PNC Financial Services Group Inc. decreased its position in shares of AutoZone, Inc. (NYSE:AZO - Free Report) by 9.4% in the third quarter, according to its most recent Form 13F filing with the Securities & Exchange Commission. The firm owned 43,149 shares of the company's stock after selling 4,456 shares during the quarter. PNC Financial Services Group Inc. owned 0.26% of AutoZone worth $135,921,000 as of its most recent SEC filing.

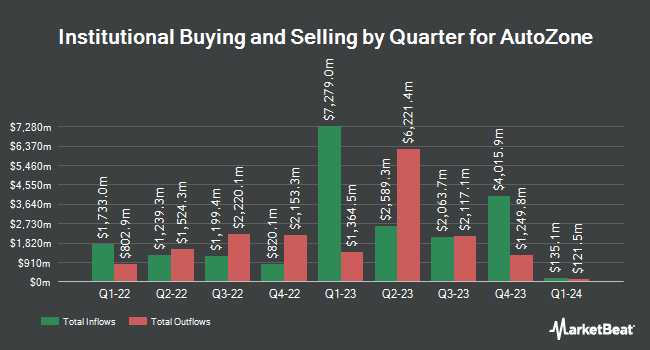

Several other large investors have also made changes to their positions in the business. International Assets Investment Management LLC grew its holdings in AutoZone by 354,692.5% during the third quarter. International Assets Investment Management LLC now owns 993,419 shares of the company's stock worth $31,293,100,000 after acquiring an additional 993,139 shares during the period. Boston Partners raised its position in shares of AutoZone by 1.7% in the first quarter. Boston Partners now owns 382,169 shares of the company's stock valued at $1,202,596,000 after buying an additional 6,226 shares during the last quarter. PineStone Asset Management Inc. boosted its holdings in shares of AutoZone by 137.6% during the 2nd quarter. PineStone Asset Management Inc. now owns 310,043 shares of the company's stock worth $918,998,000 after purchasing an additional 179,543 shares during the last quarter. Captrust Financial Advisors boosted its stake in AutoZone by 564.2% during the first quarter. Captrust Financial Advisors now owns 152,091 shares of the company's stock worth $479,338,000 after buying an additional 129,193 shares during the last quarter. Finally, Legal & General Group Plc grew its holdings in shares of AutoZone by 2.3% in the second quarter. Legal & General Group Plc now owns 150,698 shares of the company's stock valued at $446,684,000 after purchasing an additional 3,382 shares during the period. 92.74% of the stock is owned by hedge funds and other institutional investors.

Insider Activity at AutoZone

In other news, Chairman William C. Rhodes III sold 300 shares of the business's stock in a transaction on Thursday, October 3rd. The stock was sold at an average price of $3,075.20, for a total value of $922,560.00. Following the completion of the transaction, the chairman now directly owns 13,857 shares of the company's stock, valued at $42,613,046.40. The trade was a 2.12 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, VP John Scott Murphy sold 1,580 shares of the company's stock in a transaction on Wednesday, September 25th. The shares were sold at an average price of $3,107.69, for a total value of $4,910,150.20. Following the completion of the sale, the vice president now owns 1,218 shares in the company, valued at $3,785,166.42. This represents a 56.47 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last three months, insiders have sold 14,880 shares of company stock valued at $46,225,660. Insiders own 2.10% of the company's stock.

Wall Street Analyst Weigh In

A number of research firms have commented on AZO. Roth Capital upgraded AutoZone to a "strong-buy" rating in a research report on Tuesday, October 15th. UBS Group increased their price objective on AutoZone from $3,340.00 to $3,500.00 and gave the company a "buy" rating in a research note on Wednesday, September 25th. StockNews.com cut shares of AutoZone from a "buy" rating to a "hold" rating in a report on Saturday, September 21st. Truist Financial raised their target price on AutoZone from $3,341.00 to $3,501.00 and gave the stock a "buy" rating in a research report on Monday, October 14th. Finally, Redburn Atlantic upgraded shares of AutoZone to a "strong-buy" rating in a research note on Tuesday, October 1st. One analyst has rated the stock with a sell rating, three have assigned a hold rating, fourteen have assigned a buy rating and four have given a strong buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and a consensus target price of $3,202.71.

Check Out Our Latest Analysis on AZO

AutoZone Trading Down 1.8 %

Shares of AZO traded down $57.33 during trading hours on Wednesday, reaching $3,049.58. The company had a trading volume of 119,341 shares, compared to its average volume of 138,588. The company has a market capitalization of $51.54 billion, a price-to-earnings ratio of 20.37, a PEG ratio of 1.57 and a beta of 0.71. AutoZone, Inc. has a 12-month low of $2,510.00 and a 12-month high of $3,256.37. The firm has a 50 day simple moving average of $3,112.05 and a 200-day simple moving average of $3,027.79.

AutoZone (NYSE:AZO - Get Free Report) last posted its quarterly earnings results on Tuesday, September 24th. The company reported $48.11 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $53.31 by ($5.20). The company had revenue of $6.21 billion for the quarter, compared to analyst estimates of $6.25 billion. AutoZone had a net margin of 14.40% and a negative return on equity of 52.99%. AutoZone's revenue was up 9.0% on a year-over-year basis. During the same quarter in the previous year, the business posted $46.46 earnings per share. Sell-side analysts forecast that AutoZone, Inc. will post 158.09 earnings per share for the current year.

About AutoZone

(

Free Report)

AutoZone, Inc retails and distributes automotive replacement parts and accessories in the United States, Mexico, and Brazil. The company provides various products for cars, sport utility vehicles, vans, and light trucks, including new and remanufactured automotive hard parts, maintenance items, accessories, and non-automotive products.

Featured Articles

Before you consider AutoZone, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AutoZone wasn't on the list.

While AutoZone currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Options trading isn’t just for the Wall Street elite; it’s an accessible strategy for anyone armed with the proper knowledge. Think of options as a strategic toolkit, with each tool designed for a specific financial task. Keep reading to learn how options trading can help you use the market’s volatility to your advantage.

Get This Free Report