Stifel Financial Corp grew its stake in shares of Plains GP Holdings, L.P. (NYSE:PAGP - Free Report) by 13.0% in the third quarter, according to its most recent disclosure with the SEC. The fund owned 687,257 shares of the pipeline company's stock after buying an additional 78,845 shares during the period. Stifel Financial Corp owned approximately 0.35% of Plains GP worth $12,714,000 as of its most recent filing with the SEC.

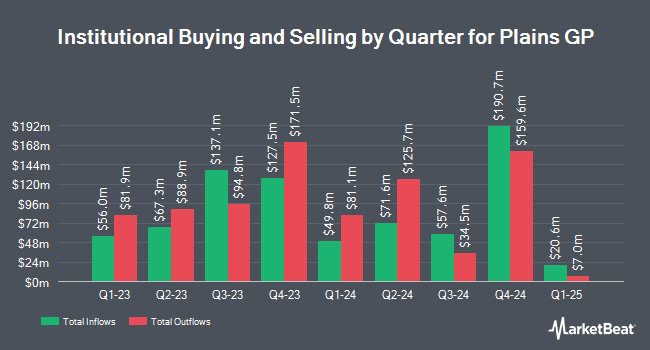

A number of other hedge funds also recently modified their holdings of the company. CWM LLC lifted its position in shares of Plains GP by 61.0% during the 2nd quarter. CWM LLC now owns 3,028 shares of the pipeline company's stock worth $57,000 after buying an additional 1,147 shares during the period. SG Americas Securities LLC increased its stake in shares of Plains GP by 85.6% in the second quarter. SG Americas Securities LLC now owns 92,808 shares of the pipeline company's stock valued at $1,747,000 after buying an additional 42,807 shares in the last quarter. ORG Partners LLC bought a new position in shares of Plains GP in the second quarter worth about $44,000. Hennessy Advisors Inc. raised its position in Plains GP by 18.1% in the 2nd quarter. Hennessy Advisors Inc. now owns 1,822,200 shares of the pipeline company's stock worth $34,294,000 after purchasing an additional 279,100 shares during the last quarter. Finally, Unique Wealth Strategies LLC bought a new stake in shares of Plains GP during the second quarter worth $70,000. Institutional investors own 88.30% of the company's stock.

Plains GP Stock Performance

PAGP stock traded up $0.03 during trading hours on Thursday, reaching $19.32. The stock had a trading volume of 3,021,113 shares, compared to its average volume of 1,725,654. The stock has a market capitalization of $3.82 billion, a PE ratio of 22.81 and a beta of 1.57. The stock has a 50-day simple moving average of $18.64 and a 200 day simple moving average of $18.69. Plains GP Holdings, L.P. has a fifty-two week low of $14.94 and a fifty-two week high of $20.10. The company has a debt-to-equity ratio of 0.49, a current ratio of 1.01 and a quick ratio of 0.92.

Plains GP Dividend Announcement

The business also recently declared a quarterly dividend, which was paid on Thursday, November 14th. Investors of record on Thursday, October 31st were paid a $0.3175 dividend. The ex-dividend date of this dividend was Thursday, October 31st. This represents a $1.27 dividend on an annualized basis and a yield of 6.57%. Plains GP's dividend payout ratio (DPR) is currently 149.41%.

Wall Street Analyst Weigh In

A number of equities analysts have issued reports on PAGP shares. Wolfe Research raised shares of Plains GP to a "hold" rating in a research note on Wednesday, September 18th. Morgan Stanley lowered Plains GP from an "overweight" rating to an "equal weight" rating and decreased their target price for the stock from $22.00 to $19.00 in a research report on Friday, October 25th. Finally, StockNews.com raised shares of Plains GP from a "hold" rating to a "buy" rating in a research note on Friday, November 8th. Two analysts have rated the stock with a sell rating, three have issued a hold rating and five have given a buy rating to the stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $19.88.

Read Our Latest Analysis on Plains GP

About Plains GP

(

Free Report)

Plains GP Holdings, L.P., through its subsidiary, Plains All American Pipeline, L.P., owns and operates midstream infrastructure systems in the United States and Canada. It operates in two segments, Crude Oil and Natural Gas Liquids (NGLs). The company engages in the gathering and transporting crude oil and NGLs using pipelines, gathering systems, and trucks.

Read More

Before you consider Plains GP, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plains GP wasn't on the list.

While Plains GP currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in electric vehicle technologies (EV) and which EV stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.