Pinnacle West Capital (NYSE:PNW - Get Free Report) had its price target increased by research analysts at Wells Fargo & Company from $92.00 to $95.00 in a note issued to investors on Wednesday,Benzinga reports. The brokerage currently has an "equal weight" rating on the utilities provider's stock. Wells Fargo & Company's target price would indicate a potential upside of 2.66% from the stock's current price.

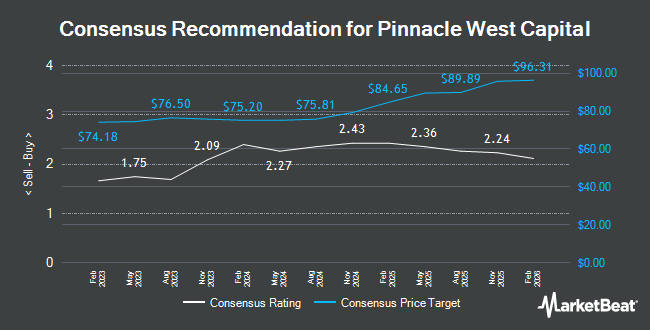

A number of other analysts have also recently weighed in on PNW. KeyCorp upgraded shares of Pinnacle West Capital from a "sector weight" rating to an "overweight" rating and set a $101.00 price target on the stock in a report on Wednesday, December 4th. Jefferies Financial Group reduced their price target on shares of Pinnacle West Capital from $106.00 to $104.00 and set a "buy" rating for the company in a research report on Tuesday, January 28th. Barclays cut Pinnacle West Capital from an "overweight" rating to an "equal weight" rating and reduced their price target for the company from $93.00 to $91.00 in a research report on Monday, November 18th. Morgan Stanley reduced their price target on Pinnacle West Capital from $82.00 to $81.00 and set an "equal weight" rating for the company in a research report on Friday, November 22nd. Finally, Citigroup lifted their price target on Pinnacle West Capital from $85.00 to $95.00 and gave the company a "neutral" rating in a research report on Wednesday, December 4th. Eight investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the company's stock. According to MarketBeat, Pinnacle West Capital presently has a consensus rating of "Hold" and an average price target of $86.58.

Read Our Latest Stock Analysis on PNW

Pinnacle West Capital Stock Performance

PNW traded up $1.67 during mid-day trading on Wednesday, reaching $92.53. 938,189 shares of the company traded hands, compared to its average volume of 1,026,315. The company's fifty day moving average price is $86.96 and its 200-day moving average price is $88.21. The stock has a market capitalization of $10.52 billion, a P/E ratio of 17.53, a P/E/G ratio of 3.59 and a beta of 0.57. Pinnacle West Capital has a 52-week low of $67.51 and a 52-week high of $95.42. The company has a quick ratio of 0.54, a current ratio of 0.71 and a debt-to-equity ratio of 1.20.

Pinnacle West Capital (NYSE:PNW - Get Free Report) last posted its quarterly earnings results on Tuesday, February 25th. The utilities provider reported ($0.06) EPS for the quarter, beating analysts' consensus estimates of ($0.31) by $0.25. Pinnacle West Capital had a return on equity of 9.60% and a net margin of 12.26%. The business had revenue of $1.10 billion for the quarter, compared to analysts' expectations of $1.06 billion. On average, sell-side analysts expect that Pinnacle West Capital will post 5.13 EPS for the current year.

Hedge Funds Weigh In On Pinnacle West Capital

Several institutional investors have recently added to or reduced their stakes in PNW. HITE Hedge Asset Management LLC boosted its position in Pinnacle West Capital by 261.2% in the 3rd quarter. HITE Hedge Asset Management LLC now owns 92,311 shares of the utilities provider's stock valued at $8,178,000 after buying an additional 66,755 shares during the last quarter. XTX Topco Ltd bought a new stake in shares of Pinnacle West Capital during the 3rd quarter worth $2,235,000. Principal Financial Group Inc. boosted its position in Pinnacle West Capital by 7.7% during the 3rd quarter. Principal Financial Group Inc. now owns 139,243 shares of the utilities provider's stock worth $12,336,000 after acquiring an additional 9,993 shares during the period. Entropy Technologies LP grew its stake in Pinnacle West Capital by 170.1% in the third quarter. Entropy Technologies LP now owns 30,314 shares of the utilities provider's stock valued at $2,686,000 after purchasing an additional 19,089 shares in the last quarter. Finally, Mirae Asset Global Investments Co. Ltd. boosted its holdings in Pinnacle West Capital by 47.2% in the fourth quarter. Mirae Asset Global Investments Co. Ltd. now owns 11,716 shares of the utilities provider's stock worth $995,000 after purchasing an additional 3,758 shares in the last quarter. 91.51% of the stock is currently owned by institutional investors and hedge funds.

Pinnacle West Capital Company Profile

(

Get Free Report)

Pinnacle West Capital Corporation, through its subsidiary, provides retail and wholesale electric services primarily in the state of Arizona. The company engages in the generation, transmission, and distribution of electricity using coal, nuclear, gas, oil, and solar generating facilities. Its transmission facilities include overhead lines and underground lines; and distribution facilities consist of overhead lines and underground primary cables.

See Also

Before you consider Pinnacle West Capital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinnacle West Capital wasn't on the list.

While Pinnacle West Capital currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.