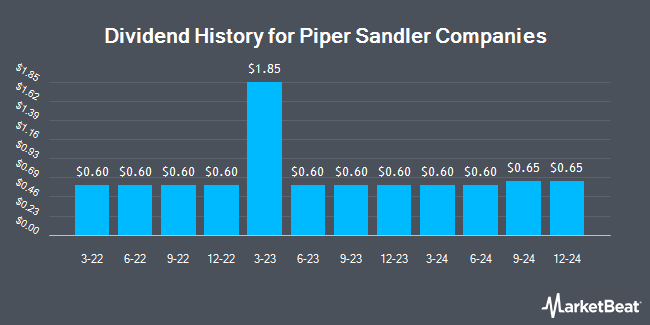

Piper Sandler Companies (NYSE:PIPR - Get Free Report) declared a quarterly dividend on Friday, January 31st,Wall Street Journal reports. Stockholders of record on Tuesday, March 4th will be paid a dividend of 0.65 per share by the financial services provider on Friday, March 14th. This represents a $2.60 annualized dividend and a dividend yield of 0.81%. The ex-dividend date is Tuesday, March 4th.

Piper Sandler Companies has increased its dividend by an average of 8.6% annually over the last three years. Piper Sandler Companies has a payout ratio of 13.5% indicating that its dividend is sufficiently covered by earnings.

Piper Sandler Companies Price Performance

Shares of PIPR stock traded down $4.06 during trading hours on Thursday, reaching $319.62. 97,400 shares of the stock were exchanged, compared to its average volume of 95,846. The business's fifty day moving average is $304.59 and its two-hundred day moving average is $314.98. The firm has a market capitalization of $5.68 billion, a P/E ratio of 31.27 and a beta of 1.46. Piper Sandler Companies has a 12-month low of $177.80 and a 12-month high of $351.80.

Piper Sandler Companies (NYSE:PIPR - Get Free Report) last announced its quarterly earnings data on Friday, January 31st. The financial services provider reported $4.80 earnings per share for the quarter, beating analysts' consensus estimates of $3.99 by $0.81. Piper Sandler Companies had a net margin of 11.87% and a return on equity of 17.00%. During the same period last year, the business posted $4.03 EPS. As a group, equities research analysts predict that Piper Sandler Companies will post 13.47 earnings per share for the current fiscal year.

Analysts Set New Price Targets

Several research firms recently weighed in on PIPR. The Goldman Sachs Group boosted their target price on Piper Sandler Companies from $298.00 to $330.00 and gave the stock a "neutral" rating in a research note on Monday. StockNews.com downgraded Piper Sandler Companies from a "buy" rating to a "hold" rating in a report on Tuesday, January 7th. Finally, JMP Securities reiterated a "market perform" rating on shares of Piper Sandler Companies in a research report on Monday.

Get Our Latest Stock Report on PIPR

About Piper Sandler Companies

(

Get Free Report)

Piper Sandler Companies operates as an investment bank and institutional securities firm that serves corporations, private equity groups, public entities, non-profit entities, and institutional investors in the United States and internationally. It offers investment banking services and institutional sales, trading, and research services for various equity and fixed income products; advisory services, such as mergers and acquisitions, equity and debt private placements, and debt and restructuring advisory; raises capital through equity and debt financings; underwrites municipal issuances; and municipal financial advisory and loan placement services, as well as various over-the-counter derivative products.

Featured Articles

Before you consider Piper Sandler Companies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Piper Sandler Companies wasn't on the list.

While Piper Sandler Companies currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.