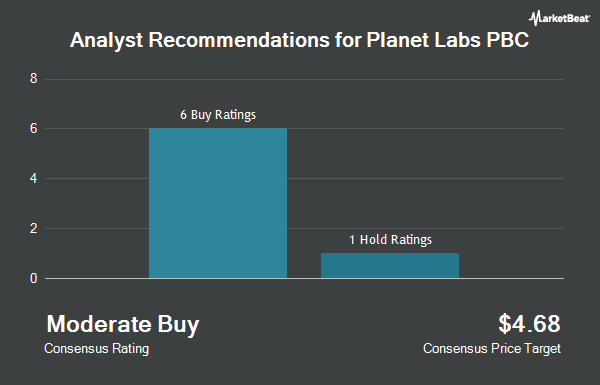

Shares of Planet Labs PBC (NYSE:PL - Get Free Report) have been given an average recommendation of "Moderate Buy" by the seven brokerages that are covering the firm, Marketbeat Ratings reports. One research analyst has rated the stock with a hold rating and six have assigned a buy rating to the company. The average 12-month target price among brokers that have issued a report on the stock in the last year is $3.93.

Several brokerages have commented on PL. The Goldman Sachs Group dropped their price objective on Planet Labs PBC from $3.50 to $3.10 and set a "buy" rating on the stock in a report on Tuesday, September 10th. Wedbush reissued an "outperform" rating and issued a $5.00 price target on shares of Planet Labs PBC in a report on Friday, August 16th. JMP Securities reaffirmed a "market outperform" rating and set a $4.00 price objective on shares of Planet Labs PBC in a report on Thursday, September 26th. Craig Hallum boosted their target price on shares of Planet Labs PBC from $2.00 to $2.50 and gave the stock a "hold" rating in a research note on Friday, September 6th. Finally, Needham & Company LLC lowered their price objective on Planet Labs PBC from $7.00 to $5.00 and set a "buy" rating on the stock in a report on Friday, September 6th.

Check Out Our Latest Report on Planet Labs PBC

Planet Labs PBC Price Performance

PL stock traded up $0.07 during midday trading on Friday, hitting $4.16. 4,684,007 shares of the stock traded hands, compared to its average volume of 4,951,129. Planet Labs PBC has a 1-year low of $1.67 and a 1-year high of $4.99. The stock's fifty day simple moving average is $2.79 and its 200-day simple moving average is $2.35. The firm has a market cap of $1.22 billion, a P/E ratio of -8.85 and a beta of 1.34.

Planet Labs PBC (NYSE:PL - Get Free Report) last posted its earnings results on Thursday, September 5th. The company reported ($0.13) EPS for the quarter, missing analysts' consensus estimates of ($0.11) by ($0.02). The business had revenue of $61.09 million for the quarter, compared to analyst estimates of $61.57 million. Planet Labs PBC had a negative net margin of 57.71% and a negative return on equity of 26.87%. On average, research analysts predict that Planet Labs PBC will post -0.41 earnings per share for the current year.

Institutional Investors Weigh In On Planet Labs PBC

Large investors have recently made changes to their positions in the stock. Geode Capital Management LLC increased its position in Planet Labs PBC by 16.5% during the third quarter. Geode Capital Management LLC now owns 4,870,492 shares of the company's stock worth $10,864,000 after purchasing an additional 689,888 shares during the last quarter. Jacobs Levy Equity Management Inc. grew its stake in shares of Planet Labs PBC by 119.8% in the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 895,109 shares of the company's stock valued at $1,996,000 after buying an additional 487,958 shares during the period. ArrowMark Colorado Holdings LLC increased its holdings in shares of Planet Labs PBC by 28.2% during the 3rd quarter. ArrowMark Colorado Holdings LLC now owns 1,817,000 shares of the company's stock worth $4,052,000 after buying an additional 400,000 shares during the last quarter. IQ EQ FUND MANAGEMENT IRELAND Ltd purchased a new stake in shares of Planet Labs PBC during the 2nd quarter valued at approximately $632,000. Finally, State Street Corp lifted its holdings in Planet Labs PBC by 5.7% in the third quarter. State Street Corp now owns 4,272,633 shares of the company's stock valued at $9,528,000 after acquiring an additional 230,076 shares during the last quarter. 41.71% of the stock is currently owned by hedge funds and other institutional investors.

About Planet Labs PBC

(

Get Free ReportPlanet Labs PBC engages in the design, construction, and launch constellations of satellites with the intent of providing high cadence geospatial data delivered to customers through an online platform worldwide. The company's platform offers planet monitoring, basemap, tasking, apps, and application programming interfaces, as well as analytics and planetary variables.

Featured Articles

Before you consider Planet Labs PBC, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Planet Labs PBC wasn't on the list.

While Planet Labs PBC currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are major institutional investors including hedge funds and endowments buying in today's market? Click the link below and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying up as quickly as they can.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.