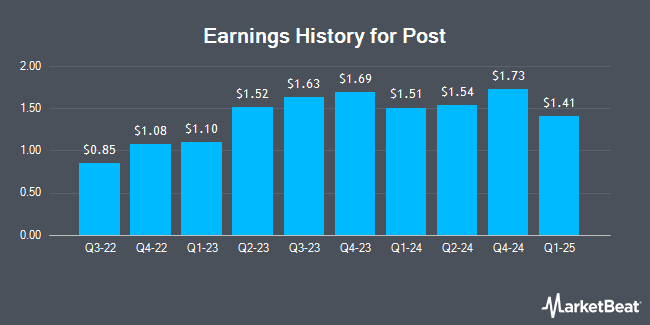

Post (NYSE:POST - Get Free Report) will be issuing its quarterly earnings data after the market closes on Thursday, November 14th. Analysts expect the company to announce earnings of $1.19 per share for the quarter. Investors interested in registering for the company's conference call can do so using this link.

Post Price Performance

Shares of NYSE POST traded up $0.69 during mid-day trading on Thursday, reaching $109.63. The company's stock had a trading volume of 249,288 shares, compared to its average volume of 514,127. The stock has a fifty day moving average of $114.04 and a two-hundred day moving average of $109.59. The firm has a market capitalization of $6.41 billion, a PE ratio of 20.29 and a beta of 0.64. Post has a 52 week low of $82.86 and a 52 week high of $118.96. The company has a debt-to-equity ratio of 1.62, a current ratio of 2.05 and a quick ratio of 1.12.

Insider Transactions at Post

In other news, Director Thomas C. Erb bought 2,000 shares of the stock in a transaction that occurred on Tuesday, August 13th. The stock was purchased at an average price of $112.94 per share, for a total transaction of $225,880.00. Following the completion of the purchase, the director now owns 35,475 shares in the company, valued at approximately $4,006,546.50. This trade represents a 0.00 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. Corporate insiders own 10.70% of the company's stock.

Wall Street Analysts Forecast Growth

POST has been the topic of several recent research reports. JPMorgan Chase & Co. increased their price target on Post from $118.00 to $125.00 and gave the company an "overweight" rating in a report on Tuesday, August 6th. Evercore ISI raised their price target on Post from $122.00 to $123.00 and gave the stock an "outperform" rating in a report on Monday, August 5th. Wells Fargo & Company boosted their price objective on Post from $108.00 to $120.00 and gave the company an "equal weight" rating in a report on Monday, August 5th. Finally, Stifel Nicolaus increased their target price on Post from $120.00 to $130.00 and gave the company a "buy" rating in a research report on Monday, August 5th. One research analyst has rated the stock with a hold rating and five have issued a buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Moderate Buy" and an average price target of $124.33.

Check Out Our Latest Report on POST

Post Company Profile

(

Get Free Report)

Post Holdings, Inc operates as a consumer packaged goods holding company in the United States and internationally. It operates through four segments: Post Consumer Brands, Weetabix, Foodservice, and Refrigerated Retail. The Post Consumer Brands segment manufactures, markets, and sells branded and private label ready-to-eat (RTE) cereals under Honey Bunches of Oats, Pebbles, and Malt-O-Meal brand names; hot cereal; peanut butter under the Peter Pan brand; and branded and private label dog and cat food products under Rachael Ray Nutrish, Nature's Recipe, 9Lives, Kibbles 'n Bits and Gravy Train brand names.

Featured Articles

Before you consider Post, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Post wasn't on the list.

While Post currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With average gains of 150% since the start of 2023, now is the time to give these stocks a look and pump up your 2024 portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.