Plato Investment Management Ltd lifted its stake in Tesla, Inc. (NASDAQ:TSLA - Free Report) by 7.2% in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 62,310 shares of the electric vehicle producer's stock after purchasing an additional 4,181 shares during the quarter. Tesla accounts for 1.3% of Plato Investment Management Ltd's portfolio, making the stock its 9th largest position. Plato Investment Management Ltd's holdings in Tesla were worth $16,286,000 as of its most recent SEC filing.

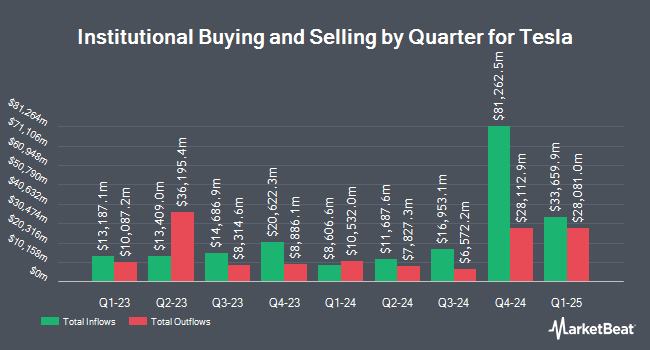

A number of other hedge funds have also recently added to or reduced their stakes in TSLA. China Universal Asset Management Co. Ltd. grew its holdings in Tesla by 0.9% during the first quarter. China Universal Asset Management Co. Ltd. now owns 36,399 shares of the electric vehicle producer's stock valued at $6,399,000 after purchasing an additional 331 shares during the last quarter. Kingsview Wealth Management LLC grew its holdings in Tesla by 0.5% during the first quarter. Kingsview Wealth Management LLC now owns 34,682 shares of the electric vehicle producer's stock valued at $6,097,000 after purchasing an additional 157 shares during the last quarter. Orion Portfolio Solutions LLC grew its holdings in Tesla by 12.4% during the first quarter. Orion Portfolio Solutions LLC now owns 77,359 shares of the electric vehicle producer's stock valued at $13,599,000 after purchasing an additional 8,534 shares during the last quarter. Private Portfolio Partners LLC grew its holdings in Tesla by 21.0% during the first quarter. Private Portfolio Partners LLC now owns 2,077 shares of the electric vehicle producer's stock valued at $365,000 after purchasing an additional 360 shares during the last quarter. Finally, Brighton Jones LLC boosted its position in shares of Tesla by 19.5% in the first quarter. Brighton Jones LLC now owns 72,529 shares of the electric vehicle producer's stock valued at $12,750,000 after acquiring an additional 11,826 shares during the period. Institutional investors and hedge funds own 66.20% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms have recently weighed in on TSLA. Phillip Securities raised Tesla to a "moderate sell" rating in a research report on Friday, October 25th. Roth Mkm reissued a "neutral" rating and set a $85.00 price objective on shares of Tesla in a report on Friday, October 11th. Bank of America lifted their price objective on Tesla from $265.00 to $350.00 and gave the company a "buy" rating in a report on Thursday, November 7th. Wells Fargo & Company lifted their price objective on Tesla from $120.00 to $125.00 and gave the company an "underweight" rating in a report on Thursday, October 24th. Finally, Citigroup cut their price objective on Tesla from $274.00 to $258.00 and set a "neutral" rating for the company in a report on Wednesday, July 24th. Eight research analysts have rated the stock with a sell rating, seventeen have given a hold rating and fourteen have assigned a buy rating to the company. According to MarketBeat, Tesla currently has a consensus rating of "Hold" and a consensus price target of $228.24.

Check Out Our Latest Stock Report on TSLA

Insider Buying and Selling at Tesla

In other Tesla news, SVP Xiaotong Zhu sold 297 shares of the business's stock in a transaction that occurred on Friday, September 6th. The stock was sold at an average price of $221.77, for a total transaction of $65,865.69. Following the transaction, the senior vice president now owns 67,491 shares of the company's stock, valued at $14,967,479.07. The trade was a 0.44 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, Director Kathleen Wilson-Thompson sold 100,000 shares of the business's stock in a transaction that occurred on Monday, November 11th. The stock was sold at an average price of $346.02, for a total value of $34,602,000.00. Following the transaction, the director now directly owns 5,400 shares in the company, valued at $1,868,508. This trade represents a 94.88 % decrease in their position. The disclosure for this sale can be found here. In the last quarter, insiders have sold 188,797 shares of company stock worth $57,616,781. Corporate insiders own 20.70% of the company's stock.

Tesla Stock Down 5.8 %

Shares of NASDAQ:TSLA traded down $19.06 during trading on Thursday, hitting $311.18. 119,970,818 shares of the company's stock traded hands, compared to its average volume of 95,937,266. Tesla, Inc. has a 52 week low of $138.80 and a 52 week high of $358.64. The company has a current ratio of 1.84, a quick ratio of 1.37 and a debt-to-equity ratio of 0.08. The company has a market cap of $998.91 billion, a price-to-earnings ratio of 87.07, a price-to-earnings-growth ratio of 10.67 and a beta of 2.29. The company has a 50-day moving average price of $248.48 and a 200-day moving average price of $218.94.

Tesla (NASDAQ:TSLA - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The electric vehicle producer reported $0.72 earnings per share for the quarter, beating the consensus estimate of $0.58 by $0.14. The business had revenue of $25.18 billion for the quarter, compared to analysts' expectations of $25.47 billion. Tesla had a return on equity of 10.24% and a net margin of 13.07%. Tesla's revenue for the quarter was up 7.8% on a year-over-year basis. During the same quarter in the previous year, the business posted $0.53 EPS. As a group, research analysts forecast that Tesla, Inc. will post 1.99 EPS for the current fiscal year.

Tesla Company Profile

(

Free Report)

Tesla, Inc designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers electric vehicles, as well as sells automotive regulatory credits; and non-warranty after-sales vehicle, used vehicles, body shop and parts, supercharging, retail merchandise, and vehicle insurance services.

Further Reading

Before you consider Tesla, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tesla wasn't on the list.

While Tesla currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report