Co. (NASDAQ:PPC - Get Free Report) have received an average rating of "Hold" from the seven ratings firms that are covering the stock, Marketbeat.com reports. Six analysts have rated the stock with a hold recommendation and one has assigned a buy recommendation to the company. The average 12 month price objective among brokers that have covered the stock in the last year is $46.33.

A number of equities research analysts have weighed in on PPC shares. StockNews.com lowered Pilgrim's Pride from a "strong-buy" rating to a "buy" rating in a research report on Sunday, March 2nd. Santander began coverage on shares of Pilgrim's Pride in a research note on Wednesday, March 5th. They issued a "neutral" rating for the company. Finally, BMO Capital Markets raised their target price on shares of Pilgrim's Pride from $47.00 to $48.00 and gave the company a "market perform" rating in a research report on Monday, March 17th.

Get Our Latest Report on PPC

Hedge Funds Weigh In On Pilgrim's Pride

Several hedge funds have recently modified their holdings of the stock. Point72 Asset Management L.P. lifted its stake in Pilgrim's Pride by 102.0% during the 4th quarter. Point72 Asset Management L.P. now owns 16,381 shares of the company's stock valued at $744,000 after acquiring an additional 827,381 shares during the period. AQR Capital Management LLC raised its position in Pilgrim's Pride by 44.1% during the fourth quarter. AQR Capital Management LLC now owns 1,883,708 shares of the company's stock valued at $85,502,000 after acquiring an additional 576,438 shares in the last quarter. Jacobs Levy Equity Management Inc. lifted its holdings in Pilgrim's Pride by 26.8% in the fourth quarter. Jacobs Levy Equity Management Inc. now owns 1,845,480 shares of the company's stock valued at $83,766,000 after acquiring an additional 389,967 shares during the period. BI Asset Management Fondsmaeglerselskab A S boosted its position in Pilgrim's Pride by 156.4% in the 4th quarter. BI Asset Management Fondsmaeglerselskab A S now owns 333,077 shares of the company's stock worth $15,118,000 after purchasing an additional 203,192 shares in the last quarter. Finally, Ruffer LLP acquired a new stake in shares of Pilgrim's Pride during the 4th quarter worth approximately $8,381,000. Institutional investors and hedge funds own 16.64% of the company's stock.

Pilgrim's Pride Trading Up 1.3 %

PPC traded up $0.68 on Friday, reaching $51.05. 231,588 shares of the company traded hands, compared to its average volume of 1,102,168. The company has a quick ratio of 1.31, a current ratio of 2.01 and a debt-to-equity ratio of 0.75. The company has a market cap of $12.10 billion, a P/E ratio of 11.21 and a beta of 0.63. The firm has a fifty day simple moving average of $51.88 and a two-hundred day simple moving average of $49.20. Pilgrim's Pride has a one year low of $33.67 and a one year high of $57.16.

Pilgrim's Pride Increases Dividend

The company also recently declared a special dividend, which will be paid on Thursday, April 24th. Shareholders of record on Thursday, April 3rd will be issued a $6.30 dividend. This is a positive change from Pilgrim's Pride's previous special dividend of $2.75. The ex-dividend date of this dividend is Thursday, April 3rd.

About Pilgrim's Pride

(

Get Free ReportPilgrim's Pride Corp. engages in the production, processing, marketing, and distribution of fresh, frozen and value-added chicken and pork products to retailers, distributors, and foodservice operators. It operates through the following segments: U.S., U.K. and Europe, and Mexico. The company was founded by Lonnie A.

Recommended Stories

Before you consider Pilgrim's Pride, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pilgrim's Pride wasn't on the list.

While Pilgrim's Pride currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.