Birkenstock (NYSE:BIRK - Free Report) had its target price decreased by Piper Sandler from $70.00 to $60.00 in a report released on Friday morning,Benzinga reports. Piper Sandler currently has an overweight rating on the stock.

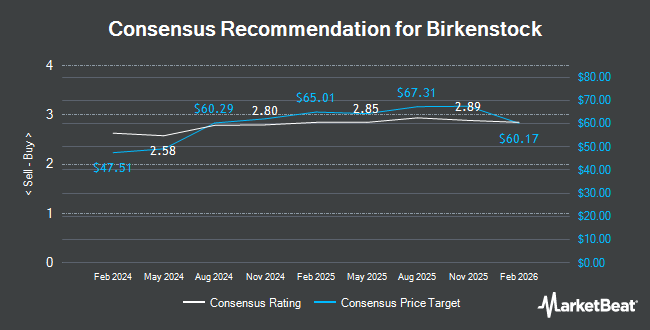

A number of other equities research analysts have also recently weighed in on the stock. BTIG Research upped their price objective on shares of Birkenstock from $60.00 to $70.00 and gave the stock a "buy" rating in a report on Wednesday, December 18th. Deutsche Bank Aktiengesellschaft increased their target price on Birkenstock from $65.00 to $66.00 and gave the stock a "buy" rating in a research note on Thursday, December 19th. Telsey Advisory Group reaffirmed an "outperform" rating and issued a $70.00 price target on shares of Birkenstock in a research report on Thursday, February 20th. Robert W. Baird increased their price objective on shares of Birkenstock from $65.00 to $72.00 and gave the company an "outperform" rating in a research report on Thursday, December 19th. Finally, BMO Capital Markets lifted their target price on shares of Birkenstock from $60.00 to $70.00 and gave the stock an "outperform" rating in a report on Thursday, December 19th. Two investment analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $67.50.

Check Out Our Latest Stock Report on Birkenstock

Birkenstock Trading Down 2.3 %

Shares of Birkenstock stock traded down $1.12 during trading on Friday, reaching $47.29. The company's stock had a trading volume of 1,232,060 shares, compared to its average volume of 1,761,342. The firm's 50-day moving average is $48.55 and its two-hundred day moving average is $51.38. Birkenstock has a 52-week low of $40.56 and a 52-week high of $64.78. The company has a market cap of $8.88 billion, a price-to-earnings ratio of 38.14, a PEG ratio of 1.02 and a beta of 1.71. The company has a quick ratio of 1.08, a current ratio of 2.84 and a debt-to-equity ratio of 0.48.

Birkenstock (NYSE:BIRK - Get Free Report) last issued its earnings results on Thursday, February 20th. The company reported $0.19 EPS for the quarter, topping the consensus estimate of $0.16 by $0.03. The company had revenue of $385.88 million for the quarter, compared to the consensus estimate of $355.80 million. Birkenstock had a net margin of 11.73% and a return on equity of 9.52%. On average, sell-side analysts anticipate that Birkenstock will post 1.77 earnings per share for the current year.

Institutional Investors Weigh In On Birkenstock

Several institutional investors have recently bought and sold shares of BIRK. Quarry LP purchased a new position in shares of Birkenstock in the third quarter worth $25,000. Signaturefd LLC lifted its position in Birkenstock by 642.6% during the 4th quarter. Signaturefd LLC now owns 505 shares of the company's stock worth $29,000 after acquiring an additional 437 shares during the period. Bank Julius Baer & Co. Ltd Zurich purchased a new stake in Birkenstock during the 4th quarter valued at about $34,000. NewEdge Advisors LLC acquired a new position in shares of Birkenstock in the fourth quarter valued at about $45,000. Finally, Headlands Technologies LLC acquired a new stake in shares of Birkenstock during the fourth quarter worth about $76,000. 19.93% of the stock is currently owned by institutional investors and hedge funds.

About Birkenstock

(

Get Free Report)

Birkenstock Holding plc manufactures and sells footwear products. It also offers sandals, shoes, closed-toe silhouettes, skincare products, and accessories. The company sells its products through e-commerce sites and a network of owned retail stores, as well as business-to-business channels. It operates in the United States, Brazil, Canada, Mexico, Europe, APMA, and internationally.

See Also

Before you consider Birkenstock, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Birkenstock wasn't on the list.

While Birkenstock currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.