Coterra Energy (NYSE:CTRA - Free Report) had its price target trimmed by Piper Sandler from $35.00 to $33.00 in a research note published on Tuesday,Benzinga reports. The brokerage currently has an overweight rating on the stock.

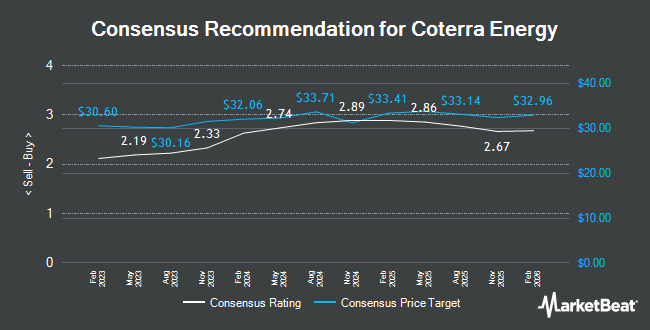

A number of other research firms also recently commented on CTRA. Roth Mkm upgraded shares of Coterra Energy from a "neutral" rating to a "buy" rating and increased their price objective for the stock from $25.00 to $29.00 in a research note on Tuesday, August 27th. Morgan Stanley boosted their price target on Coterra Energy from $27.00 to $29.00 and gave the stock an "equal weight" rating in a research report on Thursday, November 14th. Mizuho increased their price objective on Coterra Energy from $37.00 to $40.00 and gave the company an "outperform" rating in a report on Monday. Truist Financial increased their price target on shares of Coterra Energy from $31.00 to $33.00 and gave the company a "buy" rating in a research note on Thursday, November 14th. Finally, Roth Capital upgraded shares of Coterra Energy from a "hold" rating to a "strong-buy" rating in a research note on Tuesday, August 27th. Two research analysts have rated the stock with a hold rating, sixteen have issued a buy rating and one has assigned a strong buy rating to the company's stock. According to MarketBeat.com, the stock has a consensus rating of "Moderate Buy" and an average price target of $32.53.

Read Our Latest Stock Report on Coterra Energy

Coterra Energy Stock Down 0.9 %

NYSE CTRA traded down $0.21 during trading on Tuesday, hitting $24.52. The stock had a trading volume of 6,350,735 shares, compared to its average volume of 6,205,879. Coterra Energy has a 12 month low of $22.30 and a 12 month high of $28.90. The company has a debt-to-equity ratio of 0.16, a quick ratio of 1.56 and a current ratio of 1.61. The company's 50-day moving average price is $25.00 and its two-hundred day moving average price is $25.19. The company has a market capitalization of $18.06 billion, a PE ratio of 14.56, a P/E/G ratio of 1.64 and a beta of 0.27.

Coterra Energy (NYSE:CTRA - Get Free Report) last announced its quarterly earnings data on Thursday, October 31st. The company reported $0.32 EPS for the quarter, missing analysts' consensus estimates of $0.35 by ($0.03). The business had revenue of $1.36 billion during the quarter, compared to the consensus estimate of $1.28 billion. Coterra Energy had a return on equity of 9.38% and a net margin of 21.91%. The business's revenue for the quarter was up .2% compared to the same quarter last year. During the same period in the prior year, the firm earned $0.47 EPS. As a group, sell-side analysts forecast that Coterra Energy will post 1.53 EPS for the current year.

Coterra Energy Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Wednesday, November 27th. Investors of record on Thursday, November 14th were given a $0.21 dividend. This represents a $0.84 dividend on an annualized basis and a dividend yield of 3.43%. The ex-dividend date of this dividend was Thursday, November 14th. Coterra Energy's payout ratio is currently 50.60%.

Insider Buying and Selling

In other news, SVP Adam M. Vela sold 16,435 shares of the company's stock in a transaction on Wednesday, November 20th. The shares were sold at an average price of $26.76, for a total transaction of $439,800.60. Following the completion of the transaction, the senior vice president now directly owns 72,409 shares in the company, valued at approximately $1,937,664.84. This represents a 18.50 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, SVP Kevin William Smith sold 29,643 shares of the firm's stock in a transaction on Tuesday, December 3rd. The shares were sold at an average price of $26.16, for a total value of $775,460.88. Following the sale, the senior vice president now directly owns 77,075 shares in the company, valued at approximately $2,016,282. This trade represents a 27.78 % decrease in their position. The disclosure for this sale can be found here. 1.70% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Coterra Energy

Several large investors have recently bought and sold shares of the company. Fifth Third Bancorp increased its stake in shares of Coterra Energy by 0.6% in the second quarter. Fifth Third Bancorp now owns 71,138 shares of the company's stock valued at $1,897,000 after buying an additional 399 shares during the period. Cornercap Investment Counsel Inc. lifted its holdings in shares of Coterra Energy by 0.7% during the second quarter. Cornercap Investment Counsel Inc. now owns 66,280 shares of the company's stock worth $1,768,000 after purchasing an additional 436 shares during the period. Bruce G. Allen Investments LLC grew its stake in shares of Coterra Energy by 17.4% in the third quarter. Bruce G. Allen Investments LLC now owns 3,033 shares of the company's stock worth $73,000 after purchasing an additional 450 shares during the last quarter. Venturi Wealth Management LLC increased its holdings in Coterra Energy by 1.4% in the third quarter. Venturi Wealth Management LLC now owns 33,559 shares of the company's stock valued at $804,000 after purchasing an additional 474 shares during the period. Finally, SeaCrest Wealth Management LLC raised its position in Coterra Energy by 4.8% during the 3rd quarter. SeaCrest Wealth Management LLC now owns 10,983 shares of the company's stock worth $263,000 after purchasing an additional 505 shares during the last quarter. 87.92% of the stock is currently owned by institutional investors.

About Coterra Energy

(

Get Free Report)

Coterra Energy Inc, an independent oil and gas company, engages in the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States. The company's properties include the Marcellus Shale with approximately 186,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania; Permian Basin properties with approximately 296,000 net acres located in west Texas and southeast New Mexico; and Anadarko Basin properties with approximately 182,000 net acres located in Oklahoma.

Recommended Stories

Before you consider Coterra Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Coterra Energy wasn't on the list.

While Coterra Energy currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.