LyondellBasell Industries (NYSE:LYB - Free Report) had its target price cut by Piper Sandler from $117.00 to $112.00 in a report issued on Friday morning,Benzinga reports. They currently have an overweight rating on the specialty chemicals company's stock.

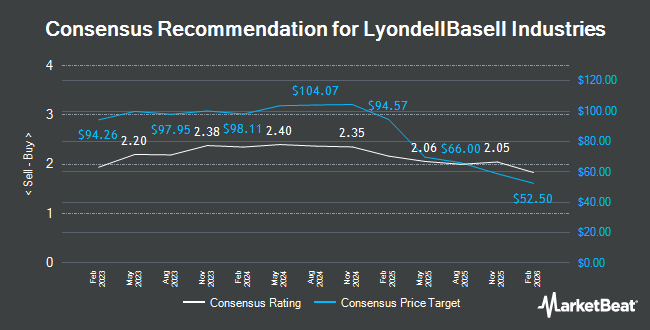

Several other research firms also recently commented on LYB. StockNews.com downgraded LyondellBasell Industries from a "buy" rating to a "hold" rating in a report on Wednesday. Deutsche Bank Aktiengesellschaft dropped their price objective on shares of LyondellBasell Industries from $100.00 to $94.00 and set a "hold" rating on the stock in a research note on Monday. Royal Bank of Canada decreased their target price on shares of LyondellBasell Industries from $110.00 to $104.00 and set an "outperform" rating for the company in a research report on Monday. Mizuho lowered their target price on shares of LyondellBasell Industries from $101.00 to $97.00 and set a "neutral" rating on the stock in a report on Monday. Finally, JPMorgan Chase & Co. cut their price target on LyondellBasell Industries from $110.00 to $100.00 and set an "overweight" rating for the company in a research note on Monday. One research analyst has rated the stock with a sell rating, eight have issued a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $101.70.

Get Our Latest Research Report on LyondellBasell Industries

LyondellBasell Industries Stock Down 2.3 %

Shares of LyondellBasell Industries stock traded down $2.04 during trading on Friday, reaching $85.29. 3,327,933 shares of the company traded hands, compared to its average volume of 1,869,984. The firm has a market capitalization of $27.70 billion, a PE ratio of 13.10, a P/E/G ratio of 1.63 and a beta of 1.08. LyondellBasell Industries has a 1-year low of $83.36 and a 1-year high of $107.02. The company has a 50 day moving average price of $92.81 and a 200-day moving average price of $95.71. The company has a debt-to-equity ratio of 0.81, a current ratio of 2.13 and a quick ratio of 1.25.

LyondellBasell Industries (NYSE:LYB - Get Free Report) last released its quarterly earnings data on Friday, November 1st. The specialty chemicals company reported $1.88 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $1.98 by ($0.10). LyondellBasell Industries had a return on equity of 17.05% and a net margin of 5.29%. The company had revenue of $10.33 billion for the quarter, compared to the consensus estimate of $10.60 billion. During the same period last year, the company earned $2.46 EPS. LyondellBasell Industries's revenue for the quarter was down 2.8% compared to the same quarter last year. As a group, equities research analysts expect that LyondellBasell Industries will post 7.38 earnings per share for the current fiscal year.

LyondellBasell Industries Dividend Announcement

The firm also recently announced a quarterly dividend, which was paid on Tuesday, September 3rd. Stockholders of record on Monday, August 26th were given a dividend of $1.34 per share. This represents a $5.36 annualized dividend and a dividend yield of 6.28%. The ex-dividend date of this dividend was Monday, August 26th. LyondellBasell Industries's dividend payout ratio is presently 81.58%.

Hedge Funds Weigh In On LyondellBasell Industries

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Prospera Private Wealth LLC raised its position in LyondellBasell Industries by 3.1% in the third quarter. Prospera Private Wealth LLC now owns 9,379 shares of the specialty chemicals company's stock worth $899,000 after acquiring an additional 281 shares during the period. Fifth Third Wealth Advisors LLC raised its holdings in shares of LyondellBasell Industries by 101.0% in the 3rd quarter. Fifth Third Wealth Advisors LLC now owns 4,295 shares of the specialty chemicals company's stock worth $412,000 after purchasing an additional 2,158 shares during the period. Prospera Financial Services Inc increased its holdings in LyondellBasell Industries by 27.0% in the 3rd quarter. Prospera Financial Services Inc now owns 3,145 shares of the specialty chemicals company's stock worth $302,000 after acquiring an additional 668 shares during the last quarter. Verity & Verity LLC lifted its holdings in LyondellBasell Industries by 18.5% during the third quarter. Verity & Verity LLC now owns 134,611 shares of the specialty chemicals company's stock valued at $12,909,000 after purchasing an additional 21,002 shares during the last quarter. Finally, Caprock Group LLC increased its stake in shares of LyondellBasell Industries by 29.0% in the third quarter. Caprock Group LLC now owns 3,788 shares of the specialty chemicals company's stock worth $363,000 after purchasing an additional 851 shares in the last quarter. 71.20% of the stock is owned by hedge funds and other institutional investors.

LyondellBasell Industries Company Profile

(

Get Free Report)

LyondellBasell Industries N.V. operates as a chemical company in the United States, Germany, Mexico, Italy, Poland, France, Japan, China, the Netherlands, and internationally. The company operates in six segments: Olefins and PolyolefinsAmericas; Olefins and PolyolefinsEurope, Asia, International; Intermediates and Derivatives; Advanced Polymer Solutions; Refining; and Technology.

Featured Stories

Before you consider LyondellBasell Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LyondellBasell Industries wasn't on the list.

While LyondellBasell Industries currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.