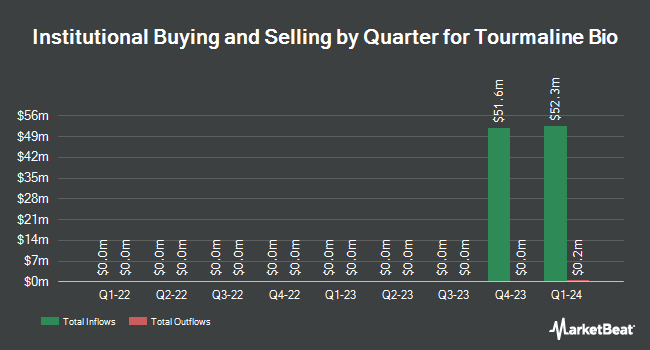

Polymer Capital Management HK LTD bought a new position in Tourmaline Bio, Inc. (NASDAQ:TRML - Free Report) during the 4th quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm bought 79,400 shares of the company's stock, valued at approximately $1,610,000. Polymer Capital Management HK LTD owned about 0.31% of Tourmaline Bio as of its most recent filing with the Securities and Exchange Commission (SEC).

Other hedge funds have also modified their holdings of the company. Geode Capital Management LLC boosted its holdings in shares of Tourmaline Bio by 6.4% in the 3rd quarter. Geode Capital Management LLC now owns 482,078 shares of the company's stock valued at $12,396,000 after purchasing an additional 29,005 shares during the last quarter. Wellington Management Group LLP grew its position in Tourmaline Bio by 72.8% during the third quarter. Wellington Management Group LLP now owns 65,741 shares of the company's stock valued at $1,690,000 after acquiring an additional 27,707 shares during the period. State Street Corp increased its stake in Tourmaline Bio by 25.6% during the third quarter. State Street Corp now owns 411,980 shares of the company's stock worth $10,592,000 after acquiring an additional 83,949 shares during the last quarter. Charles Schwab Investment Management Inc. raised its holdings in shares of Tourmaline Bio by 3.5% in the 3rd quarter. Charles Schwab Investment Management Inc. now owns 63,571 shares of the company's stock worth $1,634,000 after purchasing an additional 2,147 shares during the period. Finally, Barclays PLC lifted its stake in shares of Tourmaline Bio by 283.7% in the 3rd quarter. Barclays PLC now owns 31,833 shares of the company's stock valued at $819,000 after purchasing an additional 23,536 shares in the last quarter. 91.89% of the stock is owned by institutional investors and hedge funds.

Analyst Ratings Changes

A number of research firms recently issued reports on TRML. HC Wainwright increased their target price on shares of Tourmaline Bio from $49.00 to $50.00 and gave the stock a "buy" rating in a research report on Friday, March 14th. Wedbush raised their target price on shares of Tourmaline Bio from $42.00 to $43.00 and gave the company an "outperform" rating in a research note on Friday, March 14th. Finally, Lifesci Capital initiated coverage on shares of Tourmaline Bio in a report on Monday, February 24th. They set an "outperform" rating and a $58.00 target price on the stock. Six equities research analysts have rated the stock with a buy rating, Based on data from MarketBeat.com, the company currently has an average rating of "Buy" and an average price target of $45.20.

Read Our Latest Stock Analysis on TRML

Tourmaline Bio Stock Up 3.0 %

Shares of TRML traded up $0.36 during mid-day trading on Friday, reaching $12.46. 71,552 shares of the stock traded hands, compared to its average volume of 278,462. The stock has a fifty day simple moving average of $14.39 and a 200 day simple moving average of $20.28. Tourmaline Bio, Inc. has a 12-month low of $11.56 and a 12-month high of $29.79. The firm has a market cap of $319.96 million, a price-to-earnings ratio of -4.39 and a beta of 2.14.

Tourmaline Bio (NASDAQ:TRML - Get Free Report) last released its quarterly earnings results on Thursday, March 13th. The company reported ($0.86) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.91) by $0.05. The firm had revenue of $0.04 million for the quarter. On average, equities research analysts expect that Tourmaline Bio, Inc. will post -3.02 earnings per share for the current fiscal year.

About Tourmaline Bio

(

Free Report)

Tourmaline Bio, Inc operates as a clinical biotechnology company that develops medicines for patients with life-altering immune and inflammatory diseases. It develops TOUR006, a human anti-IL-6 monoclonal antibody that selectively binds to interleukin-6, a key proinflammatory cytokine involved in the pathogenesis of many autoimmune and inflammatory disorders.

Read More

Before you consider Tourmaline Bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Tourmaline Bio wasn't on the list.

While Tourmaline Bio currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.