Point72 Hong Kong Ltd lifted its position in Visteon Co. (NASDAQ:VC - Free Report) by 302.8% during the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 26,499 shares of the company's stock after buying an additional 19,921 shares during the quarter. Point72 Hong Kong Ltd owned approximately 0.10% of Visteon worth $2,524,000 at the end of the most recent quarter.

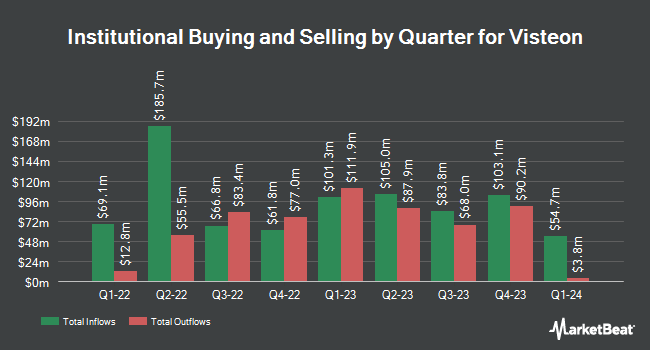

A number of other institutional investors and hedge funds have also recently modified their holdings of the company. Principal Financial Group Inc. raised its stake in Visteon by 3.2% in the third quarter. Principal Financial Group Inc. now owns 274,365 shares of the company's stock valued at $26,131,000 after purchasing an additional 8,500 shares in the last quarter. Royce & Associates LP lifted its holdings in shares of Visteon by 28.2% in the 3rd quarter. Royce & Associates LP now owns 202,214 shares of the company's stock worth $19,259,000 after acquiring an additional 44,460 shares during the last quarter. Mirabella Financial Services LLP lifted its holdings in shares of Visteon by 361.3% in the 3rd quarter. Mirabella Financial Services LLP now owns 17,096 shares of the company's stock worth $1,628,000 after acquiring an additional 13,390 shares during the last quarter. American Century Companies Inc. lifted its holdings in shares of Visteon by 1,459.9% in the 2nd quarter. American Century Companies Inc. now owns 523,521 shares of the company's stock worth $55,860,000 after acquiring an additional 489,959 shares during the last quarter. Finally, Quest Partners LLC bought a new stake in shares of Visteon in the 2nd quarter worth approximately $1,157,000. 99.71% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

A number of equities research analysts recently commented on VC shares. StockNews.com lowered shares of Visteon from a "buy" rating to a "hold" rating in a report on Sunday, November 3rd. Barclays reduced their target price on shares of Visteon from $145.00 to $140.00 and set an "overweight" rating on the stock in a research report on Tuesday, October 15th. Wolfe Research assumed coverage on shares of Visteon in a research report on Thursday, September 5th. They issued a "peer perform" rating on the stock. Royal Bank of Canada cut their price objective on shares of Visteon from $129.00 to $124.00 and set an "outperform" rating on the stock in a research report on Friday, October 25th. Finally, Morgan Stanley lowered their target price on shares of Visteon from $135.00 to $100.00 and set an "equal weight" rating on the stock in a research note on Wednesday, August 14th. Seven analysts have rated the stock with a hold rating and ten have issued a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has an average rating of "Moderate Buy" and a consensus target price of $127.57.

View Our Latest Analysis on Visteon

Visteon Stock Performance

NASDAQ VC traded up $2.71 during trading hours on Monday, reaching $96.08. The stock had a trading volume of 122,111 shares, compared to its average volume of 275,133. The stock has a fifty day moving average of $92.19 and a 200 day moving average of $100.08. The stock has a market cap of $2.65 billion, a P/E ratio of 5.07, a price-to-earnings-growth ratio of 0.45 and a beta of 1.45. Visteon Co. has a 52-week low of $86.27 and a 52-week high of $131.70. The company has a debt-to-equity ratio of 0.24, a quick ratio of 1.47 and a current ratio of 1.82.

Visteon (NASDAQ:VC - Get Free Report) last announced its earnings results on Thursday, October 24th. The company reported $2.26 earnings per share for the quarter, topping the consensus estimate of $1.89 by $0.37. The business had revenue of $980.00 million during the quarter, compared to the consensus estimate of $965.60 million. Visteon had a return on equity of 46.19% and a net margin of 13.22%. The business's quarterly revenue was down 3.4% on a year-over-year basis. During the same period in the prior year, the company posted $2.35 EPS. Sell-side analysts predict that Visteon Co. will post 8.2 earnings per share for the current year.

About Visteon

(

Free Report)

Visteon Corporation, an automotive technology company, designs, manufactures, and sells automotive electronics and connected car solutions for vehicle manufacturers worldwide. The company provides instrument clusters, including analog gauge clusters for 2-D and 3-D display-based devices; information displays that integrate a range of user interface technologies and graphics management capabilities, such as active privacy, TrueColor enhancement, local dimming, cameras, optics, haptic feedback, and light effects; and infotainment and connected car solutions, including scalable Android infotainment for seamless connectivity, as well as onboard artificial intelligence-based voice assistants with natural language understanding.

Featured Articles

Before you consider Visteon, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Visteon wasn't on the list.

While Visteon currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.