Ping Capital Management Inc. bought a new stake in shares of KE Holdings Inc. (NYSE:BEKE - Free Report) in the 4th quarter, according to its most recent 13F filing with the SEC. The firm bought 32,000 shares of the company's stock, valued at approximately $589,000.

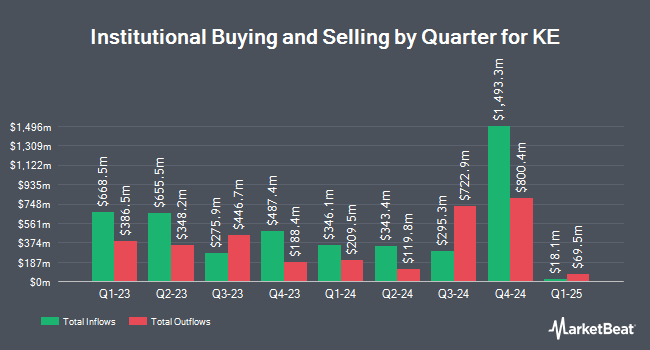

Other hedge funds have also recently added to or reduced their stakes in the company. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC grew its holdings in shares of KE by 203.1% during the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 6,478,102 shares of the company's stock worth $128,979,000 after buying an additional 4,340,517 shares in the last quarter. Assenagon Asset Management S.A. grew its holdings in shares of KE by 1,155.7% during the third quarter. Assenagon Asset Management S.A. now owns 2,353,268 shares of the company's stock worth $46,854,000 after buying an additional 2,165,863 shares in the last quarter. Lord Abbett & CO. LLC purchased a new stake in shares of KE during the third quarter worth about $28,956,000. M&G PLC grew its holdings in shares of KE by 16.4% during the third quarter. M&G PLC now owns 10,090,834 shares of the company's stock worth $201,817,000 after buying an additional 1,422,667 shares in the last quarter. Finally, Jennison Associates LLC grew its holdings in shares of KE by 72.1% during the fourth quarter. Jennison Associates LLC now owns 2,761,520 shares of the company's stock worth $50,867,000 after buying an additional 1,157,272 shares in the last quarter. 39.34% of the stock is currently owned by hedge funds and other institutional investors.

KE Stock Performance

KE stock traded up $0.04 during trading on Friday, reaching $17.90. The company had a trading volume of 4,626,874 shares, compared to its average volume of 6,427,995. KE Holdings Inc. has a 12-month low of $12.44 and a 12-month high of $26.05. The stock's 50 day moving average price is $18.00 and its two-hundred day moving average price is $17.87. The firm has a market capitalization of $21.63 billion, a price-to-earnings ratio of 36.53, a PEG ratio of 2.95 and a beta of -0.76.

Wall Street Analyst Weigh In

BEKE has been the subject of a number of recent research reports. Bank of America upgraded shares of KE from a "neutral" rating to a "buy" rating and lifted their price target for the stock from $24.00 to $28.00 in a report on Wednesday, October 30th. Barclays boosted their target price on shares of KE from $30.00 to $33.00 and gave the company an "overweight" rating in a report on Monday, November 25th.

View Our Latest Stock Report on KE

About KE

(

Free Report)

KE Holdings Inc, through its subsidiaries, engages in operating an integrated online and offline platform for housing transactions and services in the People's Republic of China. It operates through four segments: Existing Home Transaction Services, New Home Transaction Services, Home Renovation and Furnishing, and Emerging and Other Services.

Further Reading

Before you consider KE, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and KE wasn't on the list.

While KE currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.