Point72 Asset Management L.P. lifted its stake in Weatherford International plc (NASDAQ:WFRD - Free Report) by 67.3% in the third quarter, according to the company in its most recent 13F filing with the SEC. The firm owned 143,900 shares of the company's stock after purchasing an additional 57,866 shares during the quarter. Point72 Asset Management L.P. owned about 0.20% of Weatherford International worth $12,220,000 at the end of the most recent reporting period.

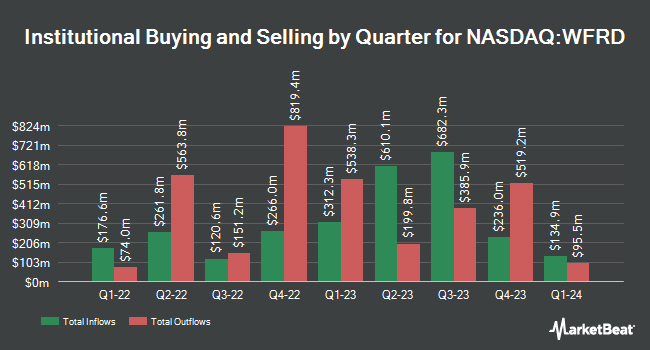

A number of other institutional investors and hedge funds have also recently modified their holdings of the stock. Cetera Investment Advisers purchased a new position in shares of Weatherford International during the first quarter worth approximately $2,132,000. Cetera Advisors LLC increased its position in shares of Weatherford International by 9.5% during the first quarter. Cetera Advisors LLC now owns 3,044 shares of the company's stock worth $351,000 after purchasing an additional 265 shares in the last quarter. GAMMA Investing LLC increased its holdings in shares of Weatherford International by 50.4% during the second quarter. GAMMA Investing LLC now owns 382 shares of the company's stock valued at $47,000 after acquiring an additional 128 shares in the last quarter. CWM LLC raised its stake in Weatherford International by 74.1% in the 2nd quarter. CWM LLC now owns 552 shares of the company's stock worth $68,000 after acquiring an additional 235 shares during the last quarter. Finally, Envestnet Portfolio Solutions Inc. boosted its position in Weatherford International by 238.2% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 6,040 shares of the company's stock valued at $740,000 after buying an additional 4,254 shares during the last quarter. Hedge funds and other institutional investors own 97.23% of the company's stock.

Insiders Place Their Bets

In other Weatherford International news, CAO Desmond J. Mills sold 6,531 shares of the company's stock in a transaction dated Friday, October 25th. The shares were sold at an average price of $79.86, for a total value of $521,565.66. Following the sale, the chief accounting officer now owns 11,680 shares of the company's stock, valued at $932,764.80. This represents a 35.86 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Insiders own 1.60% of the company's stock.

Wall Street Analysts Forecast Growth

WFRD has been the subject of a number of recent research reports. Benchmark reiterated a "buy" rating and set a $155.00 price objective on shares of Weatherford International in a research note on Thursday, October 24th. Citigroup dropped their price objective on shares of Weatherford International from $130.00 to $115.00 and set a "buy" rating for the company in a report on Thursday, November 14th. Barclays cut their price objective on Weatherford International from $154.00 to $147.00 and set an "overweight" rating on the stock in a report on Friday, October 25th. Bank of America cut their price objective on Weatherford International from $145.00 to $130.00 and set a "buy" rating on the stock in a research report on Monday, October 14th. Finally, Evercore ISI decreased their price target on shares of Weatherford International from $149.00 to $142.00 and set an "outperform" rating for the company in a research note on Thursday, October 24th. Six equities research analysts have rated the stock with a buy rating and one has given a strong buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Buy" and an average target price of $147.29.

Read Our Latest Research Report on WFRD

Weatherford International Stock Performance

Shares of NASDAQ:WFRD traded down $5.14 during midday trading on Friday, hitting $77.58. The stock had a trading volume of 700,492 shares, compared to its average volume of 702,799. The company has a market capitalization of $5.64 billion, a PE ratio of 10.90, a P/E/G ratio of 0.65 and a beta of 0.58. Weatherford International plc has a 1 year low of $76.84 and a 1 year high of $135.00. The stock has a 50 day moving average price of $85.24 and a two-hundred day moving average price of $101.71. The company has a current ratio of 2.04, a quick ratio of 1.49 and a debt-to-equity ratio of 1.20.

Weatherford International (NASDAQ:WFRD - Get Free Report) last released its earnings results on Tuesday, October 22nd. The company reported $2.06 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.65 by $0.41. The company had revenue of $1.41 billion for the quarter, compared to analysts' expectations of $1.42 billion. Weatherford International had a return on equity of 46.25% and a net margin of 9.65%. The firm's quarterly revenue was up 7.3% on a year-over-year basis. During the same quarter in the previous year, the firm posted $1.66 EPS. As a group, equities analysts predict that Weatherford International plc will post 6.85 earnings per share for the current fiscal year.

Weatherford International Announces Dividend

The firm also recently disclosed a quarterly dividend, which was paid on Thursday, December 5th. Shareholders of record on Wednesday, November 6th were given a $0.25 dividend. This represents a $1.00 annualized dividend and a yield of 1.29%. The ex-dividend date was Wednesday, November 6th. Weatherford International's payout ratio is 14.04%.

Weatherford International Company Profile

(

Free Report)

Weatherford International plc, an energy services company, provides equipment and services for the drilling, evaluation, completion, production, and intervention of oil, geothermal, and natural gas wells worldwide. The company operates through three segments: Drilling and Evaluation; Well Construction and Completions; and Production and Intervention.

Further Reading

Before you consider Weatherford International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Weatherford International wasn't on the list.

While Weatherford International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.