Plato Investment Management Ltd increased its holdings in shares of ANSYS, Inc. (NASDAQ:ANSS - Free Report) by 36,680.0% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission. The fund owned 1,839 shares of the software maker's stock after acquiring an additional 1,834 shares during the quarter. Plato Investment Management Ltd's holdings in ANSYS were worth $585,000 at the end of the most recent reporting period.

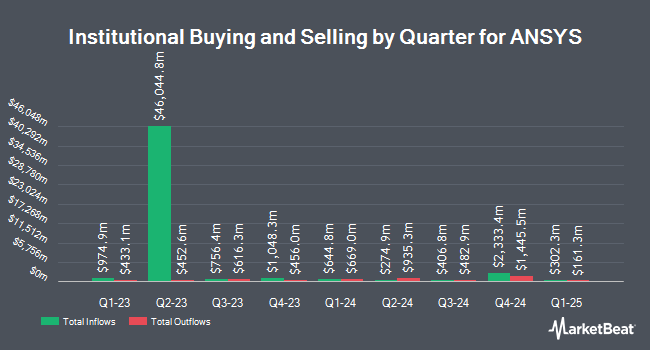

A number of other institutional investors and hedge funds also recently added to or reduced their stakes in ANSS. Swedbank AB purchased a new stake in shares of ANSYS in the first quarter valued at about $128,089,000. M&G Plc purchased a new position in ANSYS in the 1st quarter valued at $115,922,000. Magnetar Financial LLC acquired a new position in ANSYS in the 1st quarter valued at $72,797,000. Matrix Capital Management Company LP purchased a new position in ANSYS during the 1st quarter worth $50,338,000. Finally, Canada Pension Plan Investment Board lifted its stake in shares of ANSYS by 1,052.9% in the 1st quarter. Canada Pension Plan Investment Board now owns 99,263 shares of the software maker's stock worth $34,460,000 after acquiring an additional 90,653 shares during the period. Institutional investors and hedge funds own 92.39% of the company's stock.

Insiders Place Their Bets

In other news, Director Glenda Dorchak sold 152 shares of the firm's stock in a transaction dated Monday, October 7th. The stock was sold at an average price of $313.61, for a total transaction of $47,668.72. Following the sale, the director now owns 3,630 shares of the company's stock, valued at $1,138,404.30. This trade represents a 4.02 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available through this hyperlink. Company insiders own 0.46% of the company's stock.

Analysts Set New Price Targets

ANSS has been the topic of several research analyst reports. StockNews.com lowered ANSYS from a "buy" rating to a "hold" rating in a research note on Thursday. Rosenblatt Securities lowered their price objective on shares of ANSYS from $345.00 to $335.00 and set a "neutral" rating for the company in a research report on Tuesday, August 6th. Finally, Robert W. Baird lifted their price target on ANSYS from $350.00 to $365.00 and gave the company an "outperform" rating in a report on Thursday, November 7th. One equities research analyst has rated the stock with a sell rating, five have given a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus price target of $342.50.

View Our Latest Analysis on ANSS

ANSYS Price Performance

Shares of ANSS traded down $7.90 during trading hours on Friday, hitting $332.38. The stock had a trading volume of 527,036 shares, compared to its average volume of 527,067. ANSYS, Inc. has a 52 week low of $275.81 and a 52 week high of $364.31. The company's fifty day moving average is $324.40 and its two-hundred day moving average is $322.35. The company has a debt-to-equity ratio of 0.13, a current ratio of 3.11 and a quick ratio of 3.11. The stock has a market capitalization of $29.07 billion, a price-to-earnings ratio of 51.73, a P/E/G ratio of 3.90 and a beta of 1.11.

ANSYS Company Profile

(

Free Report)

ANSYS, Inc develops and markets engineering simulation software and services for engineers, designers, researchers, and students in the United States, Japan, Germany, China, Hong Kong, South Korea, rest of Europe, the Middle East, Africa, and internationally. It offers structural analysis product suite that provides simulation tools for product design and optimization; the Ansys Mechanical product, an element analysis software; LS-DYNA solver for multiphysics simulation; and power analysis and optimization software suite.

Recommended Stories

Before you consider ANSYS, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ANSYS wasn't on the list.

While ANSYS currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.