Point72 Asset Management L.P. purchased a new stake in Arcutis Biotherapeutics, Inc. (NASDAQ:ARQT - Free Report) during the third quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm purchased 244,386 shares of the company's stock, valued at approximately $2,273,000. Point72 Asset Management L.P. owned approximately 0.21% of Arcutis Biotherapeutics at the end of the most recent reporting period.

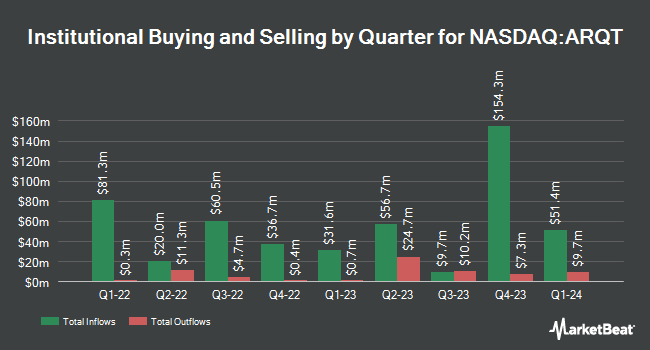

Other institutional investors also recently bought and sold shares of the company. Jennison Associates LLC grew its position in shares of Arcutis Biotherapeutics by 0.8% in the 3rd quarter. Jennison Associates LLC now owns 11,663,497 shares of the company's stock valued at $108,471,000 after buying an additional 91,803 shares during the last quarter. Rubric Capital Management LP boosted its stake in Arcutis Biotherapeutics by 11.7% in the third quarter. Rubric Capital Management LP now owns 10,966,672 shares of the company's stock valued at $101,990,000 after acquiring an additional 1,150,000 shares in the last quarter. Suvretta Capital Management LLC grew its holdings in shares of Arcutis Biotherapeutics by 7.2% during the third quarter. Suvretta Capital Management LLC now owns 10,721,511 shares of the company's stock worth $99,710,000 after purchasing an additional 717,019 shares during the last quarter. Perceptive Advisors LLC grew its holdings in shares of Arcutis Biotherapeutics by 107.8% during the second quarter. Perceptive Advisors LLC now owns 1,558,500 shares of the company's stock worth $14,494,000 after purchasing an additional 808,500 shares during the last quarter. Finally, Candriam S.C.A. acquired a new stake in shares of Arcutis Biotherapeutics during the second quarter worth about $12,159,000.

Insider Activity at Arcutis Biotherapeutics

In related news, Director Howard G. Welgus sold 10,000 shares of the business's stock in a transaction dated Monday, December 2nd. The shares were sold at an average price of $12.51, for a total value of $125,100.00. Following the completion of the transaction, the director now owns 161,944 shares of the company's stock, valued at approximately $2,025,919.44. The trade was a 5.82 % decrease in their position. The sale was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, insider Patrick Burnett sold 16,023 shares of the firm's stock in a transaction dated Friday, November 22nd. The stock was sold at an average price of $10.14, for a total transaction of $162,473.22. Following the sale, the insider now directly owns 128,669 shares in the company, valued at $1,304,703.66. This represents a 11.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders have sold 76,951 shares of company stock valued at $770,144. 9.50% of the stock is owned by corporate insiders.

Arcutis Biotherapeutics Price Performance

Arcutis Biotherapeutics stock traded up $0.52 during trading hours on Tuesday, hitting $13.10. The stock had a trading volume of 979,107 shares, compared to its average volume of 3,143,225. Arcutis Biotherapeutics, Inc. has a 1-year low of $1.89 and a 1-year high of $13.50. The stock has a market capitalization of $1.53 billion, a price-to-earnings ratio of -7.03 and a beta of 1.32. The stock's fifty day moving average is $10.08 and its two-hundred day moving average is $9.69. The company has a debt-to-equity ratio of 0.67, a current ratio of 2.46 and a quick ratio of 2.38.

Arcutis Biotherapeutics (NASDAQ:ARQT - Get Free Report) last announced its earnings results on Wednesday, November 6th. The company reported ($0.33) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.42) by $0.09. The company had revenue of $44.76 million during the quarter, compared to analysts' expectations of $38.05 million. Arcutis Biotherapeutics had a negative net margin of 140.97% and a negative return on equity of 119.11%. As a group, analysts predict that Arcutis Biotherapeutics, Inc. will post -1.34 earnings per share for the current fiscal year.

Analyst Upgrades and Downgrades

Several research analysts have commented on the company. Needham & Company LLC reaffirmed a "buy" rating and set a $18.00 price target on shares of Arcutis Biotherapeutics in a research report on Thursday, November 7th. Jefferies Financial Group started coverage on shares of Arcutis Biotherapeutics in a research report on Wednesday, August 28th. They set a "buy" rating and a $15.00 price objective on the stock.

Read Our Latest Analysis on Arcutis Biotherapeutics

About Arcutis Biotherapeutics

(

Free Report)

Arcutis Biotherapeutics, Inc, a biopharmaceutical company, focuses on developing and commercializing treatments for dermatological diseases. Its lead product candidate is ARQ-151, a topical roflumilast cream that has completed Phase III clinical trials for the treatment of plaque psoriasis and atopic dermatitis.

See Also

Before you consider Arcutis Biotherapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcutis Biotherapeutics wasn't on the list.

While Arcutis Biotherapeutics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Click the link below to learn more about using beta to protect yourself.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.