Portfolio Design Labs LLC bought a new stake in shares of Endeavor Group Holdings, Inc. (NYSE:EDR - Free Report) in the 3rd quarter, according to its most recent filing with the SEC. The institutional investor bought 97,578 shares of the company's stock, valued at approximately $2,787,000.

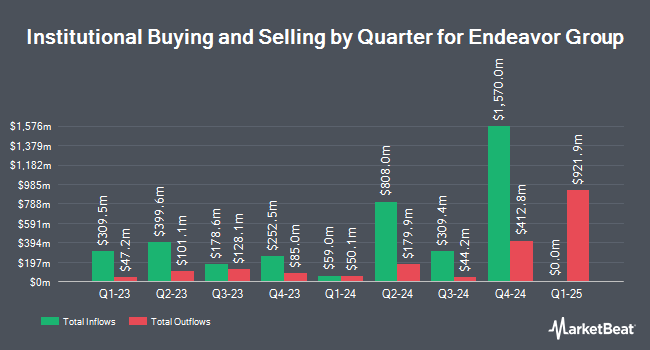

Other large investors have also recently bought and sold shares of the company. Longfellow Investment Management Co. LLC acquired a new position in shares of Endeavor Group in the 2nd quarter valued at $75,000. DekaBank Deutsche Girozentrale acquired a new stake in shares of Endeavor Group during the first quarter worth approximately $102,000. SG Americas Securities LLC acquired a new stake in shares of Endeavor Group during the second quarter worth approximately $130,000. CIBC Asset Management Inc acquired a new stake in shares of Endeavor Group during the second quarter worth approximately $226,000. Finally, ProShare Advisors LLC acquired a new stake in shares of Endeavor Group in the second quarter valued at approximately $255,000. 71.37% of the stock is currently owned by institutional investors and hedge funds.

Endeavor Group Trading Up 0.5 %

Shares of NYSE EDR traded up $0.16 during midday trading on Wednesday, reaching $29.39. 1,336,638 shares of the stock were exchanged, compared to its average volume of 3,458,620. The business has a 50-day simple moving average of $28.78 and a two-hundred day simple moving average of $27.69. The company has a market capitalization of $20.11 billion, a price-to-earnings ratio of -14.25 and a beta of 0.77. Endeavor Group Holdings, Inc. has a 12 month low of $22.64 and a 12 month high of $29.67. The company has a debt-to-equity ratio of 0.28, a current ratio of 0.63 and a quick ratio of 0.63.

Endeavor Group Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Monday, September 30th. Investors of record on Monday, September 16th were given a $0.06 dividend. The ex-dividend date was Monday, September 16th. This represents a $0.24 annualized dividend and a yield of 0.82%. Endeavor Group's dividend payout ratio is currently -11.71%.

Wall Street Analysts Forecast Growth

Separately, StockNews.com assumed coverage on shares of Endeavor Group in a report on Friday, November 15th. They issued a "hold" rating for the company. Nine research analysts have rated the stock with a hold rating and one has given a buy rating to the company's stock. According to MarketBeat.com, the stock has an average rating of "Hold" and a consensus price target of $27.86.

Check Out Our Latest Research Report on EDR

Insider Activity at Endeavor Group

In other news, CEO Ariel Emanuel sold 149,280 shares of the business's stock in a transaction dated Tuesday, September 24th. The shares were sold at an average price of $28.10, for a total transaction of $4,194,768.00. Following the transaction, the chief executive officer now directly owns 1,831,247 shares in the company, valued at $51,458,040.70. The trade was a 7.54 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. In the last ninety days, insiders have sold 225,272 shares of company stock valued at $6,372,925. 63.90% of the stock is owned by corporate insiders.

About Endeavor Group

(

Free Report)

Endeavor Group Holdings, Inc operates as a sports and entertainment company in the United States, the United Kingdom, and internationally. It operates through four segments: Owned Sports Properties; Events, Experiences & Rights; Representation; and Sports Data & Technology. The Owned Sports Properties segment operates a portfolio of sports properties, including Ultimate Fighting Championship, World Wrestling Entertainment, Inc, Professional Bull Rider, and Euroleague.

See Also

Before you consider Endeavor Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Endeavor Group wasn't on the list.

While Endeavor Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.