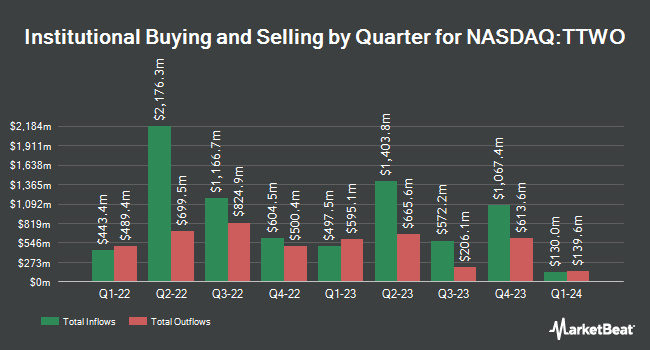

Polar Asset Management Partners Inc. purchased a new position in shares of Take-Two Interactive Software, Inc. (NASDAQ:TTWO - Free Report) during the third quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 32,500 shares of the company's stock, valued at approximately $4,996,000.

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Itau Unibanco Holding S.A. bought a new stake in shares of Take-Two Interactive Software in the 3rd quarter valued at approximately $27,000. Crewe Advisors LLC grew its position in Take-Two Interactive Software by 297.9% in the second quarter. Crewe Advisors LLC now owns 191 shares of the company's stock valued at $30,000 after acquiring an additional 143 shares during the period. UMB Bank n.a. raised its stake in Take-Two Interactive Software by 155.1% during the second quarter. UMB Bank n.a. now owns 199 shares of the company's stock worth $31,000 after acquiring an additional 121 shares in the last quarter. Truvestments Capital LLC bought a new position in shares of Take-Two Interactive Software during the third quarter valued at $31,000. Finally, Blue Trust Inc. boosted its stake in shares of Take-Two Interactive Software by 410.6% in the 2nd quarter. Blue Trust Inc. now owns 240 shares of the company's stock valued at $36,000 after purchasing an additional 193 shares in the last quarter. Institutional investors own 95.46% of the company's stock.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on TTWO. Oppenheimer increased their target price on shares of Take-Two Interactive Software from $185.00 to $190.00 and gave the stock an "outperform" rating in a research report on Thursday, November 7th. Robert W. Baird raised their price objective on shares of Take-Two Interactive Software from $172.00 to $181.00 and gave the stock an "outperform" rating in a report on Thursday, November 7th. JPMorgan Chase & Co. reduced their target price on Take-Two Interactive Software from $200.00 to $195.00 and set an "overweight" rating on the stock in a report on Tuesday, October 22nd. BMO Capital Markets reaffirmed an "outperform" rating and set a $240.00 price target (up from $190.00) on shares of Take-Two Interactive Software in a report on Thursday. Finally, Bank of America reissued a "buy" rating and issued a $185.00 price objective on shares of Take-Two Interactive Software in a research note on Wednesday, August 21st. Two research analysts have rated the stock with a hold rating, eighteen have given a buy rating and one has given a strong buy rating to the company. According to MarketBeat, Take-Two Interactive Software presently has an average rating of "Moderate Buy" and a consensus price target of $194.25.

Check Out Our Latest Research Report on Take-Two Interactive Software

Insider Buying and Selling

In other Take-Two Interactive Software news, Director Laverne Evans Srinivasan sold 2,000 shares of the company's stock in a transaction that occurred on Friday, November 8th. The shares were sold at an average price of $179.17, for a total value of $358,340.00. Following the completion of the sale, the director now owns 9,692 shares of the company's stock, valued at approximately $1,736,515.64. This represents a 17.11 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Daniel P. Emerson sold 777 shares of Take-Two Interactive Software stock in a transaction on Monday, December 2nd. The stock was sold at an average price of $187.64, for a total transaction of $145,796.28. Following the transaction, the insider now directly owns 149,379 shares in the company, valued at approximately $28,029,475.56. This represents a 0.52 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 1.45% of the stock is owned by insiders.

Take-Two Interactive Software Trading Up 1.0 %

TTWO traded up $1.83 during trading on Thursday, reaching $190.03. 1,975,668 shares of the company's stock were exchanged, compared to its average volume of 1,599,414. The company's fifty day moving average price is $167.92 and its 200-day moving average price is $158.79. The firm has a market capitalization of $33.37 billion, a PE ratio of -8.89, a P/E/G ratio of 6.18 and a beta of 0.89. Take-Two Interactive Software, Inc. has a fifty-two week low of $135.24 and a fifty-two week high of $191.63. The company has a debt-to-equity ratio of 0.53, a quick ratio of 0.85 and a current ratio of 0.85.

About Take-Two Interactive Software

(

Free Report)

Take-Two Interactive Software, Inc develops, publishes, and markets interactive entertainment solutions for consumers worldwide. It develops and publishes action/adventure products under the Grand Theft Auto, LA Noire, Max Payne, Midnight Club, and Red Dead Redemption names, as well as other franchises.

Further Reading

Before you consider Take-Two Interactive Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Take-Two Interactive Software wasn't on the list.

While Take-Two Interactive Software currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.