Point72 DIFC Ltd bought a new stake in shares of H&R Block, Inc. (NYSE:HRB - Free Report) in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund bought 11,617 shares of the company's stock, valued at approximately $738,000.

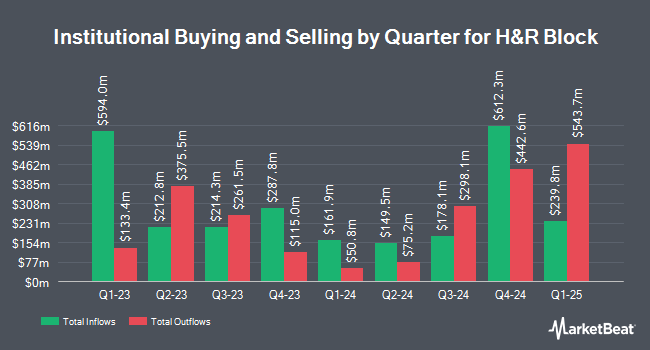

A number of other hedge funds have also recently modified their holdings of the business. Point72 Asset Management L.P. bought a new position in shares of H&R Block in the third quarter worth about $1,821,000. IHT Wealth Management LLC boosted its position in H&R Block by 5.4% in the 3rd quarter. IHT Wealth Management LLC now owns 5,586 shares of the company's stock valued at $355,000 after buying an additional 288 shares during the period. Jacobs Levy Equity Management Inc. grew its stake in H&R Block by 114.6% in the 3rd quarter. Jacobs Levy Equity Management Inc. now owns 87,532 shares of the company's stock worth $5,563,000 after acquiring an additional 46,736 shares in the last quarter. Janus Henderson Group PLC grew its stake in H&R Block by 2.0% in the 3rd quarter. Janus Henderson Group PLC now owns 62,859 shares of the company's stock worth $3,997,000 after acquiring an additional 1,212 shares in the last quarter. Finally, HighTower Advisors LLC increased its position in shares of H&R Block by 18.5% during the third quarter. HighTower Advisors LLC now owns 17,982 shares of the company's stock worth $1,147,000 after acquiring an additional 2,803 shares during the period. Institutional investors own 90.14% of the company's stock.

Insiders Place Their Bets

In related news, VP Kellie J. Logerwell sold 8,000 shares of H&R Block stock in a transaction that occurred on Monday, September 16th. The shares were sold at an average price of $64.41, for a total value of $515,280.00. Following the completion of the sale, the vice president now directly owns 18,474 shares in the company, valued at $1,189,910.34. This trade represents a 30.22 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. 1.30% of the stock is currently owned by corporate insiders.

H&R Block Stock Down 0.0 %

Shares of HRB traded down $0.01 during mid-day trading on Friday, hitting $57.34. The company's stock had a trading volume of 926,112 shares, compared to its average volume of 1,200,261. The firm has a market capitalization of $7.86 billion, a price-to-earnings ratio of 13.98, a PEG ratio of 0.88 and a beta of 0.66. The company's 50-day moving average is $60.34 and its 200-day moving average is $58.15. The company has a current ratio of 0.77, a quick ratio of 0.77 and a debt-to-equity ratio of 16.46. H&R Block, Inc. has a 52-week low of $42.28 and a 52-week high of $68.45.

H&R Block (NYSE:HRB - Get Free Report) last posted its earnings results on Thursday, November 7th. The company reported ($1.17) earnings per share for the quarter, missing analysts' consensus estimates of ($1.13) by ($0.04). H&R Block had a negative return on equity of 212.45% and a net margin of 16.19%. The company had revenue of $193.81 million for the quarter, compared to analysts' expectations of $188.78 million. During the same quarter in the prior year, the company earned ($1.05) EPS. On average, equities research analysts forecast that H&R Block, Inc. will post 5.27 EPS for the current fiscal year.

H&R Block announced that its board has approved a stock repurchase plan on Thursday, August 15th that allows the company to repurchase $1.50 billion in outstanding shares. This repurchase authorization allows the company to purchase up to 16.7% of its shares through open market purchases. Shares repurchase plans are often a sign that the company's board of directors believes its shares are undervalued.

H&R Block Dividend Announcement

The business also recently announced a quarterly dividend, which will be paid on Monday, January 6th. Shareholders of record on Thursday, December 5th will be paid a $0.375 dividend. The ex-dividend date is Thursday, December 5th. This represents a $1.50 annualized dividend and a yield of 2.62%. H&R Block's dividend payout ratio (DPR) is presently 36.59%.

Analysts Set New Price Targets

HRB has been the subject of a number of research reports. StockNews.com lowered H&R Block from a "buy" rating to a "hold" rating in a report on Friday, August 16th. Barrington Research reiterated an "outperform" rating and issued a $70.00 target price on shares of H&R Block in a report on Friday, November 8th. Finally, The Goldman Sachs Group raised their price target on H&R Block from $39.00 to $44.00 and gave the company a "sell" rating in a research note on Friday, August 16th.

View Our Latest Stock Analysis on HRB

About H&R Block

(

Free Report)

H&R Block, Inc, through its subsidiaries, provides assisted income tax return preparation and do-it-yourself (DIY) tax return preparation services and products to the general public primarily in the United States, Canada, and Australia. It offers assisted income tax return preparation and related services through a system of retail offices operated directly by the company or its franchisees.

Read More

Before you consider H&R Block, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and H&R Block wasn't on the list.

While H&R Block currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.