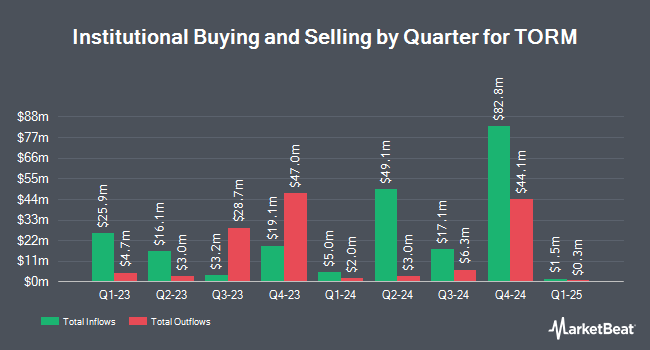

Platinum Investment Management Ltd. grew its position in shares of TORM plc (NASDAQ:TRMD - Free Report) by 92.5% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 152,439 shares of the company's stock after buying an additional 73,240 shares during the period. Platinum Investment Management Ltd. owned about 0.16% of TORM worth $2,929,000 as of its most recent SEC filing.

Several other hedge funds also recently made changes to their positions in the company. Barclays PLC boosted its holdings in TORM by 65.4% in the third quarter. Barclays PLC now owns 384,308 shares of the company's stock worth $13,140,000 after purchasing an additional 151,942 shares during the period. Soros Fund Management LLC acquired a new position in shares of TORM in the 3rd quarter valued at about $3,419,000. Centiva Capital LP acquired a new position in shares of TORM in the 3rd quarter valued at about $3,077,000. SBI Securities Co. Ltd. bought a new stake in shares of TORM during the 4th quarter valued at about $1,093,000. Finally, Holocene Advisors LP bought a new position in TORM in the third quarter worth about $1,710,000. Institutional investors and hedge funds own 73.89% of the company's stock.

TORM Stock Performance

Shares of NASDAQ:TRMD traded down $0.89 during trading on Friday, hitting $18.32. 728,759 shares of the company traded hands, compared to its average volume of 938,771. The company has a quick ratio of 2.24, a current ratio of 2.47 and a debt-to-equity ratio of 0.51. The business's fifty day moving average is $19.41 and its 200-day moving average is $23.72. The stock has a market capitalization of $1.72 billion, a price-to-earnings ratio of 2.37 and a beta of 0.14. TORM plc has a one year low of $16.76 and a one year high of $40.47.

TORM Cuts Dividend

The business also recently announced a quarterly dividend, which will be paid on Wednesday, April 2nd. Shareholders of record on Thursday, March 20th will be given a $0.60 dividend. This represents a $2.40 annualized dividend and a yield of 13.10%. The ex-dividend date is Thursday, March 20th. TORM's dividend payout ratio is presently 27.43%.

TORM Company Profile

(

Free Report)

TORM plc, a shipping company, owns and operates a fleet of product tankers in the United Kingdom. It operates in two operating segments, Tanker and Marine Exhaust. The Tanker segment transports refined oil products, such as gasoline, jet fuel, kerosene, naphtha, and gas oil, as well as dirty petroleum products, including fuel oil.

Further Reading

Before you consider TORM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TORM wasn't on the list.

While TORM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know? MarketBeat just compiled its list of the twelve stocks that corporate insiders are abandoning. Complete the form below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.