Point72 Hong Kong Ltd acquired a new position in XPeng Inc. (NYSE:XPEV - Free Report) during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund acquired 1,810,097 shares of the company's stock, valued at approximately $22,047,000. XPeng comprises approximately 1.5% of Point72 Hong Kong Ltd's investment portfolio, making the stock its 11th largest holding. Point72 Hong Kong Ltd owned about 0.19% of XPeng at the end of the most recent reporting period.

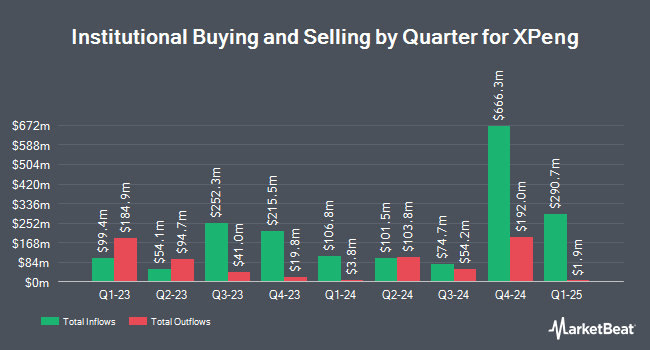

A number of other large investors also recently made changes to their positions in XPEV. Flow Traders U.S. LLC bought a new stake in XPeng during the third quarter worth $360,000. FMR LLC raised its position in XPeng by 1,053.8% in the 3rd quarter. FMR LLC now owns 323,581 shares of the company's stock valued at $3,941,000 after buying an additional 295,536 shares during the last quarter. Citigroup Inc. grew its holdings in XPeng by 14.2% during the third quarter. Citigroup Inc. now owns 293,321 shares of the company's stock valued at $3,573,000 after purchasing an additional 36,560 shares during the period. Advisors Asset Management Inc. increased its position in shares of XPeng by 48.9% during the third quarter. Advisors Asset Management Inc. now owns 49,624 shares of the company's stock valued at $604,000 after buying an additional 16,289 shares during the period. Finally, Central Asset Investments & Management Holdings HK Ltd increased its holdings in shares of XPeng by 36.0% in the 3rd quarter. Central Asset Investments & Management Holdings HK Ltd now owns 408,000 shares of the company's stock worth $4,969,000 after buying an additional 108,000 shares during the last quarter. Institutional investors and hedge funds own 23.05% of the company's stock.

XPeng Stock Up 1.2 %

XPEV stock traded up $0.14 during trading on Friday, reaching $12.05. The stock had a trading volume of 5,134,682 shares, compared to its average volume of 15,226,288. The company has a quick ratio of 1.18, a current ratio of 1.37 and a debt-to-equity ratio of 0.22. The company has a market capitalization of $11.35 billion, a price-to-earnings ratio of -13.85 and a beta of 2.80. XPeng Inc. has a one year low of $6.55 and a one year high of $17.17. The company's 50 day moving average is $12.07 and its two-hundred day moving average is $9.42.

Wall Street Analyst Weigh In

XPEV has been the subject of several recent research reports. Bank of America cut their price target on XPeng from $11.00 to $10.00 and set a "buy" rating for the company in a report on Wednesday, August 21st. The Goldman Sachs Group downgraded shares of XPeng from a "buy" rating to a "neutral" rating and set a $12.50 price objective for the company. in a research note on Thursday, November 21st. China Renaissance upgraded shares of XPeng from a "hold" rating to a "buy" rating and set a $16.70 target price on the stock in a research report on Friday, November 22nd. Macquarie raised XPeng from a "neutral" rating to an "outperform" rating in a research report on Friday, August 30th. Finally, JPMorgan Chase & Co. raised XPeng from a "neutral" rating to an "overweight" rating and raised their price objective for the stock from $8.00 to $11.50 in a report on Thursday, September 5th. Three research analysts have rated the stock with a hold rating, five have assigned a buy rating and one has issued a strong buy rating to the company. According to MarketBeat.com, XPeng has a consensus rating of "Moderate Buy" and a consensus price target of $12.05.

View Our Latest Stock Report on XPeng

About XPeng

(

Free Report)

XPeng Inc designs, develops, manufactures, and markets smart electric vehicles (EVs) in the People's Republic of China. It offers SUVs under the G3, G3i, and G9 names; four-door sports sedans under the P7 and P7i names; and family sedans under the P5 name. The company also provides sales contracts, super charging, maintenance, technical support, auto financing, insurance, technology support, ride-hailing, automotive loan referral, and other services, as well as vehicle leasing and insurance agency services.

See Also

Before you consider XPeng, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and XPeng wasn't on the list.

While XPeng currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.