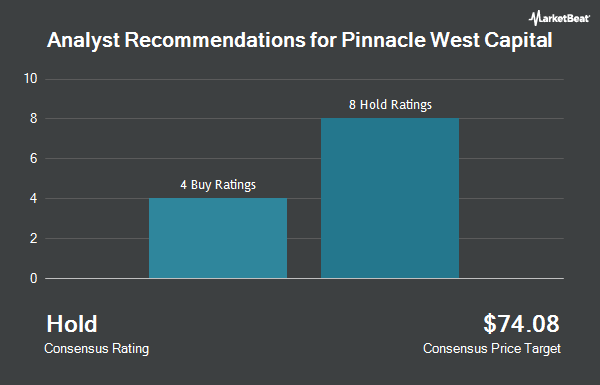

Shares of Pinnacle West Capital Co. (NYSE:PNW - Get Free Report) have been assigned an average recommendation of "Moderate Buy" from the nine ratings firms that are covering the company, MarketBeat Ratings reports. Five analysts have rated the stock with a hold recommendation, three have issued a buy recommendation and one has issued a strong buy recommendation on the company. The average 1-year price objective among brokers that have updated their coverage on the stock in the last year is $95.50.

A number of research firms have recently weighed in on PNW. UBS Group boosted their target price on Pinnacle West Capital from $96.00 to $99.00 and gave the company a "neutral" rating in a research note on Friday, March 21st. Wells Fargo & Company raised their target price on shares of Pinnacle West Capital from $92.00 to $95.00 and gave the stock an "equal weight" rating in a report on Wednesday, February 26th. LADENBURG THALM/SH SH raised shares of Pinnacle West Capital to a "strong-buy" rating in a research report on Monday, March 17th. Barclays boosted their price objective on shares of Pinnacle West Capital from $87.00 to $94.00 and gave the company an "equal weight" rating in a research report on Tuesday, April 1st. Finally, Guggenheim reissued a "buy" rating and issued a $100.00 target price on shares of Pinnacle West Capital in a research note on Wednesday, February 26th.

Get Our Latest Report on PNW

Pinnacle West Capital Price Performance

NYSE PNW traded up $1.07 during trading hours on Wednesday, reaching $94.48. 2,215,855 shares of the stock traded hands, compared to its average volume of 1,082,630. The stock has a 50 day simple moving average of $92.16 and a two-hundred day simple moving average of $89.32. Pinnacle West Capital has a 1 year low of $72.78 and a 1 year high of $96.50. The company has a debt-to-equity ratio of 1.20, a current ratio of 0.71 and a quick ratio of 0.54. The company has a market cap of $11.26 billion, a price-to-earnings ratio of 17.89, a price-to-earnings-growth ratio of 3.59 and a beta of 0.42.

Pinnacle West Capital (NYSE:PNW - Get Free Report) last announced its quarterly earnings data on Tuesday, February 25th. The utilities provider reported ($0.06) earnings per share for the quarter, topping analysts' consensus estimates of ($0.31) by $0.25. Pinnacle West Capital had a net margin of 12.26% and a return on equity of 9.60%. The firm had revenue of $1.10 billion during the quarter, compared to analyst estimates of $1.06 billion. On average, analysts predict that Pinnacle West Capital will post 5.13 EPS for the current fiscal year.

Institutional Investors Weigh In On Pinnacle West Capital

Several hedge funds and other institutional investors have recently added to or reduced their stakes in PNW. YANKCOM Partnership bought a new position in shares of Pinnacle West Capital in the 4th quarter worth about $29,000. Canada Post Corp Registered Pension Plan purchased a new stake in Pinnacle West Capital during the 4th quarter valued at about $35,000. Brown Lisle Cummings Inc. bought a new stake in Pinnacle West Capital during the 4th quarter valued at about $38,000. Roble Belko & Company Inc purchased a new position in Pinnacle West Capital in the fourth quarter worth about $42,000. Finally, Transcendent Capital Group LLC purchased a new stake in shares of Pinnacle West Capital during the fourth quarter valued at approximately $46,000. 91.51% of the stock is owned by hedge funds and other institutional investors.

Pinnacle West Capital Company Profile

(

Get Free ReportPinnacle West Capital Corporation, through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona. The company engages in the generation, transmission, and distribution of electricity using coal, nuclear, gas, oil, and solar generating facilities. Its transmission facilities include overhead lines and underground lines; and distribution facilities consist of overhead lines and underground primary cables.

See Also

Before you consider Pinnacle West Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinnacle West Capital wasn't on the list.

While Pinnacle West Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.