Polar Asset Management Partners Inc. lessened its stake in Hayward Holdings, Inc. (NYSE:HAYW - Free Report) by 45.9% in the 3rd quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The fund owned 317,800 shares of the company's stock after selling 269,800 shares during the period. Polar Asset Management Partners Inc. owned 0.15% of Hayward worth $4,875,000 as of its most recent SEC filing.

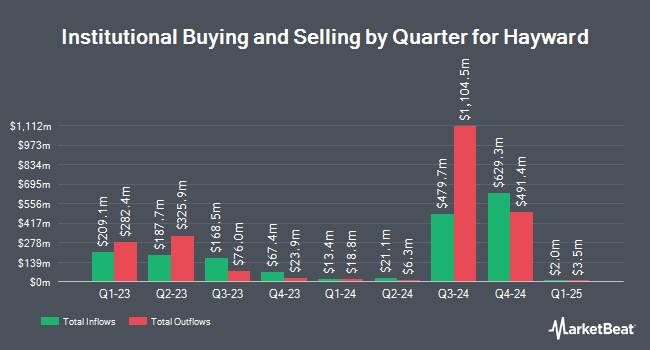

Other large investors have also recently bought and sold shares of the company. WCM Investment Management LLC boosted its stake in shares of Hayward by 2.2% in the 3rd quarter. WCM Investment Management LLC now owns 2,041,398 shares of the company's stock valued at $31,152,000 after purchasing an additional 43,222 shares during the last quarter. Victory Capital Management Inc. lifted its holdings in Hayward by 4.6% in the second quarter. Victory Capital Management Inc. now owns 5,090,726 shares of the company's stock valued at $62,616,000 after buying an additional 222,311 shares during the period. MSD Capital L P bought a new position in Hayward in the third quarter valued at approximately $418,901,000. Michael & Susan Dell Foundation acquired a new stake in Hayward during the 3rd quarter worth $39,646,000. Finally, Jade Capital Advisors LLC bought a new stake in shares of Hayward during the 3rd quarter valued at $2,301,000.

Hayward Stock Performance

Shares of NYSE HAYW traded down $0.22 during midday trading on Thursday, hitting $15.79. 1,271,828 shares of the company's stock were exchanged, compared to its average volume of 1,538,432. The company has a quick ratio of 1.69, a current ratio of 2.62 and a debt-to-equity ratio of 0.70. The firm has a market capitalization of $3.40 billion, a PE ratio of 37.60, a price-to-earnings-growth ratio of 2.24 and a beta of 1.16. Hayward Holdings, Inc. has a 12 month low of $11.81 and a 12 month high of $16.87. The company's 50 day moving average price is $15.60 and its 200 day moving average price is $14.38.

Hayward (NYSE:HAYW - Get Free Report) last announced its quarterly earnings results on Tuesday, October 29th. The company reported $0.11 EPS for the quarter, beating analysts' consensus estimates of $0.10 by $0.01. The business had revenue of $227.57 million for the quarter, compared to analyst estimates of $222.88 million. Hayward had a net margin of 9.47% and a return on equity of 9.93%. Hayward's quarterly revenue was up 3.3% on a year-over-year basis. During the same quarter in the prior year, the business earned $0.08 EPS. As a group, analysts predict that Hayward Holdings, Inc. will post 0.61 earnings per share for the current fiscal year.

Insider Buying and Selling

In other news, CEO Kevin Holleran sold 100,000 shares of the company's stock in a transaction on Monday, November 11th. The stock was sold at an average price of $15.96, for a total transaction of $1,596,000.00. Following the completion of the sale, the chief executive officer now directly owns 522,799 shares in the company, valued at approximately $8,343,872.04. This represents a 16.06 % decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this hyperlink. Also, CFO Eifion Jones sold 75,000 shares of the firm's stock in a transaction on Friday, November 8th. The stock was sold at an average price of $16.11, for a total value of $1,208,250.00. Following the completion of the transaction, the chief financial officer now owns 258,903 shares in the company, valued at $4,170,927.33. The trade was a 22.46 % decrease in their position. The disclosure for this sale can be found here. 3.25% of the stock is owned by insiders.

Analyst Ratings Changes

Several research analysts recently weighed in on the stock. Stifel Nicolaus lifted their price objective on shares of Hayward from $15.50 to $16.00 and gave the stock a "hold" rating in a research note on Monday, October 28th. KeyCorp lifted their price target on shares of Hayward from $17.00 to $18.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 30th. The Goldman Sachs Group raised their price objective on Hayward from $14.00 to $16.00 and gave the stock a "neutral" rating in a research note on Wednesday, October 30th. Finally, Robert W. Baird lifted their target price on Hayward from $19.00 to $20.00 and gave the stock a "neutral" rating in a report on Wednesday, October 30th. Four research analysts have rated the stock with a hold rating and one has issued a buy rating to the company's stock. According to MarketBeat, the stock has a consensus rating of "Hold" and an average price target of $16.80.

Get Our Latest Research Report on HAYW

Hayward Company Profile

(

Free Report)

Hayward Holdings, Inc designs, manufactures, and markets a portfolio of pool equipment and associated automation systems in North America, Europe, and internationally. The company offers pool equipment, including pumps, filters, robotics, suction and pressure cleaners, gas heaters and heat pumps, water features and landscape lighting, water sanitizers, salt chlorine generators, safety equipment, and in-floor automated cleaning systems, as well as LED illumination solutions.

Recommended Stories

Before you consider Hayward, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Hayward wasn't on the list.

While Hayward currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Growth stocks offer a lot of bang for your buck, and we've got the next upcoming superstars to strongly consider for your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.