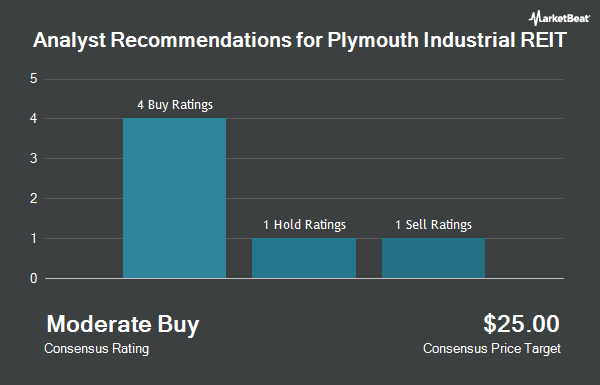

Shares of Plymouth Industrial REIT, Inc. (NYSE:PLYM - Get Free Report) have been given a consensus recommendation of "Hold" by the nine ratings firms that are covering the company, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, four have issued a hold recommendation and four have assigned a buy recommendation to the company. The average 12 month price target among brokers that have issued a report on the stock in the last year is $25.22.

A number of brokerages have issued reports on PLYM. BNP Paribas downgraded Plymouth Industrial REIT from an "outperform" rating to a "neutral" rating and set a $23.00 target price on the stock. in a research report on Friday, November 8th. Wedbush boosted their price target on shares of Plymouth Industrial REIT from $23.00 to $25.00 and gave the company a "neutral" rating in a research report on Monday, August 5th. Barclays lifted their price objective on Plymouth Industrial REIT from $22.00 to $25.00 and gave the company an "equal weight" rating in a research note on Wednesday, August 14th. Truist Financial upped their target price on Plymouth Industrial REIT from $26.00 to $27.00 and gave the stock a "buy" rating in a research note on Wednesday, August 28th. Finally, B. Riley lifted their price target on Plymouth Industrial REIT from $26.00 to $27.00 and gave the company a "buy" rating in a research report on Monday, August 5th.

Read Our Latest Research Report on PLYM

Plymouth Industrial REIT Stock Performance

PLYM traded down $0.24 during trading on Friday, hitting $18.38. 450,183 shares of the company traded hands, compared to its average volume of 255,361. The stock's fifty day moving average is $21.63 and its 200 day moving average is $21.98. Plymouth Industrial REIT has a one year low of $18.29 and a one year high of $25.55. The firm has a market cap of $834.45 million, a P/E ratio of 931.00, a price-to-earnings-growth ratio of 1.52 and a beta of 1.37. The company has a quick ratio of 0.16, a current ratio of 0.16 and a debt-to-equity ratio of 1.49.

Plymouth Industrial REIT Announces Dividend

The business also recently announced a quarterly dividend, which was paid on Thursday, October 31st. Stockholders of record on Monday, September 30th were paid a $0.24 dividend. The ex-dividend date of this dividend was Monday, September 30th. This represents a $0.96 dividend on an annualized basis and a dividend yield of 5.22%. Plymouth Industrial REIT's dividend payout ratio is currently 4,800.00%.

Insider Activity

In related news, major shareholder Mirelf Vi Reit Investments Iv, sold 563,438 shares of the stock in a transaction that occurred on Monday, August 19th. The shares were sold at an average price of $23.58, for a total transaction of $13,285,868.04. Following the transaction, the insider now owns 4,474,292 shares in the company, valued at $105,503,805.36. This represents a 11.18 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Corporate insiders own 1.40% of the company's stock.

Hedge Funds Weigh In On Plymouth Industrial REIT

Several hedge funds and other institutional investors have recently modified their holdings of the company. Quarry LP boosted its holdings in shares of Plymouth Industrial REIT by 88.4% in the third quarter. Quarry LP now owns 1,833 shares of the company's stock worth $41,000 after buying an additional 860 shares during the last quarter. Copeland Capital Management LLC purchased a new position in shares of Plymouth Industrial REIT during the 3rd quarter worth $43,000. Loomis Sayles & Co. L P grew its position in shares of Plymouth Industrial REIT by 3,130.6% during the 3rd quarter. Loomis Sayles & Co. L P now owns 2,003 shares of the company's stock valued at $45,000 after acquiring an additional 1,941 shares during the period. Point72 DIFC Ltd purchased a new stake in shares of Plymouth Industrial REIT in the 3rd quarter worth $46,000. Finally, EntryPoint Capital LLC raised its holdings in Plymouth Industrial REIT by 33.9% in the 1st quarter. EntryPoint Capital LLC now owns 4,997 shares of the company's stock worth $112,000 after purchasing an additional 1,266 shares during the period. 92.67% of the stock is owned by institutional investors.

Plymouth Industrial REIT Company Profile

(

Get Free ReportPlymouth Industrial REIT, Inc NYSE: PLYM is a full service, vertically integrated real estate investment company focused on the acquisition, ownership and management of single and multi-tenant industrial properties. Our mission is to provide tenants with cost effective space that is functional, flexible and safe.

Recommended Stories

Before you consider Plymouth Industrial REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Plymouth Industrial REIT wasn't on the list.

While Plymouth Industrial REIT currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.