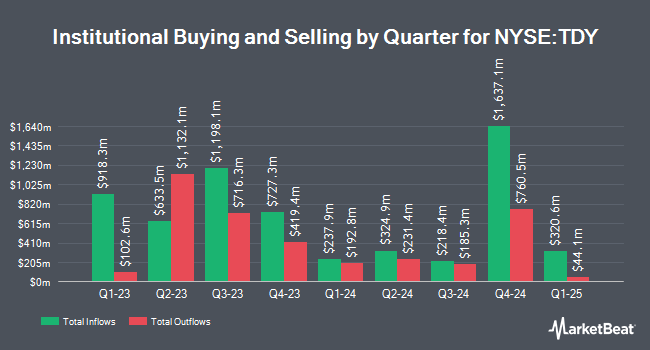

Portfolio Design Labs LLC lowered its stake in Teledyne Technologies Incorporated (NYSE:TDY - Free Report) by 80.3% in the 3rd quarter, according to the company in its most recent Form 13F filing with the Securities and Exchange Commission. The institutional investor owned 1,680 shares of the scientific and technical instruments company's stock after selling 6,832 shares during the period. Portfolio Design Labs LLC's holdings in Teledyne Technologies were worth $735,000 as of its most recent SEC filing.

Several other large investors also recently added to or reduced their stakes in the stock. Wolff Wiese Magana LLC bought a new stake in shares of Teledyne Technologies in the 3rd quarter worth about $27,000. American National Bank purchased a new position in shares of Teledyne Technologies during the second quarter valued at approximately $28,000. Innealta Capital LLC bought a new position in shares of Teledyne Technologies during the second quarter valued at approximately $28,000. Tortoise Investment Management LLC raised its holdings in shares of Teledyne Technologies by 48.0% in the second quarter. Tortoise Investment Management LLC now owns 74 shares of the scientific and technical instruments company's stock worth $29,000 after buying an additional 24 shares during the period. Finally, Crewe Advisors LLC lifted its stake in shares of Teledyne Technologies by 319.0% during the 2nd quarter. Crewe Advisors LLC now owns 88 shares of the scientific and technical instruments company's stock worth $34,000 after acquiring an additional 67 shares during the last quarter. 91.58% of the stock is owned by institutional investors.

Wall Street Analyst Weigh In

Several research firms have issued reports on TDY. Bank of America raised shares of Teledyne Technologies from a "neutral" rating to a "buy" rating and boosted their price objective for the company from $450.00 to $550.00 in a research report on Friday, November 8th. Vertical Research initiated coverage on Teledyne Technologies in a report on Tuesday, July 23rd. They set a "buy" rating and a $470.00 price objective on the stock. StockNews.com raised Teledyne Technologies from a "hold" rating to a "buy" rating in a research report on Wednesday, October 2nd. TD Cowen upped their price objective on shares of Teledyne Technologies from $450.00 to $500.00 and gave the stock a "buy" rating in a research note on Thursday, October 24th. Finally, Needham & Company LLC raised their target price on shares of Teledyne Technologies from $528.00 to $550.00 and gave the company a "buy" rating in a research report on Monday, November 11th. Five equities research analysts have rated the stock with a buy rating, According to MarketBeat, the company currently has a consensus rating of "Buy" and a consensus price target of $517.50.

View Our Latest Stock Report on Teledyne Technologies

Insiders Place Their Bets

In other Teledyne Technologies news, Chairman Robert Mehrabian sold 46,075 shares of the firm's stock in a transaction that occurred on Monday, November 11th. The shares were sold at an average price of $487.33, for a total transaction of $22,453,729.75. Following the sale, the chairman now owns 171,802 shares of the company's stock, valued at approximately $83,724,268.66. This trade represents a 21.15 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. 1.88% of the stock is owned by company insiders.

Teledyne Technologies Price Performance

TDY stock traded up $5.63 during trading on Wednesday, hitting $470.45. The stock had a trading volume of 257,311 shares, compared to its average volume of 240,910. The company's 50-day moving average price is $451.85 and its two-hundred day moving average price is $420.15. Teledyne Technologies Incorporated has a twelve month low of $355.41 and a twelve month high of $492.00. The stock has a market capitalization of $21.92 billion, a P/E ratio of 23.50, a PEG ratio of 3.26 and a beta of 1.01. The company has a debt-to-equity ratio of 0.28, a current ratio of 2.00 and a quick ratio of 1.35.

Teledyne Technologies (NYSE:TDY - Get Free Report) last released its quarterly earnings data on Wednesday, October 23rd. The scientific and technical instruments company reported $5.10 earnings per share (EPS) for the quarter, topping the consensus estimate of $4.97 by $0.13. The firm had revenue of $1.44 billion during the quarter, compared to analysts' expectations of $1.42 billion. Teledyne Technologies had a net margin of 16.88% and a return on equity of 10.02%. Teledyne Technologies's revenue was up 2.9% compared to the same quarter last year. During the same period last year, the business earned $5.05 earnings per share. As a group, research analysts predict that Teledyne Technologies Incorporated will post 19.45 EPS for the current fiscal year.

Teledyne Technologies Profile

(

Free Report)

Teledyne Technologies Incorporated, together with its subsidiaries, provides enabling technologies for industrial growth markets in the United States and internationally. Its Digital Imaging segment provides visible spectrum sensors and digital cameras; and infrared, ultraviolet, visible, and X-ray spectra; as well as micro electromechanical systems and semiconductors, including analog-to-digital and digital-to-analog converters.

Featured Stories

Before you consider Teledyne Technologies, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teledyne Technologies wasn't on the list.

While Teledyne Technologies currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Do you expect the global demand for energy to shrink?! If not, it's time to take a look at how energy stocks can play a part in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.