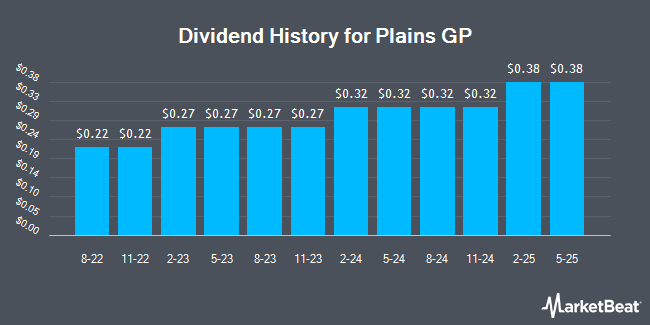

Plains GP Holdings, L.P. (NYSE:PAGP - Get Free Report) declared a quarterly dividend on Wednesday, April 2nd, Wall Street Journal reports. Stockholders of record on Thursday, May 1st will be paid a dividend of 0.38 per share by the pipeline company on Thursday, May 15th. This represents a $1.52 annualized dividend and a dividend yield of 8.31%. The ex-dividend date is Thursday, May 1st.

Plains GP Trading Up 6.0 %

NYSE:PAGP traded up $1.04 on Wednesday, reaching $18.29. The company's stock had a trading volume of 3,165,195 shares, compared to its average volume of 1,590,972. The firm has a market cap of $3.62 billion, a PE ratio of 34.51 and a beta of 1.11. The company has a debt-to-equity ratio of 0.49, a quick ratio of 0.92 and a current ratio of 1.01. The business's 50-day moving average price is $20.94 and its two-hundred day moving average price is $19.71. Plains GP has a 1-year low of $16.63 and a 1-year high of $22.48.

Wall Street Analyst Weigh In

Several analysts have commented on the stock. Wolfe Research upgraded shares of Plains GP from a "peer perform" rating to an "outperform" rating and set a $22.00 target price on the stock in a report on Friday, January 10th. Wells Fargo & Company cut Plains GP from an "overweight" rating to an "equal weight" rating and lowered their target price for the stock from $22.00 to $20.00 in a report on Wednesday, December 18th. Morgan Stanley boosted their target price on Plains GP from $19.00 to $23.00 and gave the company an "equal weight" rating in a research note on Tuesday, March 25th. Barclays boosted their price target on Plains GP from $18.00 to $19.00 and gave the stock an "underweight" rating in a research report on Thursday, January 16th. Finally, Raymond James boosted their price objective on shares of Plains GP from $23.00 to $24.00 and gave the stock a "strong-buy" rating in a research note on Tuesday, January 28th. Two equities research analysts have rated the stock with a sell rating, four have assigned a hold rating, three have given a buy rating and one has issued a strong buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus target price of $20.78.

Get Our Latest Stock Report on PAGP

About Plains GP

(

Get Free Report)

Plains GP Holdings, L.P., through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada. It operates in two segments, Crude Oil and Natural Gas Liquids (NGLs). The company engages in the gathering and transporting crude oil and NGLs using pipelines, gathering systems, and trucks.

Featured Articles

Before you consider Plains GP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains GP wasn't on the list.

While Plains GP currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.