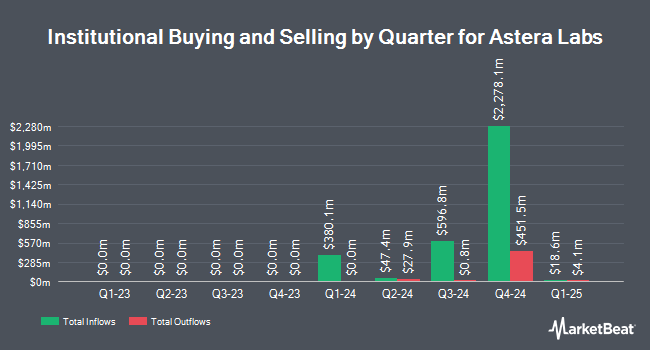

Polymer Capital Management HK LTD purchased a new stake in Astera Labs, Inc. (NASDAQ:ALAB - Free Report) in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund purchased 20,051 shares of the company's stock, valued at approximately $2,656,000.

Several other institutional investors have also made changes to their positions in the stock. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC raised its stake in Astera Labs by 5.7% in the third quarter. UBS AM a distinct business unit of UBS ASSET MANAGEMENT AMERICAS LLC now owns 5,284 shares of the company's stock valued at $277,000 after purchasing an additional 284 shares in the last quarter. Verition Fund Management LLC acquired a new position in shares of Astera Labs in the 3rd quarter valued at approximately $1,524,000. Quarry LP acquired a new stake in shares of Astera Labs during the 3rd quarter worth approximately $109,000. Stifel Financial Corp increased its stake in Astera Labs by 141.2% in the third quarter. Stifel Financial Corp now owns 98,461 shares of the company's stock valued at $5,158,000 after acquiring an additional 57,638 shares during the last quarter. Finally, State Street Corp raised its position in Astera Labs by 173.1% during the third quarter. State Street Corp now owns 698,467 shares of the company's stock valued at $36,593,000 after purchasing an additional 442,698 shares in the last quarter. 60.47% of the stock is currently owned by institutional investors.

Astera Labs Stock Performance

ALAB traded up $0.24 during midday trading on Friday, reaching $59.10. 1,942,370 shares of the company were exchanged, compared to its average volume of 3,763,441. The company's fifty day moving average price is $74.30 and its 200 day moving average price is $90.83. Astera Labs, Inc. has a one year low of $36.22 and a one year high of $147.39. The company has a market cap of $9.58 billion and a price-to-earnings ratio of -33.89.

Astera Labs (NASDAQ:ALAB - Get Free Report) last released its quarterly earnings results on Monday, February 10th. The company reported $0.10 earnings per share for the quarter, missing the consensus estimate of $0.26 by ($0.16). Astera Labs had a negative return on equity of 10.40% and a negative net margin of 21.05%. As a group, sell-side analysts anticipate that Astera Labs, Inc. will post 0.34 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

A number of brokerages have weighed in on ALAB. Needham & Company LLC reaffirmed a "buy" rating and issued a $140.00 target price on shares of Astera Labs in a report on Tuesday, February 11th. Craig Hallum increased their price target on Astera Labs from $105.00 to $125.00 and gave the company a "buy" rating in a research note on Tuesday, February 11th. Stifel Nicolaus boosted their price objective on Astera Labs from $100.00 to $150.00 and gave the stock a "buy" rating in a research report on Monday, January 6th. Raymond James initiated coverage on Astera Labs in a report on Friday, March 14th. They issued an "outperform" rating and a $82.00 target price for the company. Finally, Northland Securities raised Astera Labs from a "market perform" rating to an "outperform" rating and set a $120.00 price target on the stock in a research note on Tuesday, January 28th. One equities research analyst has rated the stock with a hold rating, twelve have given a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Astera Labs currently has an average rating of "Buy" and an average target price of $112.77.

Read Our Latest Research Report on Astera Labs

Insider Buying and Selling

In related news, CEO Jitendra Mohan sold 350,680 shares of Astera Labs stock in a transaction that occurred on Wednesday, February 19th. The shares were sold at an average price of $89.51, for a total value of $31,389,366.80. Following the sale, the chief executive officer now owns 2,353,655 shares of the company's stock, valued at approximately $210,675,659.05. The trade was a 12.97 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Michael E. Hurlston sold 2,500 shares of Astera Labs stock in a transaction dated Tuesday, February 18th. The stock was sold at an average price of $92.08, for a total value of $230,200.00. Following the completion of the sale, the director now directly owns 91,794 shares of the company's stock, valued at approximately $8,452,391.52. This trade represents a 2.65 % decrease in their position. The disclosure for this sale can be found here. Over the last three months, insiders have sold 633,990 shares of company stock worth $54,235,012.

Astera Labs Profile

(

Free Report)

Astera Labs, Inc designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure. Its Intelligent Connectivity Platform is comprised of a portfolio of data, network, and memory connectivity products, which are built on a unifying software-defined architecture that enables customers to deploy and operate high performance cloud and AI infrastructure at scale.

Read More

Before you consider Astera Labs, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Astera Labs wasn't on the list.

While Astera Labs currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.