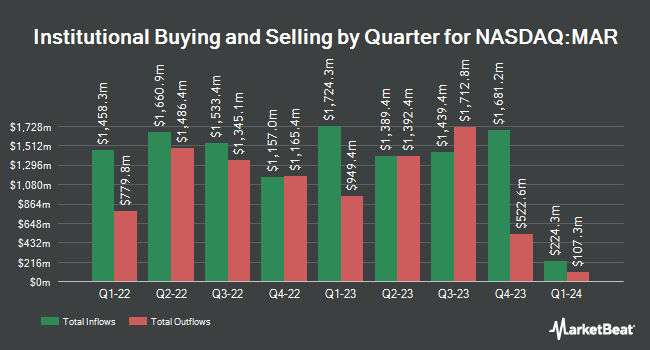

Pitcairn Co. lowered its position in Marriott International, Inc. (NASDAQ:MAR - Free Report) by 35.3% during the third quarter, according to its most recent filing with the SEC. The firm owned 3,285 shares of the company's stock after selling 1,792 shares during the period. Pitcairn Co.'s holdings in Marriott International were worth $817,000 as of its most recent filing with the SEC.

Several other institutional investors have also recently made changes to their positions in MAR. Cerity Partners LLC grew its position in Marriott International by 40.7% in the 3rd quarter. Cerity Partners LLC now owns 85,255 shares of the company's stock valued at $21,194,000 after acquiring an additional 24,666 shares during the last quarter. Great Valley Advisor Group Inc. boosted its holdings in shares of Marriott International by 3.5% in the 3rd quarter. Great Valley Advisor Group Inc. now owns 1,578 shares of the company's stock valued at $392,000 after purchasing an additional 53 shares during the last quarter. Meridian Wealth Management LLC purchased a new position in shares of Marriott International during the 3rd quarter valued at approximately $1,170,000. Icon Wealth Advisors LLC grew its holdings in Marriott International by 239.8% during the third quarter. Icon Wealth Advisors LLC now owns 3,918 shares of the company's stock worth $974,000 after acquiring an additional 2,765 shares during the period. Finally, BNP PARIBAS ASSET MANAGEMENT Holding S.A. lifted its holdings in shares of Marriott International by 0.9% during the 3rd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 83,100 shares of the company's stock valued at $20,659,000 after buying an additional 740 shares during the last quarter. Institutional investors own 70.70% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on MAR shares. UBS Group cut their price target on shares of Marriott International from $267.00 to $244.00 and set a "neutral" rating on the stock in a research note on Tuesday, August 13th. Barclays increased their price objective on Marriott International from $240.00 to $249.00 and gave the stock an "equal weight" rating in a report on Tuesday, November 5th. Wells Fargo & Company raised their price target on Marriott International from $238.00 to $261.00 and gave the company an "equal weight" rating in a report on Tuesday, October 22nd. Sanford C. Bernstein raised their target price on Marriott International from $262.00 to $290.00 and gave the stock an "outperform" rating in a report on Tuesday, November 5th. Finally, Deutsche Bank Aktiengesellschaft lowered their target price on Marriott International from $222.00 to $216.00 and set a "hold" rating for the company in a research note on Thursday, August 1st. Thirteen equities research analysts have rated the stock with a hold rating and six have given a buy rating to the company. Based on data from MarketBeat, Marriott International currently has a consensus rating of "Hold" and an average target price of $259.00.

Read Our Latest Stock Analysis on Marriott International

Marriott International Price Performance

Marriott International stock traded up $3.71 during mid-day trading on Monday, reaching $288.00. 1,806,804 shares of the stock traded hands, compared to its average volume of 1,467,686. The stock has a market capitalization of $80.03 billion, a PE ratio of 30.13, a price-to-earnings-growth ratio of 5.59 and a beta of 1.58. The business's 50-day moving average is $262.99 and its 200-day moving average is $243.80. Marriott International, Inc. has a 12-month low of $200.94 and a 12-month high of $289.63.

Marriott International (NASDAQ:MAR - Get Free Report) last issued its quarterly earnings results on Monday, November 4th. The company reported $2.26 earnings per share for the quarter, missing the consensus estimate of $2.31 by ($0.05). Marriott International had a negative return on equity of 177.91% and a net margin of 11.18%. The business had revenue of $6.26 billion during the quarter, compared to analysts' expectations of $6.27 billion. During the same quarter in the previous year, the company posted $2.11 earnings per share. The company's quarterly revenue was up 5.5% compared to the same quarter last year. Equities analysts anticipate that Marriott International, Inc. will post 9.26 EPS for the current fiscal year.

Marriott International Announces Dividend

The company also recently declared a quarterly dividend, which will be paid on Tuesday, December 31st. Shareholders of record on Thursday, November 21st will be given a dividend of $0.63 per share. The ex-dividend date is Thursday, November 21st. This represents a $2.52 dividend on an annualized basis and a yield of 0.88%. Marriott International's dividend payout ratio is currently 26.36%.

Insider Activity

In other Marriott International news, CAO Felitia Lee sold 916 shares of the firm's stock in a transaction dated Thursday, November 7th. The stock was sold at an average price of $276.48, for a total transaction of $253,255.68. Following the transaction, the chief accounting officer now owns 5,609 shares of the company's stock, valued at approximately $1,550,776.32. This trade represents a 14.04 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CEO Anthony Capuano sold 8,332 shares of the firm's stock in a transaction dated Tuesday, November 12th. The shares were sold at an average price of $284.49, for a total transaction of $2,370,370.68. Following the completion of the sale, the chief executive officer now owns 108,361 shares of the company's stock, valued at approximately $30,827,620.89. The trade was a 7.14 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 13,815 shares of company stock valued at $3,919,739 in the last quarter. 10.07% of the stock is currently owned by company insiders.

Marriott International Profile

(

Free Report)

Marriott International, Inc engages in operating, franchising, and licensing hotel, residential, timeshare, and other lodging properties worldwide. It operates its properties under the JW Marriott, The Ritz-Carlton, The Luxury Collection, W Hotels, St. Regis, EDITION, Bvlgari, Marriott Hotels, Sheraton, Westin, Autograph Collection, Renaissance Hotels, Le Méridien, Delta Hotels by Marriott, Tribute Portfolio, Gaylord Hotels, Design Hotels, Marriott Executive Apartments, Apartments by Marriott Bonvoy, Courtyard by Marriott, Fairfield by Marriott, Residence Inn by Marriott, SpringHill Suites by Marriott, Four Points by Sheraton, TownePlace Suites by Marriott, Aloft Hotels, AC Hotels by Marriott, Moxy Hotels, Element Hotels, Protea Hotels by Marriott, City Express by Marriott, and St.

Featured Articles

Before you consider Marriott International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Marriott International wasn't on the list.

While Marriott International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report