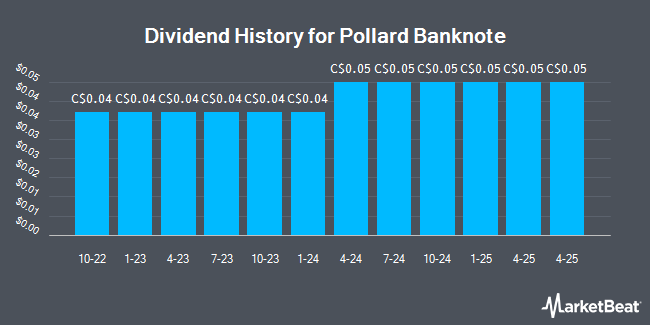

Pollard Banknote Limited (TSE:PBL - Get Free Report) announced a quarterly dividend on Monday, March 31st, TickerTech Dividends reports. Stockholders of record on Tuesday, April 15th will be paid a dividend of 0.05 per share on Tuesday, April 15th. This represents a $0.20 dividend on an annualized basis and a dividend yield of 1.00%. The ex-dividend date is Monday, March 31st.

Pollard Banknote Trading Down 0.3 %

PBL traded down C$0.07 during trading on Wednesday, reaching C$20.00. The company had a trading volume of 8,852 shares, compared to its average volume of 15,156. The firm's 50-day simple moving average is C$25.06 and its 200 day simple moving average is C$24.97. The company has a debt-to-equity ratio of 51.70, a quick ratio of 1.01 and a current ratio of 1.87. The company has a market cap of C$551.68 million, a price-to-earnings ratio of 11.47 and a beta of 0.63. Pollard Banknote has a 12-month low of C$17.95 and a 12-month high of C$37.50.

Analyst Ratings Changes

A number of equities research analysts have recently issued reports on the stock. Cormark cut their price target on shares of Pollard Banknote from C$42.00 to C$37.00 in a report on Thursday, March 27th. Raymond James cut their target price on shares of Pollard Banknote from C$46.00 to C$39.00 and set an "outperform" rating on the stock in a research note on Tuesday, March 11th.

Check Out Our Latest Report on Pollard Banknote

Pollard Banknote Company Profile

(

Get Free Report)

Pollard Banknote Ltd is principally engaged in the manufacturing, development, and sale of lottery and charitable gaming products throughout the world. Its operating segments are Lotteries and charitable gaming and eGaming systems. It provides instant tickets and lottery services including licensed products, distribution, SureTrack lottery management system, retail telephone selling, marketing, iLottery, digital products, Social InstantsTM, retail management services, and instant ticket vending machines.

Recommended Stories

Before you consider Pollard Banknote, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Pollard Banknote wasn't on the list.

While Pollard Banknote currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.