Plug Power (NASDAQ:PLUG - Get Free Report) had its price target dropped by investment analysts at Craig Hallum from $4.00 to $3.00 in a report released on Thursday,Benzinga reports. The firm presently has a "buy" rating on the electronics maker's stock. Craig Hallum's target price indicates a potential upside of 57.61% from the stock's previous close.

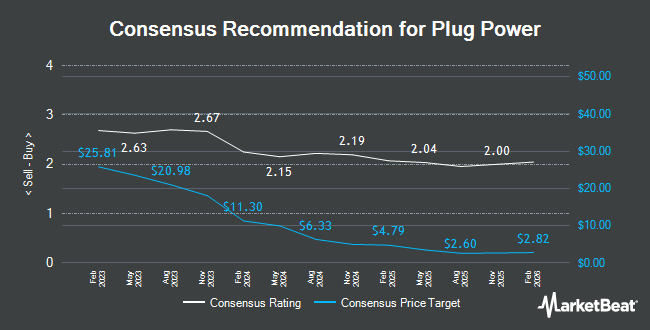

Other equities research analysts have also recently issued reports about the company. Piper Sandler lowered their target price on Plug Power from $1.60 to $1.40 and set an "underweight" rating for the company in a research note on Thursday. Canaccord Genuity Group reduced their price objective on Plug Power from $2.50 to $2.25 and set a "hold" rating for the company in a research report on Wednesday. Truist Financial dropped their target price on Plug Power from $3.00 to $2.00 and set a "hold" rating on the stock in a research report on Monday, August 12th. HC Wainwright reaffirmed a "buy" rating and set a $18.00 price target on shares of Plug Power in a research report on Wednesday. Finally, Wells Fargo & Company cut their price objective on shares of Plug Power from $3.00 to $2.00 and set an "equal weight" rating on the stock in a research report on Thursday. Four equities research analysts have rated the stock with a sell rating, twelve have given a hold rating, seven have issued a buy rating and one has given a strong buy rating to the stock. According to data from MarketBeat.com, the stock presently has a consensus rating of "Hold" and a consensus target price of $4.60.

Get Our Latest Report on PLUG

Plug Power Price Performance

PLUG stock traded down $0.07 on Thursday, hitting $1.90. 43,334,215 shares of the company's stock traded hands, compared to its average volume of 40,954,945. The company has a current ratio of 2.07, a quick ratio of 0.91 and a debt-to-equity ratio of 0.16. Plug Power has a 1-year low of $1.60 and a 1-year high of $5.14. The stock has a market cap of $1.67 billion, a price-to-earnings ratio of -0.88 and a beta of 1.81. The stock has a fifty day moving average of $2.06 and a 200-day moving average of $2.41.

Plug Power (NASDAQ:PLUG - Get Free Report) last issued its quarterly earnings results on Tuesday, November 12th. The electronics maker reported ($0.25) earnings per share for the quarter, missing analysts' consensus estimates of ($0.24) by ($0.01). Plug Power had a negative net margin of 214.05% and a negative return on equity of 47.36%. The business had revenue of $173.70 million for the quarter, compared to analysts' expectations of $207.25 million. During the same quarter in the prior year, the firm posted ($0.47) EPS. The business's quarterly revenue was down 12.6% compared to the same quarter last year. On average, analysts forecast that Plug Power will post -1.16 EPS for the current fiscal year.

Institutional Trading of Plug Power

A number of hedge funds and other institutional investors have recently modified their holdings of the business. Empowered Funds LLC bought a new position in shares of Plug Power during the first quarter valued at approximately $48,000. Swiss National Bank raised its holdings in shares of Plug Power by 0.8% in the first quarter. Swiss National Bank now owns 1,075,988 shares of the electronics maker's stock valued at $3,701,000 after acquiring an additional 8,300 shares in the last quarter. State Board of Administration of Florida Retirement System increased its position in Plug Power by 5.9% during the 1st quarter. State Board of Administration of Florida Retirement System now owns 600,188 shares of the electronics maker's stock valued at $2,065,000 after purchasing an additional 33,311 shares during the period. HBK Sorce Advisory LLC bought a new position in shares of Plug Power during the first quarter valued at approximately $37,000. Finally, Vanguard Group Inc. increased its holdings in Plug Power by 1.9% during the first quarter. Vanguard Group Inc. now owns 54,986,479 shares of the electronics maker's stock valued at $189,153,000 after buying an additional 999,194 shares during the period. 43.48% of the stock is owned by hedge funds and other institutional investors.

Plug Power Company Profile

(

Get Free Report)

Plug Power Inc develops hydrogen and fuel cell product solutions in North America, Europe, Asia, and internationally. The company offers GenDrive, a hydrogen-fueled proton exchange membrane (PEM) fuel cell system that provides power to material handling electric vehicles; GenSure, a stationary fuel cell solution that offers modular PEM fuel cell power to support the backup and grid-support power requirements of the telecommunications, transportation, and utility sectors; ProGen, a fuel cell stack and engine technology used in mobility and stationary fuel cell systems, and as engines in electric delivery vans; GenFuel, a liquid hydrogen fueling delivery, generation, storage, and dispensing system; GenCare, an ongoing Internet of Things-based maintenance and on-site service program for GenDrive fuel cell systems, GenSure fuel cell systems, GenFuel hydrogen storage and dispensing products, and ProGen fuel cell engines; and GenKey, an integrated turn-key solution for transitioning to fuel cell power.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Plug Power, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plug Power wasn't on the list.

While Plug Power currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.