Pinterest (NYSE:PINS - Get Free Report) had its price objective reduced by stock analysts at Rosenblatt Securities from $48.00 to $46.00 in a report released on Friday,Benzinga reports. The firm presently has a "buy" rating on the stock. Rosenblatt Securities' target price indicates a potential upside of 57.67% from the stock's current price.

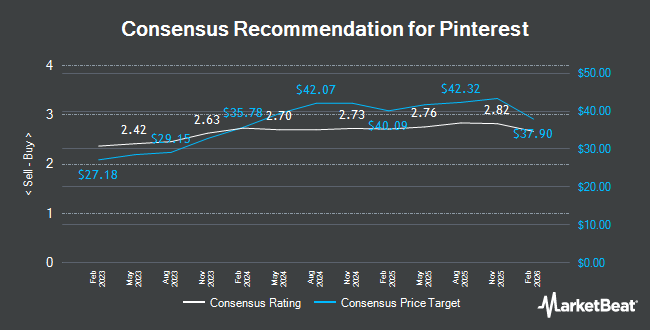

Several other research firms have also issued reports on PINS. Citigroup lowered their price target on Pinterest from $51.00 to $44.00 and set a "buy" rating for the company in a research report on Wednesday, July 31st. Roth Mkm decreased their target price on shares of Pinterest from $39.00 to $33.00 and set a "neutral" rating for the company in a report on Friday. Stifel Nicolaus cut their price target on shares of Pinterest from $46.00 to $45.00 and set a "buy" rating on the stock in a report on Wednesday, July 31st. KeyCorp boosted their price objective on shares of Pinterest from $43.00 to $45.00 and gave the stock an "overweight" rating in a report on Wednesday, October 9th. Finally, Cantor Fitzgerald reiterated an "overweight" rating and set a $41.00 target price on shares of Pinterest in a research note on Monday, October 7th. Eight equities research analysts have rated the stock with a hold rating and twenty-one have issued a buy rating to the company's stock. According to data from MarketBeat, Pinterest presently has a consensus rating of "Moderate Buy" and an average target price of $42.22.

Get Our Latest Stock Analysis on PINS

Pinterest Price Performance

NYSE PINS traded down $4.75 during trading hours on Friday, reaching $29.18. 55,937,006 shares of the company's stock traded hands, compared to its average volume of 9,503,379. The firm has a market cap of $20.02 billion, a PE ratio of 108.06, a PEG ratio of 2.60 and a beta of 1.02. Pinterest has a 52-week low of $27.00 and a 52-week high of $45.19. The firm has a 50-day simple moving average of $31.88 and a 200 day simple moving average of $36.36.

Insider Buying and Selling

In other news, Director Gokul Rajaram sold 1,150 shares of the firm's stock in a transaction on Wednesday, October 16th. The shares were sold at an average price of $33.52, for a total transaction of $38,548.00. Following the sale, the director now directly owns 33,686 shares in the company, valued at $1,129,154.72. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this hyperlink. In related news, Director Gokul Rajaram sold 1,150 shares of Pinterest stock in a transaction that occurred on Wednesday, October 16th. The stock was sold at an average price of $33.52, for a total transaction of $38,548.00. Following the sale, the director now owns 33,686 shares of the company's stock, valued at approximately $1,129,154.72. This trade represents a 0.00 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, CFO Donnelly Julia Brau sold 30,280 shares of the business's stock in a transaction that occurred on Friday, September 27th. The stock was sold at an average price of $32.72, for a total value of $990,761.60. Following the completion of the transaction, the chief financial officer now directly owns 297,351 shares in the company, valued at approximately $9,729,324.72. This represents a 0.00 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 7.11% of the stock is currently owned by insiders.

Hedge Funds Weigh In On Pinterest

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in PINS. Brown Shipley& Co Ltd purchased a new position in shares of Pinterest in the 2nd quarter worth $25,000. Wellington Shields Capital Management LLC purchased a new position in Pinterest in the second quarter worth about $26,000. Hexagon Capital Partners LLC grew its position in Pinterest by 157.7% in the second quarter. Hexagon Capital Partners LLC now owns 750 shares of the company's stock worth $33,000 after acquiring an additional 459 shares in the last quarter. GAMMA Investing LLC increased its stake in Pinterest by 113.4% during the second quarter. GAMMA Investing LLC now owns 762 shares of the company's stock worth $34,000 after acquiring an additional 405 shares during the last quarter. Finally, Rothschild Investment LLC purchased a new stake in Pinterest during the second quarter valued at approximately $35,000. 88.81% of the stock is owned by institutional investors.

Pinterest Company Profile

(

Get Free Report)

Pinterest, Inc operates as a visual search and discovery platform in the United States and internationally. Its platform allows people to find ideas, such as recipes, home and style inspiration, and others; and to search, save, and shop the ideas. The company was formerly known as Cold Brew Labs Inc and changed its name to Pinterest, Inc in April 2012.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Pinterest, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pinterest wasn't on the list.

While Pinterest currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.