Zillow Group (NASDAQ:ZG - Get Free Report) had its price objective upped by equities researchers at Piper Sandler from $73.00 to $93.00 in a report issued on Friday,Benzinga reports. The firm currently has an "overweight" rating on the technology company's stock. Piper Sandler's price objective indicates a potential upside of 17.31% from the company's previous close.

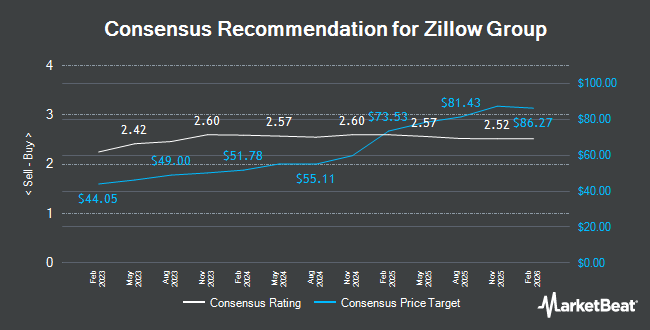

Other equities research analysts also recently issued reports about the company. Royal Bank of Canada boosted their price target on Zillow Group from $66.00 to $74.00 and gave the company an "outperform" rating in a research note on Thursday, November 7th. Evercore ISI boosted their target price on shares of Zillow Group from $55.00 to $75.00 and gave the company an "outperform" rating in a research report on Thursday, November 7th. UBS Group increased their price target on shares of Zillow Group from $70.00 to $80.00 and gave the stock a "buy" rating in a research report on Tuesday, October 22nd. Wedbush upgraded shares of Zillow Group from a "neutral" rating to an "outperform" rating and lifted their price target for the stock from $50.00 to $80.00 in a research note on Monday, September 16th. Finally, Canaccord Genuity Group upped their price objective on Zillow Group from $64.00 to $86.00 and gave the stock a "hold" rating in a research note on Monday, December 2nd. One research analyst has rated the stock with a sell rating, five have given a hold rating and twelve have issued a buy rating to the stock. According to data from MarketBeat.com, Zillow Group presently has an average rating of "Moderate Buy" and a consensus price target of $72.12.

Read Our Latest Analysis on ZG

Zillow Group Stock Up 1.3 %

Shares of NASDAQ ZG traded up $1.02 during midday trading on Friday, hitting $79.28. The stock had a trading volume of 318,326 shares, compared to its average volume of 569,867. The company has a market cap of $18.52 billion, a P/E ratio of -139.09 and a beta of 2.08. The company has a quick ratio of 3.13, a current ratio of 3.13 and a debt-to-equity ratio of 0.11. The business's 50 day moving average is $67.11 and its 200-day moving average is $55.37. Zillow Group has a 52 week low of $38.06 and a 52 week high of $83.67.

Zillow Group (NASDAQ:ZG - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The technology company reported $0.35 EPS for the quarter, beating the consensus estimate of $0.32 by $0.03. Zillow Group had a negative return on equity of 2.33% and a negative net margin of 6.17%. The company had revenue of $581.00 million for the quarter, compared to analysts' expectations of $555.45 million. During the same period last year, the firm posted ($0.12) earnings per share. Zillow Group's revenue was up 17.1% compared to the same quarter last year. As a group, analysts predict that Zillow Group will post -0.34 EPS for the current year.

Insider Buying and Selling at Zillow Group

In other Zillow Group news, insider Dan Spaulding sold 4,565 shares of the stock in a transaction on Friday, November 29th. The stock was sold at an average price of $86.22, for a total value of $393,594.30. Following the sale, the insider now owns 58,217 shares in the company, valued at $5,019,469.74. This trade represents a 7.27 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, General Counsel Bradley D. Owens sold 1,212 shares of the business's stock in a transaction on Wednesday, November 13th. The shares were sold at an average price of $73.98, for a total transaction of $89,663.76. Following the sale, the general counsel now directly owns 31,739 shares of the company's stock, valued at $2,348,051.22. This represents a 3.68 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 163,591 shares of company stock worth $11,892,886 over the last ninety days. Company insiders own 17.14% of the company's stock.

Institutional Investors Weigh In On Zillow Group

Hedge funds have recently made changes to their positions in the company. Price T Rowe Associates Inc. MD boosted its stake in shares of Zillow Group by 4.9% during the first quarter. Price T Rowe Associates Inc. MD now owns 32,501 shares of the technology company's stock valued at $1,556,000 after purchasing an additional 1,526 shares in the last quarter. California State Teachers Retirement System raised its position in shares of Zillow Group by 169.9% in the 1st quarter. California State Teachers Retirement System now owns 24,773 shares of the technology company's stock worth $1,186,000 after acquiring an additional 15,594 shares in the last quarter. Wedmont Private Capital lifted its stake in shares of Zillow Group by 4.2% during the 2nd quarter. Wedmont Private Capital now owns 12,483 shares of the technology company's stock worth $610,000 after purchasing an additional 504 shares during the last quarter. Envestnet Portfolio Solutions Inc. boosted its position in Zillow Group by 24.7% during the second quarter. Envestnet Portfolio Solutions Inc. now owns 49,569 shares of the technology company's stock valued at $2,233,000 after purchasing an additional 9,828 shares in the last quarter. Finally, Raymond James & Associates boosted its position in Zillow Group by 7.0% during the second quarter. Raymond James & Associates now owns 193,023 shares of the technology company's stock valued at $8,694,000 after purchasing an additional 12,616 shares in the last quarter. 20.32% of the stock is currently owned by hedge funds and other institutional investors.

About Zillow Group

(

Get Free Report)

Zillow Group, Inc operates real estate brands in mobile applications and Websites in the United States. The company offers premier agent and rentals marketplaces, new construction marketplaces, advertising, display advertising, and business technology solutions, as well as dotloop and floor plans. It also provides mortgage originations and the sale of mortgages, and advertising to mortgage lenders and other mortgage professionals; and title and escrow services.

Read More

Before you consider Zillow Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zillow Group wasn't on the list.

While Zillow Group currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.