Point72 Hong Kong Ltd purchased a new position in STMicroelectronics (NYSE:STM - Free Report) in the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 47,900 shares of the semiconductor producer's stock, valued at approximately $1,424,000.

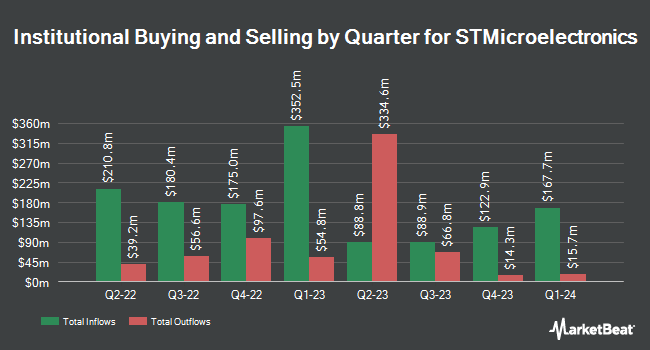

A number of other large investors have also recently made changes to their positions in STM. B. Riley Wealth Advisors Inc. bought a new stake in shares of STMicroelectronics in the first quarter worth approximately $235,000. Jane Street Group LLC grew its stake in shares of STMicroelectronics by 153.8% in the first quarter. Jane Street Group LLC now owns 178,483 shares of the semiconductor producer's stock worth $7,718,000 after acquiring an additional 108,152 shares during the period. Tidal Investments LLC grew its stake in shares of STMicroelectronics by 12.4% in the first quarter. Tidal Investments LLC now owns 20,083 shares of the semiconductor producer's stock worth $868,000 after acquiring an additional 2,214 shares during the period. Cetera Investment Advisers boosted its holdings in shares of STMicroelectronics by 340.9% in the first quarter. Cetera Investment Advisers now owns 45,285 shares of the semiconductor producer's stock worth $1,958,000 after buying an additional 35,015 shares during the last quarter. Finally, Cetera Advisors LLC boosted its holdings in shares of STMicroelectronics by 145.6% in the first quarter. Cetera Advisors LLC now owns 18,735 shares of the semiconductor producer's stock worth $810,000 after buying an additional 11,106 shares during the last quarter. 5.05% of the stock is currently owned by institutional investors.

Wall Street Analysts Forecast Growth

A number of equities analysts recently issued reports on STM shares. Susquehanna reissued a "positive" rating and issued a $33.00 price objective on shares of STMicroelectronics in a report on Thursday, November 21st. StockNews.com downgraded shares of STMicroelectronics from a "buy" rating to a "hold" rating in a report on Thursday, September 19th. Citigroup raised shares of STMicroelectronics to a "strong-buy" rating in a report on Thursday, October 10th. Morgan Stanley downgraded shares of STMicroelectronics from an "equal weight" rating to an "underweight" rating in a report on Monday, November 4th. Finally, Robert W. Baird dropped their price objective on shares of STMicroelectronics from $35.00 to $30.00 and set a "neutral" rating on the stock in a report on Friday, November 1st. One equities research analyst has rated the stock with a sell rating, four have given a hold rating, seven have issued a buy rating and one has issued a strong buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Moderate Buy" and an average target price of $37.63.

Check Out Our Latest Stock Analysis on STM

STMicroelectronics Price Performance

Shares of STM stock traded up $0.54 during mid-day trading on Monday, hitting $26.04. The company had a trading volume of 2,715,954 shares, compared to its average volume of 4,040,124. The stock's 50 day moving average price is $27.19 and its 200-day moving average price is $33.24. STMicroelectronics has a 52-week low of $23.95 and a 52-week high of $51.27. The company has a market capitalization of $23.52 billion, a P/E ratio of 10.61, a P/E/G ratio of 3.10 and a beta of 1.57. The company has a debt-to-equity ratio of 0.12, a current ratio of 2.84 and a quick ratio of 2.16.

STMicroelectronics (NYSE:STM - Get Free Report) last announced its quarterly earnings results on Thursday, October 31st. The semiconductor producer reported $0.37 earnings per share for the quarter, topping the consensus estimate of $0.33 by $0.04. STMicroelectronics had a net margin of 16.11% and a return on equity of 13.29%. The company had revenue of $3.25 billion for the quarter, compared to analysts' expectations of $3.27 billion. During the same quarter in the previous year, the business posted $1.16 earnings per share. STMicroelectronics's quarterly revenue was down 26.6% on a year-over-year basis. Equities research analysts forecast that STMicroelectronics will post 1.64 earnings per share for the current year.

STMicroelectronics Profile

(

Free Report)

STMicroelectronics N.V., together with its subsidiaries, designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific. The company operates through Automotive and Discrete Group; Analog, MEMS and Sensors Group; and Microcontrollers and Digital ICs Group segments.

Further Reading

Before you consider STMicroelectronics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and STMicroelectronics wasn't on the list.

While STMicroelectronics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.