State Street Corp decreased its stake in Pitney Bowes Inc. (NYSE:PBI - Free Report) by 1.1% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 6,309,514 shares of the technology company's stock after selling 72,849 shares during the quarter. State Street Corp owned about 3.47% of Pitney Bowes worth $44,987,000 at the end of the most recent reporting period.

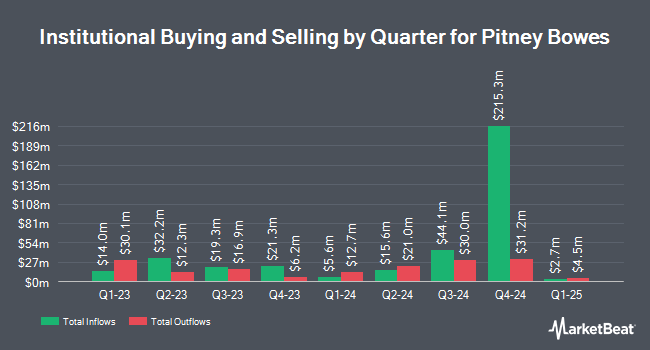

Several other large investors have also recently modified their holdings of the stock. Cutter & CO Brokerage Inc. boosted its stake in shares of Pitney Bowes by 6.7% during the 2nd quarter. Cutter & CO Brokerage Inc. now owns 31,933 shares of the technology company's stock worth $162,000 after purchasing an additional 2,000 shares during the period. Envestnet Portfolio Solutions Inc. raised its holdings in shares of Pitney Bowes by 15.6% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 15,189 shares of the technology company's stock worth $77,000 after buying an additional 2,054 shares during the period. Louisiana State Employees Retirement System lifted its stake in shares of Pitney Bowes by 3.0% during the 2nd quarter. Louisiana State Employees Retirement System now owns 78,300 shares of the technology company's stock worth $398,000 after acquiring an additional 2,300 shares during the last quarter. Zurcher Kantonalbank Zurich Cantonalbank increased its stake in Pitney Bowes by 10.8% in the third quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 48,663 shares of the technology company's stock worth $347,000 after purchasing an additional 4,728 shares during the period. Finally, Federated Hermes Inc. lifted its position in shares of Pitney Bowes by 6.8% during the second quarter. Federated Hermes Inc. now owns 79,420 shares of the technology company's stock worth $403,000 after purchasing an additional 5,073 shares during the last quarter. Institutional investors own 67.88% of the company's stock.

Pitney Bowes Trading Up 1.1 %

Shares of NYSE PBI traded up $0.08 during mid-day trading on Friday, reaching $7.23. The company had a trading volume of 6,094,703 shares, compared to its average volume of 1,773,372. Pitney Bowes Inc. has a 52 week low of $3.68 and a 52 week high of $8.80. The business's 50-day moving average is $7.56 and its 200-day moving average is $6.79. The stock has a market cap of $1.31 billion, a price-to-earnings ratio of -3.32, a price-to-earnings-growth ratio of 1.35 and a beta of 1.97.

Pitney Bowes (NYSE:PBI - Get Free Report) last posted its quarterly earnings results on Friday, November 8th. The technology company reported $0.21 earnings per share for the quarter, beating the consensus estimate of $0.13 by $0.08. Pitney Bowes had a negative net margin of 13.02% and a negative return on equity of 12.85%. The firm had revenue of $499.46 million during the quarter, compared to the consensus estimate of $467.80 million. As a group, equities research analysts forecast that Pitney Bowes Inc. will post 0.38 earnings per share for the current year.

Pitney Bowes Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, December 6th. Stockholders of record on Monday, November 18th were given a dividend of $0.05 per share. This represents a $0.20 dividend on an annualized basis and a dividend yield of 2.77%. The ex-dividend date was Monday, November 18th. Pitney Bowes's payout ratio is -9.17%.

Insider Activity at Pitney Bowes

In related news, EVP Lauren Freemen-Bosworth sold 42,308 shares of the business's stock in a transaction that occurred on Friday, November 29th. The shares were sold at an average price of $8.12, for a total value of $343,540.96. Following the completion of the transaction, the executive vice president now owns 18,664 shares of the company's stock, valued at $151,551.68. The trade was a 69.39 % decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, Director Paul J. Evans bought 29,000 shares of the stock in a transaction on Wednesday, November 20th. The shares were bought at an average price of $7.80 per share, with a total value of $226,200.00. Following the acquisition, the director now owns 29,000 shares of the company's stock, valued at $226,200. This trade represents a ∞ increase in their ownership of the stock. The disclosure for this purchase can be found here. 14.30% of the stock is currently owned by corporate insiders.

Pitney Bowes Profile

(

Free Report)

Pitney Bowes Inc, a shipping and mailing company, provides technology, logistics, and financial services to small and medium-sized businesses, large enterprises, retailers, and government clients in the United States and internationally. It operates through Global Ecommerce, Presort Services, and SendTech Solutions segments.

Further Reading

Before you consider Pitney Bowes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pitney Bowes wasn't on the list.

While Pitney Bowes currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat has just released its list of 20 stocks that Wall Street analysts hate. These companies may appear to have good fundamentals, but top analysts smell something seriously rotten. Are any of these companies lurking around your portfolio? Find out by clicking the link below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.