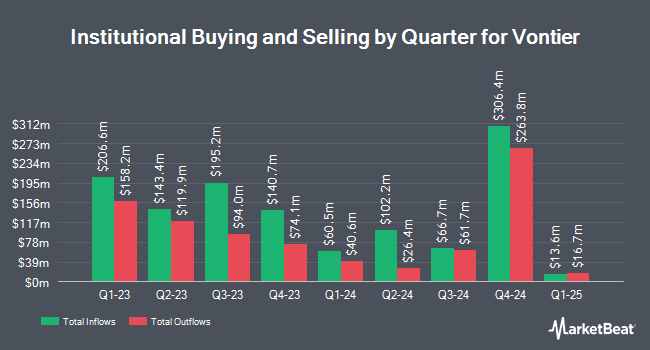

Point72 Hong Kong Ltd boosted its holdings in Vontier Co. (NYSE:VNT - Free Report) by 19,555.7% during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The fund owned 37,739 shares of the company's stock after acquiring an additional 37,547 shares during the period. Point72 Hong Kong Ltd's holdings in Vontier were worth $1,273,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds and other institutional investors also recently added to or reduced their stakes in VNT. Covestor Ltd increased its stake in shares of Vontier by 37.1% during the 3rd quarter. Covestor Ltd now owns 1,461 shares of the company's stock worth $49,000 after purchasing an additional 395 shares in the last quarter. Blue Trust Inc. grew its holdings in Vontier by 10.9% during the 3rd quarter. Blue Trust Inc. now owns 4,171 shares of the company's stock valued at $141,000 after buying an additional 410 shares during the last quarter. Ritholtz Wealth Management increased its position in Vontier by 3.3% during the second quarter. Ritholtz Wealth Management now owns 13,129 shares of the company's stock worth $502,000 after buying an additional 420 shares in the last quarter. Benjamin Edwards Inc. raised its holdings in shares of Vontier by 6.2% in the second quarter. Benjamin Edwards Inc. now owns 7,729 shares of the company's stock worth $295,000 after acquiring an additional 448 shares during the last quarter. Finally, Creative Planning lifted its position in shares of Vontier by 2.8% in the second quarter. Creative Planning now owns 17,918 shares of the company's stock valued at $684,000 after acquiring an additional 491 shares in the last quarter. Institutional investors and hedge funds own 95.83% of the company's stock.

Vontier Trading Up 0.5 %

Shares of Vontier stock traded up $0.20 during trading hours on Monday, reaching $39.46. The stock had a trading volume of 258,113 shares, compared to its average volume of 806,608. The firm has a market capitalization of $5.93 billion, a price-to-earnings ratio of 15.04, a P/E/G ratio of 1.84 and a beta of 1.25. Vontier Co. has a 1 year low of $31.22 and a 1 year high of $45.62. The company has a current ratio of 1.64, a quick ratio of 1.23 and a debt-to-equity ratio of 2.10. The firm has a 50 day simple moving average of $36.04 and a two-hundred day simple moving average of $36.67.

Vontier (NYSE:VNT - Get Free Report) last posted its quarterly earnings results on Thursday, October 31st. The company reported $0.73 EPS for the quarter, beating the consensus estimate of $0.69 by $0.04. Vontier had a net margin of 13.54% and a return on equity of 45.48%. The firm had revenue of $750.00 million for the quarter, compared to analyst estimates of $729.23 million. During the same quarter last year, the firm posted $0.73 earnings per share. Vontier's revenue for the quarter was down 2.0% compared to the same quarter last year. As a group, equities research analysts anticipate that Vontier Co. will post 2.89 earnings per share for the current year.

Vontier Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Thursday, December 12th. Investors of record on Thursday, November 21st will be given a dividend of $0.025 per share. The ex-dividend date is Thursday, November 21st. This represents a $0.10 dividend on an annualized basis and a yield of 0.25%. Vontier's dividend payout ratio (DPR) is 3.83%.

Wall Street Analyst Weigh In

Several research analysts recently weighed in on the stock. Barclays boosted their target price on shares of Vontier from $44.00 to $46.00 and gave the company an "overweight" rating in a research note on Tuesday, November 5th. Evercore ISI reduced their price objective on shares of Vontier from $45.00 to $40.00 and set an "outperform" rating on the stock in a research note on Monday, August 19th. Finally, Argus lowered shares of Vontier from a "buy" rating to a "hold" rating in a research report on Tuesday, August 20th. Three investment analysts have rated the stock with a hold rating and five have issued a buy rating to the stock. According to data from MarketBeat.com, the company has a consensus rating of "Moderate Buy" and an average target price of $44.50.

View Our Latest Report on Vontier

About Vontier

(

Free Report)

Vontier Corporation provides mobility ecosystem solutions worldwide. The company operates through Mobility Technologies, Repair Solutions, and Environmental and Fueling Solutions segments. The Mobility Technologies segment provides digitally equipment solutions for mobility ecosystem, such as point-of-sale and payment systems, workflow automation, telematics, data analytics, software platform, and integrated solutions for alternative fuel dispensing.

Further Reading

Before you consider Vontier, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vontier wasn't on the list.

While Vontier currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Like this article? Share it with a colleague.

Link copied to clipboard.