Pitcairn Co. acquired a new position in Kanzhun Limited (NASDAQ:BZ - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 42,244 shares of the company's stock, valued at approximately $733,000.

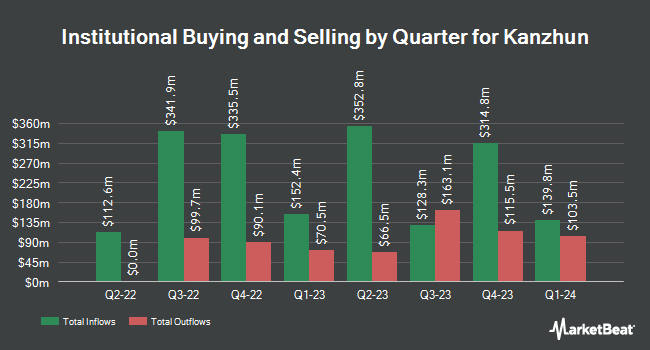

A number of other institutional investors and hedge funds have also bought and sold shares of BZ. Atlas Capital Advisors LLC acquired a new stake in shares of Kanzhun during the 2nd quarter worth approximately $25,000. UMB Bank n.a. acquired a new position in shares of Kanzhun in the 3rd quarter valued at $42,000. Summit Securities Group LLC bought a new position in shares of Kanzhun during the 2nd quarter worth about $44,000. Van ECK Associates Corp acquired a new position in Kanzhun in the third quarter worth about $61,000. Finally, Blue Trust Inc. raised its position in Kanzhun by 21.4% in the second quarter. Blue Trust Inc. now owns 7,638 shares of the company's stock worth $134,000 after purchasing an additional 1,347 shares in the last quarter. Institutional investors own 60.67% of the company's stock.

Analyst Upgrades and Downgrades

Several equities research analysts have recently weighed in on the company. Barclays lowered their price objective on Kanzhun from $27.00 to $14.00 and set an "overweight" rating on the stock in a research note on Friday, August 30th. CLSA began coverage on Kanzhun in a research note on Monday, November 18th. They set an "outperform" rating and a $18.00 price objective for the company. Three investment analysts have rated the stock with a hold rating and six have assigned a buy rating to the stock. According to MarketBeat, the stock currently has an average rating of "Moderate Buy" and an average price target of $22.50.

View Our Latest Research Report on Kanzhun

Kanzhun Stock Performance

BZ traded down $0.12 during midday trading on Monday, hitting $12.64. The company had a trading volume of 5,125,267 shares, compared to its average volume of 4,099,486. Kanzhun Limited has a twelve month low of $10.57 and a twelve month high of $22.74. The company has a market capitalization of $4.79 billion, a PE ratio of 29.68 and a beta of 0.55. The firm's 50-day simple moving average is $15.04 and its 200-day simple moving average is $16.42.

Kanzhun (NASDAQ:BZ - Get Free Report) last released its earnings results on Wednesday, August 28th. The company reported $0.13 earnings per share for the quarter, topping analysts' consensus estimates of $0.12 by $0.01. The company had revenue of $263.75 million during the quarter, compared to the consensus estimate of $264.38 million. Kanzhun had a return on equity of 10.19% and a net margin of 20.90%. As a group, sell-side analysts anticipate that Kanzhun Limited will post 0.47 EPS for the current fiscal year.

About Kanzhun

(

Free Report)

Kanzhun Limited, together with its subsidiaries, provides online recruitment services in the People's Republic of China. The company offers its recruitment services through a mobile app under the BOSS Zhipin brand name. Its services allow enterprise customers to access and interact with job seekers and manage their recruitment process.

Featured Stories

Before you consider Kanzhun, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kanzhun wasn't on the list.

While Kanzhun currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.