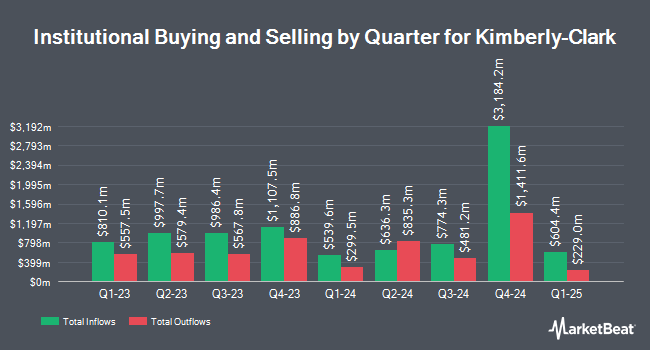

Pine Valley Investments Ltd Liability Co trimmed its stake in shares of Kimberly-Clark Co. (NYSE:KMB - Free Report) by 14.3% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 30,620 shares of the company's stock after selling 5,105 shares during the quarter. Pine Valley Investments Ltd Liability Co's holdings in Kimberly-Clark were worth $4,366,000 at the end of the most recent reporting period.

Several other institutional investors and hedge funds have also recently modified their holdings of KMB. Wealth Enhancement Advisory Services LLC boosted its stake in Kimberly-Clark by 9.6% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 102,332 shares of the company's stock valued at $14,142,000 after purchasing an additional 8,926 shares during the period. Archford Capital Strategies LLC bought a new stake in shares of Kimberly-Clark in the second quarter valued at about $211,000. Swedbank AB grew its stake in shares of Kimberly-Clark by 4.0% in the second quarter. Swedbank AB now owns 166,108 shares of the company's stock valued at $22,956,000 after acquiring an additional 6,392 shares in the last quarter. Fiduciary Financial Group LLC bought a new position in Kimberly-Clark during the second quarter worth about $317,000. Finally, JLB & Associates Inc. raised its stake in Kimberly-Clark by 2.2% in the 2nd quarter. JLB & Associates Inc. now owns 15,922 shares of the company's stock worth $2,200,000 after purchasing an additional 350 shares in the last quarter. 76.29% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

A number of research analysts have issued reports on the stock. Royal Bank of Canada restated an "outperform" rating and set a $165.00 target price on shares of Kimberly-Clark in a research report on Wednesday, October 23rd. UBS Group cut their price target on Kimberly-Clark from $153.00 to $151.00 and set a "neutral" rating for the company in a research note on Wednesday, October 23rd. Barclays raised their price objective on Kimberly-Clark from $135.00 to $144.00 and gave the stock an "equal weight" rating in a research note on Friday, October 11th. Deutsche Bank Aktiengesellschaft upped their target price on Kimberly-Clark from $146.00 to $147.00 and gave the company a "hold" rating in a research report on Tuesday, October 8th. Finally, JPMorgan Chase & Co. reduced their target price on Kimberly-Clark from $142.00 to $140.00 and set an "underweight" rating on the stock in a report on Wednesday, October 23rd. Two equities research analysts have rated the stock with a sell rating, seven have issued a hold rating and seven have issued a buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and an average price target of $149.93.

Check Out Our Latest Stock Report on Kimberly-Clark

Kimberly-Clark Price Performance

KMB stock traded up $0.28 during trading on Thursday, reaching $130.89. 1,760,530 shares of the company were exchanged, compared to its average volume of 2,115,716. Kimberly-Clark Co. has a twelve month low of $117.67 and a twelve month high of $149.30. The company has a debt-to-equity ratio of 4.77, a current ratio of 0.83 and a quick ratio of 0.55. The company has a market capitalization of $43.65 billion, a price-to-earnings ratio of 17.06, a P/E/G ratio of 2.83 and a beta of 0.40. The company has a 50-day moving average of $137.45 and a two-hundred day moving average of $139.37.

Kimberly-Clark (NYSE:KMB - Get Free Report) last announced its quarterly earnings results on Tuesday, October 22nd. The company reported $1.83 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.69 by $0.14. Kimberly-Clark had a net margin of 12.97% and a return on equity of 198.59%. The company had revenue of $4.95 billion during the quarter, compared to the consensus estimate of $5.06 billion. During the same period in the prior year, the business earned $1.74 earnings per share. The company's revenue for the quarter was down 3.5% compared to the same quarter last year. As a group, equities analysts predict that Kimberly-Clark Co. will post 7.27 earnings per share for the current fiscal year.

Kimberly-Clark Dividend Announcement

The company also recently declared a quarterly dividend, which will be paid on Friday, January 3rd. Stockholders of record on Friday, December 6th will be paid a dividend of $1.22 per share. This represents a $4.88 dividend on an annualized basis and a dividend yield of 3.73%. The ex-dividend date is Friday, December 6th. Kimberly-Clark's payout ratio is 63.29%.

Insider Transactions at Kimberly-Clark

In related news, VP Andrew Drexler sold 3,000 shares of the firm's stock in a transaction on Friday, November 22nd. The stock was sold at an average price of $139.01, for a total transaction of $417,030.00. Following the completion of the transaction, the vice president now directly owns 5,053 shares of the company's stock, valued at $702,417.53. This trade represents a 37.25 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. Company insiders own 0.62% of the company's stock.

Kimberly-Clark Company Profile

(

Free Report)

Kimberly-Clark Corporation, together with its subsidiaries, manufactures and markets personal care and consumer tissue products in the United States. It operates through three segments: Personal Care, Consumer Tissue, and K-C Professional. The company's Personal Care segment offers disposable diapers, training and youth pants, swimpants, baby wipes, feminine and incontinence care products, reusable underwear, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Thinx, Poise, Depend, Plenitud, Softex, and other brand names.

See Also

Before you consider Kimberly-Clark, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kimberly-Clark wasn't on the list.

While Kimberly-Clark currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.