Point72 Hong Kong Ltd reduced its position in shares of Paylocity Holding Co. (NASDAQ:PCTY - Free Report) by 91.5% in the third quarter, according to the company in its most recent 13F filing with the SEC. The institutional investor owned 4,700 shares of the software maker's stock after selling 50,598 shares during the quarter. Point72 Hong Kong Ltd's holdings in Paylocity were worth $775,000 as of its most recent SEC filing.

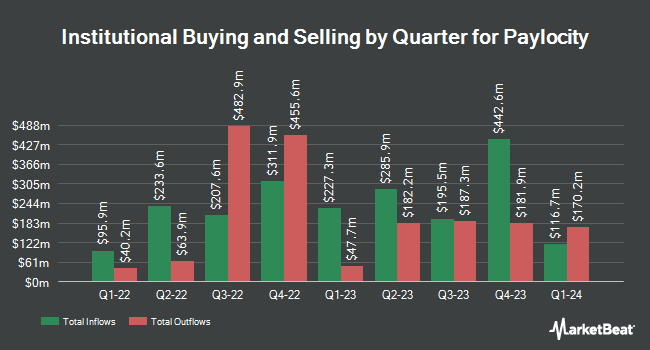

Several other hedge funds also recently modified their holdings of the company. Edgestream Partners L.P. raised its position in shares of Paylocity by 222.3% during the third quarter. Edgestream Partners L.P. now owns 10,837 shares of the software maker's stock worth $1,788,000 after purchasing an additional 7,475 shares during the period. Caisse DE Depot ET Placement DU Quebec boosted its position in Paylocity by 113.6% during the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 96,406 shares of the software maker's stock worth $15,904,000 after acquiring an additional 51,276 shares during the period. Fred Alger Management LLC grew its stake in Paylocity by 2.8% during the 3rd quarter. Fred Alger Management LLC now owns 62,450 shares of the software maker's stock valued at $10,302,000 after acquiring an additional 1,727 shares in the last quarter. Eventide Asset Management LLC acquired a new position in shares of Paylocity in the 3rd quarter valued at about $1,154,000. Finally, Verition Fund Management LLC lifted its position in shares of Paylocity by 46.6% in the third quarter. Verition Fund Management LLC now owns 24,506 shares of the software maker's stock worth $4,043,000 after purchasing an additional 7,785 shares in the last quarter. 94.76% of the stock is currently owned by institutional investors and hedge funds.

Paylocity Stock Performance

PCTY stock traded down $1.89 during trading on Tuesday, reaching $207.57. 191,145 shares of the stock were exchanged, compared to its average volume of 495,480. Paylocity Holding Co. has a twelve month low of $129.94 and a twelve month high of $215.68. The company has a market capitalization of $11.57 billion, a P/E ratio of 53.09, a price-to-earnings-growth ratio of 5.16 and a beta of 0.92. The stock has a 50 day simple moving average of $185.65 and a 200-day simple moving average of $161.75. The company has a current ratio of 1.32, a quick ratio of 1.32 and a debt-to-equity ratio of 0.29.

Analysts Set New Price Targets

PCTY has been the topic of several research reports. StockNews.com lowered shares of Paylocity from a "buy" rating to a "hold" rating in a research note on Friday. KeyCorp increased their price objective on Paylocity from $187.00 to $210.00 and gave the stock an "overweight" rating in a report on Thursday, October 31st. JMP Securities restated a "market outperform" rating and issued a $250.00 target price on shares of Paylocity in a research note on Monday, August 5th. Jefferies Financial Group raised their price target on Paylocity from $200.00 to $215.00 and gave the stock a "buy" rating in a research note on Thursday, October 31st. Finally, Needham & Company LLC boosted their price target on Paylocity from $200.00 to $220.00 and gave the company a "buy" rating in a research note on Thursday, October 31st. Four equities research analysts have rated the stock with a hold rating and eleven have assigned a buy rating to the stock. According to MarketBeat, the company currently has a consensus rating of "Moderate Buy" and a consensus price target of $196.64.

View Our Latest Stock Report on Paylocity

Insider Buying and Selling

In related news, Director Steven I. Sarowitz sold 2,900 shares of Paylocity stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $208.17, for a total transaction of $603,693.00. Following the sale, the director now directly owns 9,211,215 shares of the company's stock, valued at $1,917,498,626.55. This trade represents a 0.03 % decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Also, SVP Rachit Lohani sold 658 shares of Paylocity stock in a transaction dated Wednesday, October 2nd. The stock was sold at an average price of $162.83, for a total value of $107,142.14. Following the sale, the senior vice president now directly owns 39,764 shares in the company, valued at approximately $6,474,772.12. This trade represents a 1.63 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 88,927 shares of company stock valued at $17,759,122 over the last three months. 21.91% of the stock is owned by corporate insiders.

About Paylocity

(

Free Report)

Paylocity Holding Corporation engages in the provision of cloud-based human capital management and payroll software solutions for workforce in the United States. The company offers payroll software solution for global payroll, expense management, tax services, on demand payment, and garnishment managed services; and time and labor management software for time and attendance, scheduling, and time collection.

Featured Stories

Before you consider Paylocity, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Paylocity wasn't on the list.

While Paylocity currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.