Polar Asset Management Partners Inc. cut its stake in Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN - Free Report) by 69.2% in the third quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The fund owned 400 shares of the biopharmaceutical company's stock after selling 900 shares during the period. Polar Asset Management Partners Inc.'s holdings in Regeneron Pharmaceuticals were worth $420,000 as of its most recent filing with the Securities and Exchange Commission.

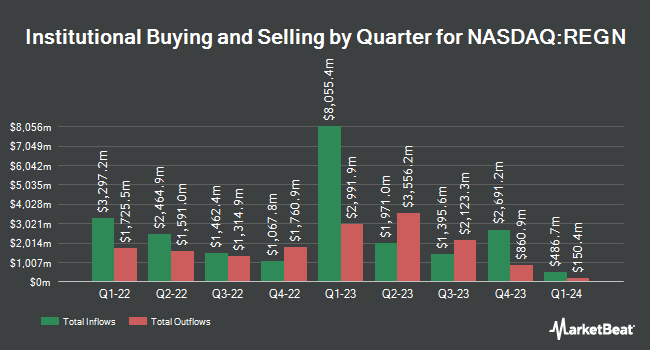

A number of other large investors also recently modified their holdings of the stock. International Assets Investment Management LLC boosted its holdings in Regeneron Pharmaceuticals by 86,013.3% in the third quarter. International Assets Investment Management LLC now owns 880,939 shares of the biopharmaceutical company's stock valued at $926,078,000 after acquiring an additional 879,916 shares during the last quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. grew its position in shares of Regeneron Pharmaceuticals by 23.8% during the 2nd quarter. BNP PARIBAS ASSET MANAGEMENT Holding S.A. now owns 500,274 shares of the biopharmaceutical company's stock worth $525,804,000 after buying an additional 96,266 shares during the period. TD Asset Management Inc raised its stake in shares of Regeneron Pharmaceuticals by 30.4% during the second quarter. TD Asset Management Inc now owns 351,545 shares of the biopharmaceutical company's stock worth $369,484,000 after buying an additional 82,034 shares during the last quarter. Icon Wealth Advisors LLC raised its stake in shares of Regeneron Pharmaceuticals by 18,342.0% during the third quarter. Icon Wealth Advisors LLC now owns 75,981 shares of the biopharmaceutical company's stock worth $79,874,000 after buying an additional 75,569 shares during the last quarter. Finally, Zurcher Kantonalbank Zurich Cantonalbank lifted its holdings in Regeneron Pharmaceuticals by 86.6% in the second quarter. Zurcher Kantonalbank Zurich Cantonalbank now owns 144,865 shares of the biopharmaceutical company's stock valued at $152,257,000 after buying an additional 67,235 shares during the period. 83.31% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analyst Weigh In

A number of analysts have commented on the stock. JPMorgan Chase & Co. lowered their target price on shares of Regeneron Pharmaceuticals from $1,200.00 to $1,150.00 and set an "overweight" rating for the company in a report on Thursday, October 24th. Piper Sandler decreased their price objective on Regeneron Pharmaceuticals from $1,242.00 to $1,195.00 and set an "overweight" rating for the company in a research note on Friday, November 1st. Evercore ISI cut their target price on Regeneron Pharmaceuticals from $1,250.00 to $1,175.00 and set an "outperform" rating on the stock in a research note on Thursday, October 24th. Citigroup began coverage on Regeneron Pharmaceuticals in a report on Thursday, November 14th. They set a "neutral" rating and a $895.00 target price on the stock. Finally, Oppenheimer lowered their price target on Regeneron Pharmaceuticals from $1,150.00 to $1,000.00 and set an "outperform" rating for the company in a research note on Wednesday, November 6th. One investment analyst has rated the stock with a sell rating, four have assigned a hold rating, seventeen have assigned a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the stock has an average rating of "Moderate Buy" and an average price target of $1,107.29.

View Our Latest Research Report on Regeneron Pharmaceuticals

Regeneron Pharmaceuticals Stock Up 1.3 %

Regeneron Pharmaceuticals stock traded up $10.10 during midday trading on Friday, reaching $778.00. The stock had a trading volume of 813,640 shares, compared to its average volume of 785,952. Regeneron Pharmaceuticals, Inc. has a 1-year low of $735.95 and a 1-year high of $1,211.20. The company has a debt-to-equity ratio of 0.09, a quick ratio of 4.46 and a current ratio of 5.28. The firm's fifty day simple moving average is $882.14 and its 200-day simple moving average is $1,013.01. The stock has a market capitalization of $85.49 billion, a P/E ratio of 19.25, a price-to-earnings-growth ratio of 2.91 and a beta of 0.08.

Regeneron Pharmaceuticals Profile

(

Free Report)

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company's products include EYLEA injection to treat wet age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity.

Further Reading

Before you consider Regeneron Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Regeneron Pharmaceuticals wasn't on the list.

While Regeneron Pharmaceuticals currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.