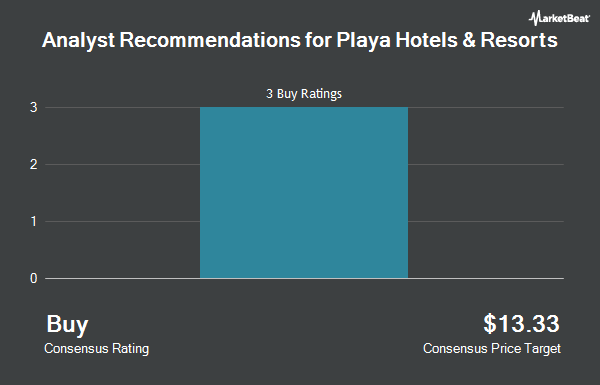

Playa Hotels & Resorts (NASDAQ:PLYA - Get Free Report) was downgraded by equities research analysts at Deutsche Bank Aktiengesellschaft from a "buy" rating to a "hold" rating in a research note issued to investors on Tuesday, Marketbeat reports. They currently have a $13.50 price target on the stock, down from their previous price target of $15.00. Deutsche Bank Aktiengesellschaft's price objective indicates a potential upside of 1.09% from the stock's previous close.

A number of other analysts have also recently issued reports on PLYA. Truist Financial restated a "hold" rating and set a $13.00 price objective on shares of Playa Hotels & Resorts in a research report on Tuesday, January 7th. Oppenheimer boosted their price objective on Playa Hotels & Resorts from $10.00 to $12.00 and gave the company an "outperform" rating in a research report on Monday, November 11th. Five investment analysts have rated the stock with a hold rating, According to data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $12.10.

Read Our Latest Analysis on Playa Hotels & Resorts

Playa Hotels & Resorts Stock Performance

NASDAQ PLYA traded down $0.02 during trading on Tuesday, hitting $13.36. The company's stock had a trading volume of 1,648,907 shares, compared to its average volume of 3,859,290. The firm has a market cap of $1.62 billion, a P/E ratio of 27.82, a price-to-earnings-growth ratio of 1.83 and a beta of 1.54. The company has a quick ratio of 2.14, a current ratio of 2.24 and a debt-to-equity ratio of 2.16. Playa Hotels & Resorts has a 52 week low of $6.95 and a 52 week high of $13.38. The firm has a 50 day moving average price of $11.98 and a 200 day moving average price of $9.62.

Institutional Trading of Playa Hotels & Resorts

A number of large investors have recently bought and sold shares of PLYA. Inspire Investing LLC bought a new stake in Playa Hotels & Resorts in the third quarter valued at $414,000. MQS Management LLC acquired a new position in shares of Playa Hotels & Resorts during the third quarter valued at $689,000. Oppenheimer & Co. Inc. lifted its stake in shares of Playa Hotels & Resorts by 69.8% during the third quarter. Oppenheimer & Co. Inc. now owns 52,443 shares of the company's stock valued at $406,000 after acquiring an additional 21,562 shares during the period. King Luther Capital Management Corp increased its holdings in Playa Hotels & Resorts by 1.2% in the third quarter. King Luther Capital Management Corp now owns 429,200 shares of the company's stock valued at $3,326,000 after purchasing an additional 5,154 shares during the last quarter. Finally, FMR LLC increased its holdings in shares of Playa Hotels & Resorts by 59.5% in the third quarter. FMR LLC now owns 26,041 shares of the company's stock worth $202,000 after acquiring an additional 9,713 shares in the last quarter. 74.58% of the stock is currently owned by institutional investors.

About Playa Hotels & Resorts

(

Get Free Report)

Playa Hotels & Resorts NV engages in the operation of hotels and resorts. The firm's geographical segments include Yucatán Peninsula, Pacific Coast, Dominican Republic, and Jamaica. It owns all-inclusive oceanfront resorts in Cancun, Los Cabos, Montego Bay, Puerto Vallarta, Playa del Carmen, and Cap Cana.

Recommended Stories

Before you consider Playa Hotels & Resorts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Playa Hotels & Resorts wasn't on the list.

While Playa Hotels & Resorts currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Almost everyone loves strong dividend-paying stocks, but high yields can signal danger. Discover 20 high-yield dividend stocks paying an unsustainably large percentage of their earnings. Enter your email to get this report and avoid a high-yield dividend trap.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.