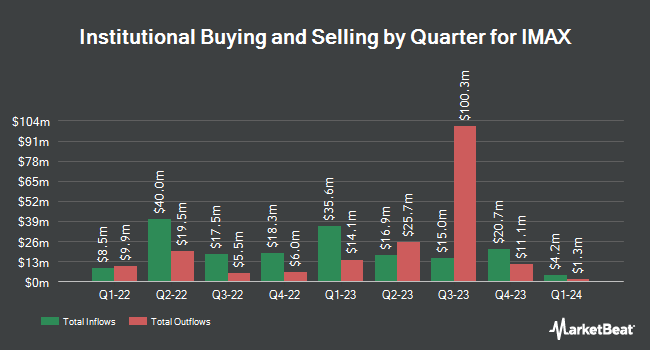

Polar Asset Management Partners Inc. trimmed its holdings in shares of IMAX Co. (NYSE:IMAX - Free Report) by 81.3% during the third quarter, according to its most recent Form 13F filing with the SEC. The firm owned 70,147 shares of the company's stock after selling 305,200 shares during the period. Polar Asset Management Partners Inc. owned 0.13% of IMAX worth $1,439,000 as of its most recent SEC filing.

A number of other hedge funds and other institutional investors also recently bought and sold shares of IMAX. Huntington National Bank bought a new stake in IMAX during the third quarter worth approximately $34,000. Headlands Technologies LLC acquired a new stake in shares of IMAX during the second quarter worth approximately $35,000. nVerses Capital LLC purchased a new position in IMAX during the third quarter valued at approximately $70,000. Summit Securities Group LLC acquired a new position in IMAX in the 2nd quarter valued at approximately $80,000. Finally, Laurus Investment Counsel Inc. acquired a new stake in shares of IMAX during the 2nd quarter valued at $150,000. 93.51% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

Several research firms recently issued reports on IMAX. StockNews.com lowered shares of IMAX from a "buy" rating to a "hold" rating in a report on Friday, November 29th. JPMorgan Chase & Co. upped their price target on shares of IMAX from $20.00 to $21.00 and gave the company a "neutral" rating in a research note on Monday, October 14th. Roth Mkm raised their price target on shares of IMAX from $27.00 to $28.00 and gave the stock a "buy" rating in a research report on Thursday, October 31st. Rosenblatt Securities restated a "buy" rating and issued a $28.00 price target on shares of IMAX in a research report on Thursday, October 31st. Finally, Barrington Research reiterated an "outperform" rating and issued a $24.00 price target on shares of IMAX in a research note on Thursday, October 31st. One investment analyst has rated the stock with a sell rating, two have issued a hold rating, seven have given a buy rating and one has issued a strong buy rating to the stock. According to data from MarketBeat, IMAX currently has an average rating of "Moderate Buy" and a consensus price target of $24.22.

Check Out Our Latest Analysis on IMAX

IMAX Stock Performance

Shares of NYSE IMAX traded down $0.37 during trading hours on Friday, hitting $25.85. The company's stock had a trading volume of 260,738 shares, compared to its average volume of 755,423. The business has a 50-day simple moving average of $22.83 and a 200-day simple moving average of $20.04. The stock has a market cap of $1.36 billion, a price-to-earnings ratio of 59.59, a P/E/G ratio of 1.71 and a beta of 1.23. IMAX Co. has a 12 month low of $13.20 and a 12 month high of $26.84.

IMAX (NYSE:IMAX - Get Free Report) last issued its quarterly earnings data on Wednesday, October 30th. The company reported $0.35 EPS for the quarter, topping the consensus estimate of $0.23 by $0.12. The business had revenue of $91.50 million during the quarter, compared to analyst estimates of $93.71 million. IMAX had a net margin of 6.74% and a return on equity of 7.53%. IMAX's quarterly revenue was down 11.9% compared to the same quarter last year. During the same period last year, the business posted $0.27 earnings per share. On average, equities research analysts forecast that IMAX Co. will post 0.77 EPS for the current year.

IMAX Company Profile

(

Free Report)

IMAX Corporation, together with its subsidiaries, operates as a technology platform for entertainment and events worldwide. The company operates in two segments, Content Solutions and Technology Products and Services. The company offers IMAX DMR, a proprietary technology that digitally remasters films and other content into IMAX formats for distribution to the IMAX network; IMAX Enhanced that provides end-to-end technology across streaming content and entertainment devices at home; and SSIMWAVE, an AI-driven video quality solutions for media and entertainment companies.

Featured Articles

Before you consider IMAX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and IMAX wasn't on the list.

While IMAX currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.