Planet Fitness (NYSE:PLNT - Free Report) had its price objective boosted by Royal Bank of Canada from $110.00 to $120.00 in a research note issued to investors on Tuesday morning,Benzinga reports. Royal Bank of Canada currently has an outperform rating on the stock.

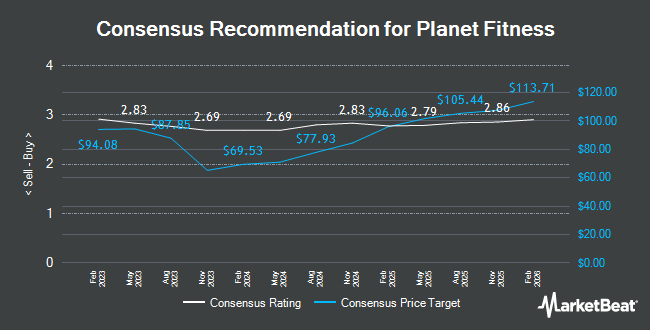

Several other brokerages have also commented on PLNT. BNP Paribas raised Planet Fitness from a "neutral" rating to an "outperform" rating and set a $97.00 price target on the stock in a research note on Thursday, September 5th. Stifel Nicolaus increased their target price on shares of Planet Fitness from $70.00 to $75.00 and gave the stock a "hold" rating in a research note on Wednesday, October 16th. Robert W. Baird boosted their price target on shares of Planet Fitness from $92.00 to $110.00 and gave the company an "outperform" rating in a research note on Friday, November 8th. Morgan Stanley increased their price objective on shares of Planet Fitness from $84.00 to $89.00 and gave the stock an "overweight" rating in a research report on Tuesday, October 29th. Finally, DA Davidson boosted their target price on Planet Fitness from $70.00 to $87.00 and gave the company a "neutral" rating in a research report on Friday, November 29th. Five analysts have rated the stock with a hold rating, eleven have assigned a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $94.00.

Read Our Latest Stock Analysis on Planet Fitness

Planet Fitness Stock Up 2.9 %

Shares of Planet Fitness stock traded up $2.86 during trading hours on Tuesday, reaching $101.88. 1,246,976 shares of the company's stock were exchanged, compared to its average volume of 1,488,060. The business has a fifty day moving average of $90.66 and a two-hundred day moving average of $81.64. The company has a market capitalization of $8.62 billion, a P/E ratio of 54.77, a price-to-earnings-growth ratio of 3.33 and a beta of 1.53. Planet Fitness has a 1 year low of $54.35 and a 1 year high of $102.90.

Planet Fitness (NYSE:PLNT - Get Free Report) last announced its quarterly earnings data on Thursday, November 7th. The company reported $0.64 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.57 by $0.07. Planet Fitness had a net margin of 14.23% and a negative return on equity of 107.97%. The company had revenue of $292.20 million during the quarter, compared to analysts' expectations of $283.79 million. During the same quarter in the prior year, the company earned $0.59 EPS. Planet Fitness's revenue was up 5.3% compared to the same quarter last year. As a group, research analysts predict that Planet Fitness will post 2.5 EPS for the current year.

Insider Buying and Selling

In related news, insider Jennifer Simmons sold 11,453 shares of the company's stock in a transaction that occurred on Thursday, November 14th. The stock was sold at an average price of $96.20, for a total value of $1,101,778.60. Following the completion of the transaction, the insider now directly owns 19,110 shares of the company's stock, valued at $1,838,382. This represents a 37.47 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. 5.94% of the stock is owned by insiders.

Institutional Inflows and Outflows

A number of hedge funds have recently added to or reduced their stakes in PLNT. William Blair Investment Management LLC purchased a new position in shares of Planet Fitness during the second quarter worth approximately $166,978,000. Anomaly Capital Management LP acquired a new stake in Planet Fitness during the 2nd quarter worth $106,795,000. Point72 Asset Management L.P. grew its position in Planet Fitness by 169.8% during the 2nd quarter. Point72 Asset Management L.P. now owns 1,317,909 shares of the company's stock worth $96,985,000 after purchasing an additional 829,509 shares during the last quarter. FMR LLC increased its stake in Planet Fitness by 666.9% in the third quarter. FMR LLC now owns 795,485 shares of the company's stock valued at $64,609,000 after purchasing an additional 691,761 shares during the period. Finally, Dorsal Capital Management LP raised its holdings in shares of Planet Fitness by 7.7% in the second quarter. Dorsal Capital Management LP now owns 2,907,193 shares of the company's stock valued at $213,940,000 after buying an additional 207,193 shares during the last quarter. Hedge funds and other institutional investors own 95.53% of the company's stock.

Planet Fitness Company Profile

(

Get Free Report)

Planet Fitness, Inc, together with its subsidiaries, franchises and operates fitness centers under the Planet Fitness brand. The company operates through three segments: Franchise, Corporate-Owned Stores, and Equipment. The company is involved in franchising business in the United States, Puerto Rico, Canada, Panama, Mexico, and Australia.

Read More

Before you consider Planet Fitness, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Fitness wasn't on the list.

While Planet Fitness currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.