Point72 Asia Singapore Pte. Ltd. reduced its position in shares of Mettler-Toledo International Inc. (NYSE:MTD - Free Report) by 68.5% during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 935 shares of the medical instruments supplier's stock after selling 2,035 shares during the quarter. Point72 Asia Singapore Pte. Ltd.'s holdings in Mettler-Toledo International were worth $1,402,000 as of its most recent SEC filing.

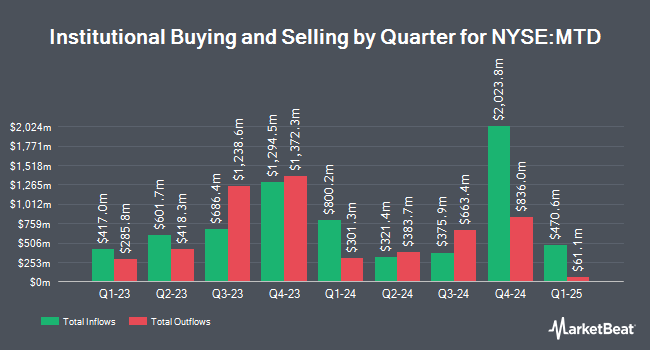

Other institutional investors have also recently modified their holdings of the company. Gateway Investment Advisers LLC purchased a new position in Mettler-Toledo International during the second quarter worth approximately $685,000. SG Americas Securities LLC grew its stake in Mettler-Toledo International by 52.9% in the 2nd quarter. SG Americas Securities LLC now owns 4,516 shares of the medical instruments supplier's stock valued at $6,312,000 after acquiring an additional 1,562 shares during the period. Allspring Global Investments Holdings LLC increased its holdings in Mettler-Toledo International by 14.0% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 1,240 shares of the medical instruments supplier's stock worth $1,860,000 after acquiring an additional 152 shares in the last quarter. Linden Thomas Advisory Services LLC raised its position in Mettler-Toledo International by 212.2% during the second quarter. Linden Thomas Advisory Services LLC now owns 1,308 shares of the medical instruments supplier's stock worth $1,828,000 after acquiring an additional 889 shares during the period. Finally, Federated Hermes Inc. lifted its holdings in Mettler-Toledo International by 10.3% during the second quarter. Federated Hermes Inc. now owns 7,667 shares of the medical instruments supplier's stock valued at $10,715,000 after purchasing an additional 717 shares in the last quarter. 95.07% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at Mettler-Toledo International

In other news, Director Elisha W. Finney sold 76 shares of the stock in a transaction dated Monday, November 11th. The shares were sold at an average price of $1,311.75, for a total transaction of $99,693.00. Following the sale, the director now owns 240 shares of the company's stock, valued at approximately $314,820. This represents a 24.05 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through the SEC website. Company insiders own 1.94% of the company's stock.

Analyst Ratings Changes

A number of analysts have recently commented on the stock. Robert W. Baird cut their target price on shares of Mettler-Toledo International from $1,375.00 to $1,310.00 and set a "neutral" rating for the company in a research note on Monday, November 11th. Wells Fargo & Company reduced their target price on Mettler-Toledo International from $1,400.00 to $1,350.00 and set an "equal weight" rating for the company in a report on Monday, November 11th. Evercore ISI lifted their price target on Mettler-Toledo International from $1,375.00 to $1,450.00 and gave the stock an "in-line" rating in a research note on Tuesday, October 1st. JPMorgan Chase & Co. increased their price objective on Mettler-Toledo International from $1,300.00 to $1,400.00 and gave the company a "neutral" rating in a research note on Monday, August 5th. Finally, Stifel Nicolaus lowered their target price on shares of Mettler-Toledo International from $1,550.00 to $1,450.00 and set a "buy" rating on the stock in a research note on Monday, November 11th. Two equities research analysts have rated the stock with a sell rating, five have issued a hold rating and two have given a buy rating to the company. Based on data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $1,338.75.

Read Our Latest Research Report on MTD

Mettler-Toledo International Stock Performance

Shares of NYSE MTD traded down $2.13 during trading on Monday, hitting $1,249.07. 41,212 shares of the company were exchanged, compared to its average volume of 136,470. The company has a fifty day moving average price of $1,345.17 and a 200-day moving average price of $1,392.37. The firm has a market capitalization of $26.36 billion, a PE ratio of 33.49, a P/E/G ratio of 4.13 and a beta of 1.16. Mettler-Toledo International Inc. has a 12-month low of $1,068.33 and a 12-month high of $1,546.93.

Mettler-Toledo International (NYSE:MTD - Get Free Report) last issued its quarterly earnings data on Thursday, November 7th. The medical instruments supplier reported $10.21 earnings per share (EPS) for the quarter, beating the consensus estimate of $10.00 by $0.21. Mettler-Toledo International had a net margin of 21.15% and a negative return on equity of 531.78%. The firm had revenue of $954.54 million for the quarter, compared to analyst estimates of $941.93 million. Research analysts anticipate that Mettler-Toledo International Inc. will post 40.42 earnings per share for the current fiscal year.

Mettler-Toledo International Profile

(

Free Report)

Mettler-Toledo International Inc manufactures and supplies precision instruments and services in the Americas, Europe, Asia, and internationally. It operates through five segments: U.S. Operations, Swiss Operations, Western European Operations, Chinese Operations, and Other. The company's laboratory instruments include laboratory balances, liquid pipetting solutions, automated laboratory reactors, real-time analytics, titrators, pH meters, process analytics sensors and analyzer technologies, physical value analyzers, density and refractometry, thermal analysis systems, and other analytical instruments; and LabX, a laboratory software platform to manage and analyze data generated from its instruments.

See Also

Before you consider Mettler-Toledo International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Mettler-Toledo International wasn't on the list.

While Mettler-Toledo International currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.